Cost to Sell Home in Toronto & Durham 2025 Guide

Thinking about selling your home in Toronto or Durham? Most people expect to pay some fees, but few realize total selling costs can swallow up as much as 10 percent of your home’s value. Here’s the twist. Those numbers are not set in stone, and a few smart moves can put thousands back in your pocket.

Understanding the Cost to Sell a Home in Ontario

Selling a home in Ontario involves several financial considerations that can significantly impact your overall transaction costs. Homeowners must carefully evaluate the expenses associated with bringing their property to market, understanding that these costs extend far beyond the simple listing price.

Real Estate Commission Expenses

The most substantial cost for most home sellers is the real estate commission. In Ontario, agents typically charge around 5% of the home's sale price, though this rate remains negotiable. Research from the Financial Consumer Agency of Canada confirms that commissions represent a significant portion of selling expenses. For a home valued at $800,000 in the Toronto or Durham region, this could translate to approximately $40,000 in commission fees, split between the listing and buyer's agents.

While the commission might seem steep, professional agents provide crucial services, including market analysis, pricing strategy, professional marketing, negotiation support, and transaction management. Learn more about our comprehensive selling strategies to understand the full value professional representation brings to your home sale.

Additional Transaction Costs

Beyond real estate commissions, sellers must budget for several other expenses. According to MoneySense, legal fees in Ontario typically range from $500 to $1,500. These fees cover essential services like title transfer, mortgage discharge documentation, and ensuring a smooth legal transition of property ownership.

Other potential costs include home staging (which can range from $1,000 to $3,000), professional photography ($300 to $700), minor repairs or improvements to enhance marketability, and potential mortgage discharge fees. Moving expenses can also add $1,000 to $5,000, depending on the distance and volume of belongings.

Strategic Financial Planning

Successful home selling in Ontario requires meticulous financial planning. Homeowners should anticipate spending approximately 7% to 10% of their home's value in total selling costs. This means for a property valued at $750,000, sellers might need to budget $52,500 to $75,000 for the entire selling process.

To optimize your financial strategy, consider getting a professional home valuation, understanding current market conditions, and consulting with an experienced real estate professional who can provide transparent guidance about potential expenses. Explore our detailed breakdown of real estate fees to gain deeper insights into managing your home-selling costs effectively.

By approaching the selling process with comprehensive financial awareness, Ontario homeowners can minimize surprises and maximize their potential return on investment.

Breakdown of Seller Fees in Toronto and Durham

Selling a home in the Toronto and Durham regions requires a comprehensive understanding of various fees that can impact your overall financial outcome. While the potential for a profitable sale exists, sellers must carefully navigate the complex landscape of transaction expenses specific to these dynamic real estate markets.

Mandatory Transaction Costs

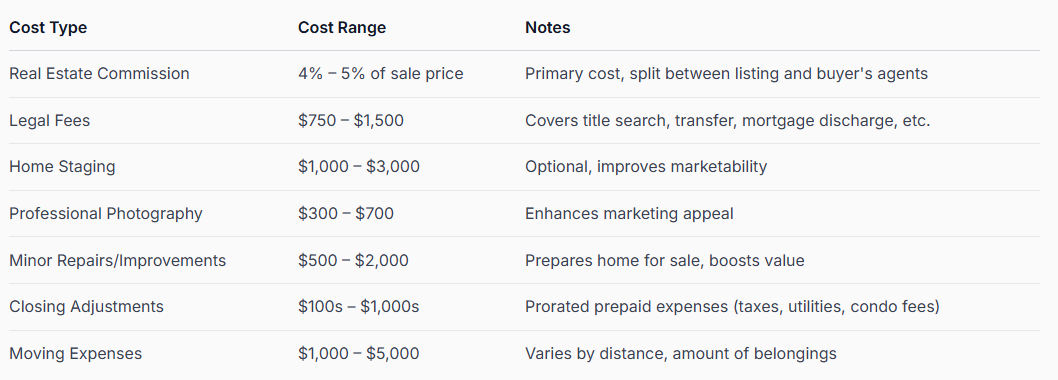

The Toronto and Durham real estate markets present unique financial considerations for home sellers. According to the Ontario Real Estate Association, transaction costs can significantly vary depending on specific local market conditions. Real estate commissions remain the most substantial expense, typically ranging between 4% to 5% of the home's final sale price.

Legal fees represent another critical expense for sellers. Research from legal experts indicates that professional legal services for property transfers in Ontario generally cost between $750 and $1,500. These fees cover essential services such as title search, document preparation, and ensuring a smooth legal transfer of property ownership.

Closing Cost Adjustments and Hidden Expenses

Sellers often overlook the importance of prorated expenses at closing. According to real estate financial experts, homeowners may need to reimburse buyers for prepaid expenses like property taxes, utility bills, and potential condo fees. These adjustments can range from a few hundred to several thousand dollars, depending on the timing of the sale and prepaid services.

Additional potential expenses include home preparation costs. Professional home staging can range from $1,000 to $3,000, while minor repairs and improvements might add another $500 to $2,000. Professional photography and marketing materials can cost between $300 and $700, crucial for attracting potential buyers in competitive markets like Toronto and Durham.

Strategic Financial Planning for Home Sellers

Successful home selling in these regions requires meticulous financial planning. Learn more about strategic home sale preparation to understand the nuanced financial landscape. For a property valued at $900,000 in Toronto or Durham, sellers should anticipate total selling costs between $63,000 and $90,000, which includes commissions, legal fees, potential repairs, and closing adjustments.

Homeowners can mitigate unexpected expenses by obtaining a professional home valuation, understanding current market conditions, and consulting with experienced real estate professionals who provide transparent guidance about potential costs. Explore a comprehensive breakdown of real estate fees to gain deeper insights into managing your home-selling expenses effectively.

By approaching the selling process with financial awareness and strategic planning, Toronto and Durham homeowners can optimize their sales and minimize unexpected financial surprises.

To help readers quickly compare the most common seller expenses, here’s a summary table outlining typical cost ranges mentioned in this section:

How Market Trends Affect Selling Costs

Market trends play a pivotal role in determining the overall cost of selling a home in Toronto and Durham, creating a dynamic landscape that can significantly impact a seller's financial strategy. Understanding these trends is crucial for homeowners looking to maximize their property's value and minimize selling expenses.

Interest Rates and Market Dynamics

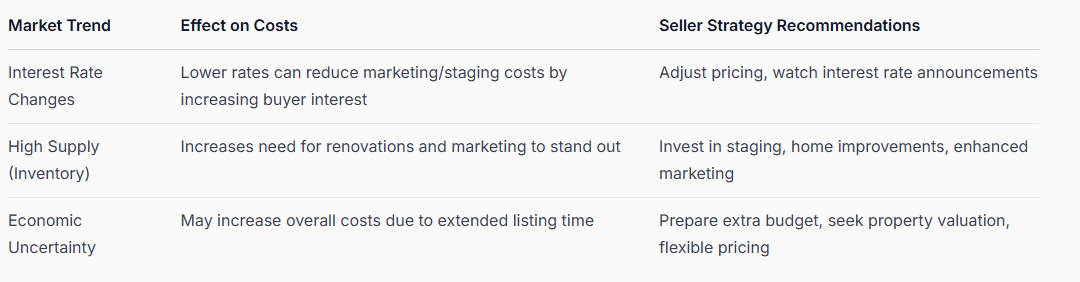

According to Reuters financial reports, interest rate fluctuations in 2025 have created a complex selling environment for Toronto and Durham homeowners. The Bank of Canada's monetary policies directly influence buyer affordability and market activity. When interest rates decrease, more potential buyers enter the market, potentially reducing time-on-market and associated selling costs.

For instance, lower interest rates can translate to reduced marketing expenses and fewer price reductions. Sellers might spend less on extended marketing campaigns and staging, as increased buyer interest creates more competitive selling conditions. Learn more about strategic home-selling approaches to understand how market conditions impact your selling strategy.

Supply and Demand Considerations

Research from market analysts indicates that supply and demand dynamics significantly influence selling costs. In periods of high inventory, sellers may face additional expenses to make their properties stand out.

This could include more extensive home improvements, professional staging, and advanced marketing techniques.

For example, when new listings increase, sellers might need to invest more in:

- Professional home staging ($1,000 to $3,000)

- Enhanced marketing materials ($500 to $1,500)

- Minor renovations to increase property appeal ($2,000 to $5,000)

Economic Uncertainty and Selling Strategies

Economic reports from financial experts suggest that broader economic conditions create nuanced challenges for home sellers. Trade uncertainties and market volatility can impact buyer confidence, potentially extending selling timelines and increasing associated costs.

Homeowners can mitigate these challenges by:

- Obtaining a comprehensive property valuation

- Understanding current market microtrends

- Preparing for potential additional marketing or preparation expenses

By staying informed about market trends and maintaining an adaptable approach, homeowners can effectively navigate the complex real estate landscape, minimizing unexpected costs and maximizing their property's potential value.

Here’s a table summarizing how different market trends may influence selling costs and strategies based on the information from this section:

Tips to Reduce Your Cost When Selling

Reducing the cost of selling a home in Toronto and Durham requires strategic planning and a proactive approach. Homeowners can implement several targeted strategies to minimize expenses while maximizing their property's market potential.

DIY Preparation and Home Presentation

According to the Financial Consumer Agency of Canada, significant cost savings can be achieved through strategic self-preparation. Professional home staging typically costs between $1,000 and $3,000, but homeowners can dramatically reduce these expenses by taking a do-it-yourself approach. Explore our decluttering strategies to enhance your home's appeal without breaking the bank. Key cost-effective preparation techniques include:

- Deep cleaning the entire property

- Removing personal items

- Neutral paint touch-ups

- Minor landscaping improvements

- Organizing storage spaces

Strategic Marketing and Commission Negotiation

Research from real estate experts suggests that commission rates are negotiable. Homeowners can potentially reduce real estate commission fees by:

- Requesting commission rate discounts

- Exploring flat-fee real estate services

- Negotiating comprehensive service packages

- Comparing multiple realtor proposals

Cost-Effective Professional Support

Comprehensive home-selling guides recommend balancing cost-cutting with professional support. Strategic approaches include:

- Selecting realtors offering comprehensive marketing services

- Leveraging digital marketing platforms

- Timing your sale during optimal market conditions

- Getting pre-listing home inspections to avoid unexpected repair costs

Smart sellers understand that reducing costs isn't about cutting corners, but making informed, strategic decisions. By combining personal effort with targeted professional support, homeowners can significantly minimize their selling expenses while maintaining the potential for a successful, profitable transaction in the Toronto and Durham real estate markets.

Frequently Asked Questions

What are the typical costs involved in selling a home in Toronto and Durham?

Selling a home in Toronto and Durham usually involves costs such as real estate commissions (approximately 4% to 5% of the sale price), legal fees (ranging from $750 to $1,500), home staging (between $1,000 and $3,000), and other potential expenses like photography and repairs. Total costs can be around 7% to 10% of the home's value.

Can I negotiate real estate commission fees when selling my home?

Yes, real estate commission fees in Ontario are negotiable. Most sellers can discuss and potentially reduce the standard commission rate, which is typically around 5%, to lower their overall selling costs.

How can market trends in 2025 affect my home's selling costs?

Market trends such as interest rates and supply-demand dynamics significantly impact selling costs. Lower interest rates can lead to increased buyer interest, potentially reducing marketing costs, while high inventory may require additional spending on home improvements and marketing to attract buyers.

What are some effective ways to reduce selling costs when I sell my home?

To reduce selling costs, homeowners can prepare their property through DIY improvements, negotiate real estate commissions, and select cost-effective professional support services. Simple actions like decluttering, minor repairs, and obtaining a professional home valuation can lead to substantial savings.

Unlock Massive Savings When You Sell With Confidence

Are rising selling costs in Toronto and Durham making you hesitant to list your home? Many homeowners discover too late that real estate commissions, legal fees, staging, and hidden transaction expenses can drain thousands from their final sale price. With unpredictable market trends and multiple fee surprises, it is easy to feel overwhelmed and unsure about how to maximize your return.

Experience peace of mind and put more money in your pocket by leveraging the right expertise. Fanis Makrigiannis and the https://fanis.ca team offer exclusive home evaluations, strategic selling tips, and proven local knowledge to lower your total cost to sell. Ready to see exactly how you can reduce expenses, negotiate commissions, and create a customized selling plan? Book your free consultation today and discover how you can turn today’s challenges into tomorrow’s profit.

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

How to Plan a Home Sale in Toronto & Durham for 2025 - Fanis Makrigiannis Realtor®

How to Market a Home in Toronto & Durham: 2025 Realtor® Guide - Fanis Makrigiannis Realtor®

Selling Your Home Faster in Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Home Selling Tips for Toronto and Durham 2025 - Fanis Makrigiannis Realtor®

Selling a House Fast in Toronto & Durham Guide in 2025 - Fanis Makrigiannis Realtor®

How to Prepare for a Home Sale in Toronto & Durham for 2025 - Fanis Makrigiannis Realtor®