Renting vs Buying Home in Toronto & Durham: Key 2025 Insights

Renting a one-bedroom apartment in Toronto now costs over $2,500 a month, putting serious pressure on many people’s budgets. It sounds steep and, surprisingly, even with Durham Region offering homes for an average of $959,000, the rent-versus-buy debate is less clear-cut than ever.

What most folks miss is that while rates and prices grab the headlines, the real story in 2025 is about the growing power buyers have to negotiate and the unpredictability facing renters as supply and demand keep shifting. Here’s why these numbers signal a turning point you might not expect.

The financial landscape of housing in Toronto and Durham continues to challenge prospective homeowners and renters in 2025, with complex economic factors influencing the decision between renting and buying. Understanding the nuanced cost implications requires a comprehensive analysis of current market dynamics.

In 2025, the financial calculus of renting versus buying has become increasingly sophisticated. Learn more about current market trends to understand the broader context. According to market research from Justo, the average monthly rent for a one-bedroom apartment in Toronto now exceeds $2,500, while the average home price in the Greater Toronto Area remains above $1 million.

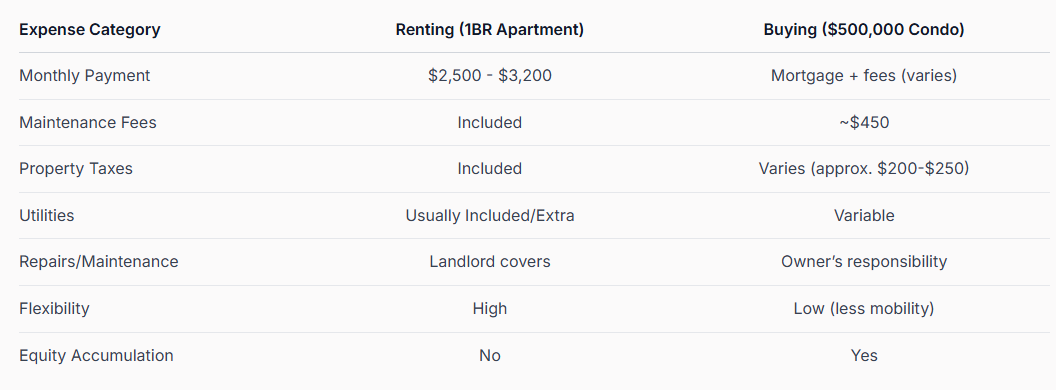

Breaking down the monthly expenses reveals critical insights:

Comparing Costs: Renting vs Buying in 2025

The financial landscape of housing in Toronto and Durham continues to challenge prospective homeowners and renters in 2025, with complex economic factors influencing the decision between renting and buying. Understanding the nuanced cost implications requires a comprehensive analysis of current market dynamics.

Monthly Expenses: A Detailed Financial Breakdown

In 2025, the financial calculus of renting versus buying has become increasingly sophisticated. Learn more about current market trends to understand the broader context. According to market research from Justo, the average monthly rent for a one-bedroom apartment in Toronto now exceeds $2,500, while the average home price in the Greater Toronto Area remains above $1 million.

Breaking down the monthly expenses reveals critical insights:

- Rental Costs: A typical one-bedroom apartment ranges between $2,500 to $3,200 per month, depending on location and amenities.

- Ownership Expenses: For a $500,000 condo, monthly costs include mortgage payments, maintenance fees (around $450), property taxes, and potential utility expenses.

Expense Category Renting (1BR Apartment) Buying ($500,000 Condo)

The decision between renting and buying extends beyond immediate monthly expenses. While renting offers flexibility, homeownership provides potential equity building and investment opportunities. Teamsabharwal's analysis suggests that the total monthly outlay for buyers can be significantly higher than for renters in the short term.

Key considerations for potential buyers and renters include:

- Equity Accumulation: Homeownership allows building personal wealth through property appreciation.

- Maintenance Responsibilities: Owners bear the full cost of repairs and maintenance, whereas renters typically have these expenses covered by landlords.

- Market Volatility: Real estate prices and rental rates can fluctuate, impacting long-term financial planning.

Ultimately, the renting versus buying decision in 2025 requires careful personal financial assessment. Factors such as job stability, long-term housing goals, personal savings, and individual financial health play crucial roles in making an informed choice.

Potential homeowners and renters should conduct thorough research, consult financial advisors, and realistically evaluate their circumstances before making a significant housing commitment.

Market Trends in Toronto and Durham Region

The real estate landscape in Toronto and Durham Region continues to evolve dynamically in 2025, presenting unique opportunities and challenges for both buyers and sellers. Explore the latest regional housing insights to understand the current market nuances.

Shifting Market Dynamics

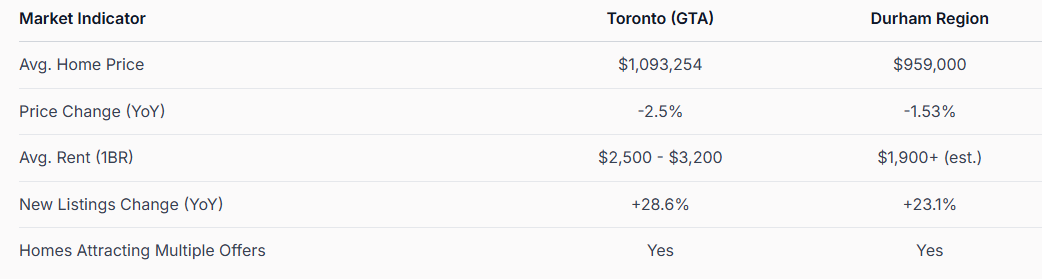

According to House Hunt Master's Q1 2025 market report, the Durham Region experienced a significant 23.10% year-over-year increase in new listings. This surge signals growing seller confidence and provides potential buyers with expanded options as the market gradually moves towards a more balanced state.

Key market indicators reveal interesting trends:

- Pricing Dynamics: The average sale price in Durham Region slightly decreased to $959,000, representing a 1.53% drop compared to the previous year.

- Comparative Affordability: Durham Region remains more affordable than the Greater Toronto Area, with homes under $1 million continuing to attract multiple offers.

Regional Market Performance

Dan Plowman's market analysis highlights the Greater Toronto Area's broader market trends. In March 2025, the GTA saw a substantial 28.6% year-over-year increase in new listings. The average selling price across the region stood at $1,093,254, marking a 2.5% decrease from March 2024.

These trends suggest several critical insights for potential buyers and sellers:

- Increased Inventory: More listings provide greater choice and potentially more negotiating power for buyers.

- Price Stabilization: The slight price corrections indicate a market moving towards greater affordability.

- Buyer Opportunities: Reduced competition and more balanced market conditions create favourable purchasing environments.

Understanding these market trends requires careful analysis and personalized strategy. While broad regional data provides valuable context, individual property characteristics, neighbourhood specifics, and personal financial circumstances remain crucial in making informed real estate decisions.

Potential buyers and sellers should consult local real estate professionals who can offer nuanced insights tailored to specific investment goals and market segments.

The real estate landscape in Toronto and Durham Region presents a nuanced environment for investors and sellers in 2025, characterized by strategic opportunities and calculated decision-making. Understand key investment strategies to navigate this complex market effectively.

According to Durham Region market analysis, the region's fundamental economic drivers continue to create compelling investment opportunities. Strategic location, ongoing transit infrastructure investments, and robust population growth are positioning Durham as an attractive market for both residential and commercial real estate investors.

Key investment considerations include:

House Hunt Master's Q1 2025 report reveals a 23.1% increase in new home listings, indicating a shifting market dynamic that requires sophisticated selling strategies. Sellers must now focus on strategic pricing, property presentation, and understanding buyer preferences to maximize their property's value.

Investor and Seller Perspectives: What Matters Most

The real estate landscape in Toronto and Durham Region presents a nuanced environment for investors and sellers in 2025, characterized by strategic opportunities and calculated decision-making. Understand key investment strategies to navigate this complex market effectively.

Investment Potential and Market Fundamentals

According to Durham Region market analysis, the region's fundamental economic drivers continue to create compelling investment opportunities. Strategic location, ongoing transit infrastructure investments, and robust population growth are positioning Durham as an attractive market for both residential and commercial real estate investors.

Key investment considerations include:

- Projected Growth: An anticipated 5% annual price increase suggests a stable investment environment.

- Property Type Diversity: Townhomes and condominiums offer attractive entry points for investors seeking rental income.

- Market Resilience: Strong underlying economic fundamentals support sustained market interest.

Seller Strategies in a Changing Landscape

House Hunt Master's Q1 2025 report reveals a 23.1% increase in new home listings, indicating a shifting market dynamic that requires sophisticated selling strategies. Sellers must now focus on strategic pricing, property presentation, and understanding buyer preferences to maximize their property's value.

Critical selling considerations for 2025 include:

- Strategic Pricing: Aligning property prices with current market conditions and local neighbourhood trends.

- Property Preparation: Investing in targeted improvements that enhance marketability.

The most successful investors and sellers in 2025 will be those who combine deep market knowledge with adaptable strategies. This requires a comprehensive approach that goes beyond traditional real estate thinking. Understanding micro-market dynamics, demographic shifts, and emerging neighbourhood trends becomes crucial for making informed decisions.

While the market shows promising signs, individual success depends on personalized strategies tailored to specific investment goals and property characteristics. Potential investors and sellers should conduct thorough research, consult local real estate professionals, and develop a nuanced understanding of the Toronto and Durham Region's unique real estate ecosystem. The ability to interpret market data, anticipate trends, and make strategic decisions will ultimately differentiate successful real estate participants in this dynamic market landscape.

Choosing the Right Path for Your Needs

Navigating the complex real estate landscape in Toronto and Durham Region requires a personalized approach that aligns with individual financial goals, lifestyle preferences, and long-term objectives. Discover your ideal housing strategy to make an informed decision that suits your unique circumstances.

Lifestyle and Financial Considerations

According to House Hunt Master's Q1 2025 market report, the Durham Region presents a compelling alternative for those seeking affordability and opportunity. With average home prices around $959,000—significantly lower than Toronto's market—the region offers an attractive option for young professionals, families, and investors looking to maximize their real estate potential.

Key factors to evaluate when choosing between renting and buying include:

- Financial Flexibility: Assess your current income, savings, and long-term financial goals.

- Career Mobility: Consider your professional trajectory and potential relocation needs.

- Personal Lifestyle Preferences: Evaluate your desire for customization, stability, and community engagement.

Regional Accessibility and Future Potential

Regional development insights highlight the transformative impact of improved transportation infrastructure and ongoing economic development. These factors significantly enhance the appeal of buying in Durham Region, particularly for professionals seeking a balance between affordability and accessibility.

Critical decision-making factors include:

- Commute Considerations: Evaluate proximity to work, public transit, and transportation networks.

- Long-Term Investment Potential: Analyze neighbourhood growth, infrastructure developments, and future value appreciation.

- Quality of Life: Assess community amenities, school districts, and lifestyle opportunities.

Consider consulting with local real estate professionals who can provide personalized insights tailored to your specific needs. They can help you navigate the nuanced landscape, understand market trends, and develop a strategy that aligns with your financial goals and lifestyle preferences.

Remember, the most successful real estate decisions are those that balance personal objectives with market realities, creating a path that supports both your immediate needs and long-term ambitions.

What are the average monthly rental costs in Toronto in 2025?

Frequently Asked Questions

What are the average monthly rental costs in Toronto in 2025?

The average monthly rent for a one-bedroom apartment in Toronto now ranges from $2,500 to $3,200, making it a significant financial consideration for potential renters.

How does buying a home in Durham Region compare to renting in Toronto?

With average home prices around $959,000, buying in Durham Region may offer more affordable options compared to renting in Toronto, where the price significantly exceeds $1 million.

What financial implications should I consider when deciding between renting and buying a home?

Renting offers flexibility without long-term commitments, while buying allows for equity accumulation and potential investment returns, but entails ongoing maintenance and financial responsibilities.

Are current market trends favouring buyers or renters in 2025?

In 2025, increased inventory and slight price corrections are giving buyers more negotiating power and options, whereas renters face fluctuating rental rates amidst changing supply and demand.

Ready to Take Control of Your Toronto or Durham Housing Journey?

If you are feeling the weight of rising rents in Toronto or struggling with the uncertainty that comes from a rapidly changing market, you are not alone. Many readers just like you are stuck between high monthly rental costs and the pressures of saving for a down payment, all while trying to predict when and where to make a smart move.

This article highlighted the critical choice between renting and buying, the power of market timing and negotiating, and the importance of making decisions that build your financial future.

Now is your chance to turn insight into action. Whether you want to explore featured homes, get a custom strategy to fit your budget, or simply talk through your best next step, discover the difference with Fanis Makrigiannis and RE/MAX Rouge River Realty Ltd. You will find up-to-date property listings, tailored tools, and expert guidance built on local experience. Start by searching homes or connecting for a personalized consultation today. Sharpen your advantage before the 2025 market shifts again—secure your future with confidence.

Now is your chance to turn insight into action. Whether you want to explore featured homes, get a custom strategy to fit your budget, or simply talk through your best next step, discover the difference with Fanis Makrigiannis and RE/MAX Rouge River Realty Ltd. You will find up-to-date property listings, tailored tools, and expert guidance built on local experience. Start by searching homes or connecting for a personalized consultation today. Sharpen your advantage before the 2025 market shifts again—secure your future with confidence.

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended Articles

- How to Find a Dream Home in Toronto & Durham Region: 2025 Guide - Fanis Makrigiannis Realtor®

- Why Buy in Toronto: Real Estate Opportunities in 2025 - Fanis Makrigiannis Realtor®

- Home Buying Process in Toronto & Durham Region for 2025 - Fanis Makrigiannis Realtor®

- Durham Region Housing 2025: Opportunities for Buyers and Sellers - Fanis Makrigiannis Realtor®

- Durham Region Housing Trends 2025 Insights - Fanis Makrigiannis Realtor®

- How to Market a Home in Toronto & Durham: 2025 Realtor® Guide - Fanis Makrigiannis Realtor®