How to Sell an Inherited Home in Toronto & Durham 2025

Selling an inherited home in Toronto or Durham might sound straightforward, but the process can get complicated fast. Shockingly, selling could trigger capital gains tax on 50 percent of your property’s appreciation since it was first bought. Most people expect to walk away with a windfall, yet paperwork missteps and missed deadlines can erase thousands in value. Here’s how to avoid hidden traps and protect your inheritance.

Understanding Your Inherited Property Rights

Inheriting a property in the Toronto and Durham regions involves navigating complex legal and financial considerations that require careful understanding and strategic planning. Knowing your rights as an inherited property owner can significantly impact your ability to manage and potentially sell the property effectively.

Legal Framework of Property Inheritance

In Ontario, property inheritance follows specific legal protocols governed by the Succession Law Reform Act. When a property is inherited, several critical factors determine your rights and potential actions. According to ontario.ca, if the deceased did not leave a will (intestate), the estate distribution follows a predetermined legal structure. Typically, the surviving spouse receives the first $350,000 of the estate's value, with any remaining balance divided between the spouse and children.

The probate process plays a crucial role in property inheritance. Research indicates that probate involves the court validating the will and granting the executor authority to distribute assets. During this process, the executor must apply for a certificate of appointment of estate trustee, manage the deceased's assets, settle any outstanding debts, and ensure proper asset distribution.

Tax Implications and Financial Considerations

Property inheritance comes with significant financial considerations that can impact your decision to sell. Tax experts note that beneficiaries are generally exempt from paying Land Transfer Tax when inheriting property. However, selling an inherited property may trigger capital gains tax on 50% of the property's appreciation since the original purchase.

If multiple beneficiaries inherit a property and one decides to buy out the others' shares, additional tax implications might arise. This scenario requires careful financial planning and potentially consulting with a tax professional to understand the full scope of potential tax obligations.

Successfully managing an inherited property demands a comprehensive approach. This involves understanding legal documentation, potential tax liabilities, and the property's current market value. While the inheritance process can seem overwhelming, breaking down the steps and seeking professional guidance can simplify the journey.

Before making any decisions about selling the inherited home, consider consulting with a local real estate professional who understands the nuanced property regulations in the Durham region. They can provide tailored advice specific to your unique inheritance situation and help you make informed decisions about potentially selling the property.

Remember that each inheritance scenario is unique. The legal and financial landscape can vary significantly depending on factors such as the existence of a will, the number of beneficiaries, property value, and potential outstanding debts. Patience, thorough research, and professional guidance are key to successfully navigating your inherited property rights.

Steps to Prepare an Inherited Home for Sale

Preparing an inherited home for sale requires a strategic approach that balances emotional considerations with practical real estate requirements. The process involves multiple critical steps that can significantly impact the property's market value and potential sale timeline.

Clearing and Organizing the Property

The initial phase of preparing an inherited home involves a comprehensive clearance and organization strategy. Financial experts recommend a systematic approach to managing the property's contents. Begin by conducting a thorough inventory of the home's belongings, which involves carefully sorting items into categories: keep, sell, donate, and discard.

Distributing personal belongings among family members can help streamline the decluttering process. Professional organizers suggest coordinating donation pick-ups for items not being retained, which supports charitable causes while efficiently clearing the home. This process not only prepares the property for sale but also helps family members process the emotional aspects of losing a loved one.

Property Assessment and Necessary Improvements

Before listing the inherited home, a comprehensive property assessment is crucial. Real estate professionals advise conducting a professional home inspection to identify potential repair needs. This evaluation helps determine which improvements will provide the best return on investment. Minor repairs and strategic updates can significantly enhance the property's marketability.

Consider making targeted improvements such as:

- Fresh interior painting

- Updating light fixtures

- Addressing minor structural repairs

- Enhancing curb appeal

Documentation and Legal Preparation

Preparing the necessary documentation is a critical step in selling an inherited home. Learn more about comprehensive home selling strategies to ensure a smooth transaction. Gather essential documents, including:

- Original property deed

- Recent property tax receipts

- Survey plans

- Probate documents

- Maintenance records

- Utility bill history

Remember that selling an inherited home is both a financial and emotional process. Approach each step with patience, seek professional advice when needed, and remain flexible throughout the journey. The goal is not just to sell a property, but to honour the memory of your loved one while making sound financial decisions.

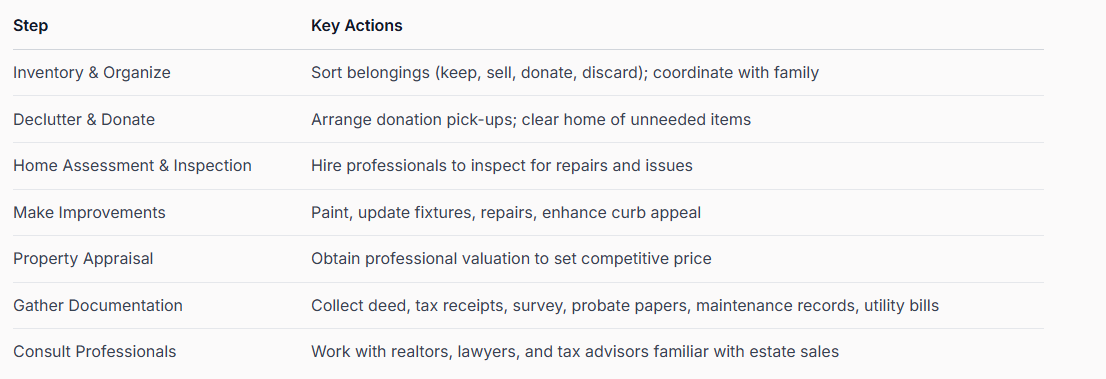

Here is a table summarizing the main steps to prepare an inherited home for sale based on the process outlined above:

Legal and Tax Implications in Ontario

Inheriting a property in Ontario involves navigating a complex landscape of legal and tax considerations that can significantly impact your financial outcome. Understanding these implications is crucial for making informed decisions about your inherited property.

Estate Administration Tax and Property Valuation

Ontario's Ministry of Finance outlines specific regulations regarding Estate Administration Tax (EAT), which is levied on the total value of a deceased person's assets. The tax is calculated based on the appraised value of the property at the date of death, regardless of subsequent market fluctuations. This means that the property's value is essentially frozen at the moment of the deceased's passing for tax purposes.

The EAT calculation can be intricate. For estates valued under $50,000, no tax is typically required. However, for estates exceeding this threshold, the tax is calculated at a rate of $5 per $1,000 of the estate's value. This tax must be paid before the court will issue a certificate of appointment of estate trustee, which is essential for legally managing and potentially selling the inherited property.

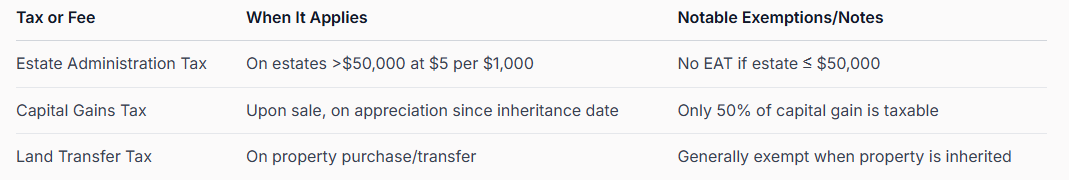

Below is a table summarizing the key tax implications and exemptions for inherited property in Ontario as discussed above:

Below is a table summarizing the key tax implications and exemptions for inherited property in Ontario as discussed above:

Capital Gains and Inheritance Taxation

Canada Revenue Agency regulations provide specific guidance on taxation for inherited properties. When you inherit a property, you are considered to have acquired it at its fair market value (FMV) on the date of the deceased's death. This means that if you decide to sell the property, you will only be liable for capital gains tax on the appreciation that occurs after the inheritance date.

For example, if the property was valued at $500,000 at the time of inheritance and you sell it later for $600,000, you would only be taxed on the $100,000 difference. Capital gains tax in Canada requires you to report 50% of this gain as taxable income. This approach provides some tax relief for inherited properties and can be financially advantageous.

Land Transfer and Property Rights

Learn more about complex land title regulations that can impact inherited properties. Land transfer tax in Ontario is typically payable when acquiring land, but certain transfers may be exempt. For instance, transfers between spouses or to a family business corporation might qualify for tax exemptions.

It's important to note that inherited properties come with unique legal considerations. If multiple beneficiaries inherit a property, they must agree on its disposition. This can involve complex negotiations, potentially requiring legal mediation to resolve disputes about selling, maintaining, or dividing the property.

Consulting with a tax professional and a real estate lawyer who specializes in estate properties is strongly recommended. They can provide personalized guidance tailored to your specific situation, helping you navigate the intricate legal and tax landscape of inherited property in Ontario.

Remember that each inherited property scenario is unique. Careful planning, thorough documentation, and professional advice can help you make informed decisions that minimize tax liability and maximize the potential value of your inherited property.

Choosing the Right Realtor for Durham and Toronto

Selecting the right realtor is a critical decision when selling an inherited home in the Toronto and Durham regions. The perfect real estate professional can significantly impact your selling experience, potentially maximizing your property's value and minimizing stress throughout the transaction.

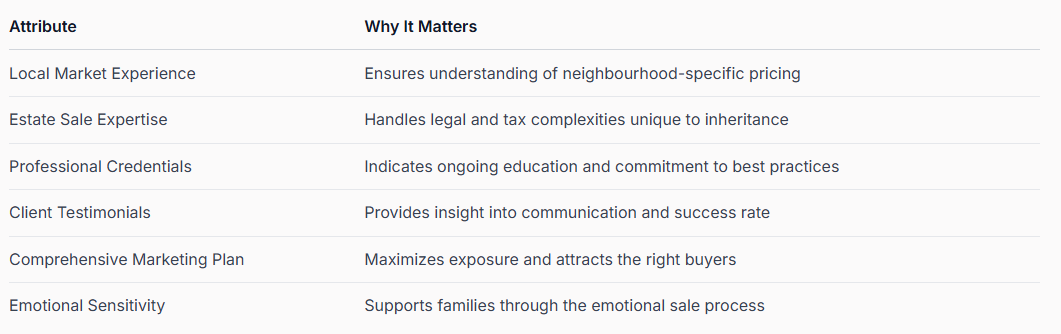

Understanding Local Market Expertise

The Toronto Regional Real Estate Board highlights the importance of choosing a realtor with deep local market knowledge.

In the Durham and Toronto regions, market dynamics can vary dramatically between neighbourhoods, making specialized local expertise crucial.

A realtor who understands the nuanced real estate landscape of these areas can provide insights into specific community trends, pricing strategies, and potential buyer demographics.

Key factors to consider in local expertise include:

Financial experts recommend a thorough vetting process when selecting a real estate professional. For inherited properties, you need a realtor with specific experience in estate sales and a proven track record of handling complex property transactions.

- A comprehensive understanding of neighbourhood property values

- Recent sales history in specific communities

- Knowledge of local development plans

- Insights into school district impacts on property values

- Understanding of unique local real estate regulations

Evaluating Professional Credentials and Experience

Financial experts recommend a thorough vetting process when selecting a real estate professional. For inherited properties, you need a realtor with specific experience in estate sales and a proven track record of handling complex property transactions.

Critical credentials to investigate include:

- Years of experience in the Durham and Toronto markets

- Specialized training in estate property sales

- Professional certifications

- Client testimonials and references

- Proven marketing strategies for unique properties

Selecting Your Ideal Real Estate Partner

Discover comprehensive guidance for selecting the perfect real estate agent to navigate your inherited property sale. The ideal realtor should offer more than just market listings. Look for a professional who provides comprehensive support, including:

- Emotional sensitivity to inherited property sales

- Transparent communication

- Detailed marketing strategies

- Comprehensive property valuation services

- Guidance through legal and documentation processes

Remember that the right realtor is not just a transactional partner but a strategic advisor who understands the unique emotional and financial complexities of selling an inherited home. Take time to find a professional who combines market expertise, empathy, and a proven track record of successful sales in the Durham and Toronto regions.

Ultimately, your chosen realtor should make you feel confident, supported, and well-informed throughout the entire selling process. Trust your instincts and select someone who demonstrates a genuine commitment to achieving your specific real estate goals.

Frequently Asked Questions

How do I prepare an inherited home for sale in Toronto and Durham?

To prepare an inherited home for sale, start by decluttering and organizing the property. Conduct a thorough inventory, make necessary repairs, and consider professional assessments to enhance its market value. Gather essential documents like the original property deed and probate documents to streamline the selling process.

What are the tax implications of selling an inherited home in Ontario?

When selling an inherited home, you may face capital gains tax on 50% of the property's appreciation since the date of inheritance. However, beneficiaries generally do not pay Land Transfer Tax when inheriting the property. Consulting with a tax professional is recommended to navigate these complexities.

Do I need a realtor to sell my inherited property?

While it is not mandatory to hire a realtor to sell your inherited property, working with a knowledgeable real estate professional can significantly ease the process. A realtor with local market expertise can help you price the home competitively, manage negotiations, and maximize the property's value.

What should I consider when choosing a realtor for my inherited home?

When selecting a realtor, look for local market expertise, experience with estate sales, and a proven track record. Evaluate their professional credentials, client testimonials, and communication style to ensure that they can effectively address the unique emotional and financial complexities associated with selling an inherited property.

Ready to Navigate the Complexities of Selling Your Inherited Home?

Managing an inherited property in Toronto or Durham can feel overwhelming. There is so much at stake. You are not just handling paperwork. You are juggling legal details, sensitive family discussions, and the pressure of getting the sale right. From understanding probate and capital gains tax to preparing your home to get the most value, the challenges are real. The last thing you want is to leave money on the table or make a costly mistake.

Let Fanis Makrigiannis guide you through every step with the dedicated support and local expertise you deserve. Explore our trusted home selling tools and personalized strategies now. Discover how we can simplify your journey and help you protect your financial future. Take the first step and connect with Fanis today. The right advice makes all the difference. Act now while the market is in your favour.

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

How to Plan a Home Sale in Toronto & Durham for 2025 - Fanis Makrigiannis Realtor®

Selling Your Home Faster in Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Selling a House Fast in Toronto & Durham Guide in 2025 - Fanis Makrigiannis Realtor®

Home Selling Tips for Toronto and Durham 2025 - Fanis Makrigiannis Realtor®

How to Prepare for a Home Sale in Toronto & Durham for 2025 - Fanis Makrigiannis Realtor®

How to Market a Home in Toronto & Durham: 2025 Realtor® Guide - Fanis Makrigiannis Realtor®