Buying Investment Property in Toronto & Durham 2025

Toronto home sales just reached a five-month high with over 5,000 units changing hands and an 8.1 percent jump in June 2025 alone. Most people think the big city is the only hot spot for property investment right now. The surprise is that Durham homes are selling for about 18 percent less than the Toronto average, and those lower entry prices could mean bigger returns if you know where to look.

Understanding Toronto and Durham Real Estate Markets

The Toronto and Durham real estate markets represent a dynamic and complex investment landscape that demands careful analysis and a strategic approach. In 2025, these markets will continue to offer unique opportunities for investors willing to understand their nuanced characteristics and emerging trends.

Market Dynamics and Price Trends

The Greater Toronto Area (GTA) real estate market has shown remarkable resilience and complexity. Insights into regional investment strategies reveal significant variations between the Toronto and Durham regions. According to Reuters market data, home sales in the GTA increased for the third consecutive month in June 2025, reaching a five-month high with 5,068 seasonally adjusted units sold—an impressive 8.1% month-over-month rise.

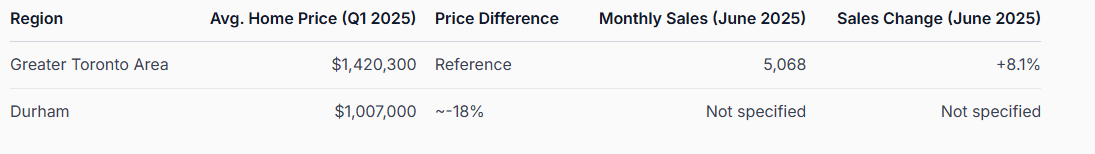

Durham Region presents a particularly interesting investment proposition. Official Durham economic data indicates that residential real estate prices in Q1 2025 were approximately 18% lower than the Greater Toronto Area average. Single-family detached homes in Durham averaged $1,007,000, compared to the GTA's $1,420,300, offering a significant cost advantage for investors seeking more affordable entry points.

To illustrate the price differences and sales data between Toronto (GTA) and Durham, here is a comparison table summarizing the figures mentioned:

Investment Potential and Market Characteristics

The Durham Region market demonstrates unique characteristics that make it attractive for investment. The DR Group's market analysis highlighted a substantial increase in active listings, reaching 2,583 in April 2025—the highest level for April since at least 2004. This expansion provides investors with increased selection and potentially more negotiating power.

Key considerations for buying investment property in these markets include understanding localized market trends, municipal growth strategies, and infrastructure development plans. Investors should pay close attention to emerging neighbourhoods, transportation accessibility, and potential future value appreciation. The proximity to Toronto makes Durham Region particularly compelling, offering more affordable options while maintaining strong connectivity to the broader metropolitan area.

Strategic investors recognize that successful real estate investment goes beyond simple price comparisons. Factors such as rental demand, local economic indicators, employment rates, and population growth play crucial roles in determining long-term investment viability. The Toronto and Durham markets offer a complex but potentially rewarding landscape for those prepared to conduct thorough research and maintain a flexible investment approach.

By understanding the nuanced differences between Toronto and Durham real estate markets, investors can make more informed decisions, identifying opportunities that align with their financial goals and risk tolerance. The key lies in comprehensive market analysis, staying informed about regional trends, and maintaining a strategic, patient approach to property investment.

Steps for Buying Investment Property in Ontario

Buying an investment property in Ontario requires strategic planning, financial preparation, and a comprehensive understanding of legal and market requirements. Successful investors approach this process with meticulous attention to detail and a well-structured strategy.

Financial Preparation and Assessment

Before diving into the investment property market, potential buyers must conduct a thorough financial assessment. Your comprehensive home buying guide recommends carefully evaluating your financial capacity. According to the Canada Financial Consumer Agency, investors should ensure their monthly housing costs do not exceed 39% of gross monthly income, with total monthly debt load remaining under 44%.

This financial discipline involves several critical steps:

- Mortgage Pre-approval: Secure a mortgage pre-approval to understand your borrowing capacity

- Down Payment Planning: Prepare for a minimum 20% down payment for investment properties

- Emergency Fund: Maintain a reserve for unexpected maintenance and vacancy periods

Legal and Property Evaluation

Navigating the legal landscape of investment property acquisition is crucial. The Residential Tenancies Act provides critical guidelines for property investors. Professional home inspection becomes paramount in identifying potential issues and ensuring the property meets safety standards.

Key legal and evaluation considerations include:

- Comprehensive property condition assessment

- Verification of zoning regulations

- Understanding tenant rights and landlord responsibilities

- Analyzing potential rental income and market demand

Strategic Investment Selection

Selecting the right investment property goes beyond mere financial calculations. Real estate investment insights emphasize the importance of location, potential appreciation, and rental market dynamics.

Investors should focus on:

- Researching neighbourhood growth potential

- Evaluating proximity to amenities and transportation

- Understanding local rental market trends

- Assessing long-term appreciation possibilities

Tips for Evaluating Property Value and ROI

Evaluating property value and return on investment (ROI) is a critical skill for successful real estate investors in the Toronto and Durham markets. A strategic approach combines comprehensive analysis, financial insight, and forward-looking market understanding.

Property Valuation Methodologies

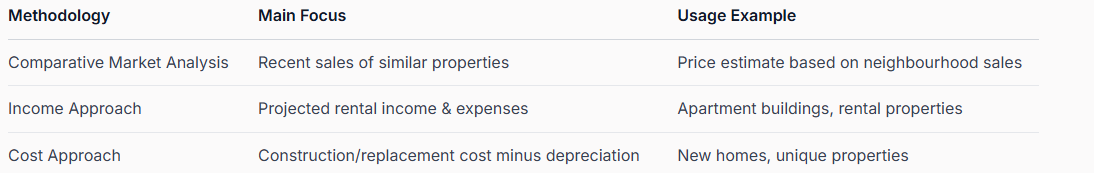

Investors must master multiple valuation techniques to accurately assess potential investment properties. Comprehensive property value insights highlight the importance of diverse assessment strategies. According to Canadian Real Estate Magazine, three primary valuation methods emerge as crucial:

- Comparative Market Analysis (CMA): Comparing recently sold similar properties

- Income Approach: Analyzing potential rental income generation

- Cost Approach: Estimating construction costs for equivalent properties

Below is a summary table outlining the three key property valuation methodologies and their primary focus:

Financial Considerations and ROI Calculation

Strategies for increasing property value emphasize the importance of a comprehensive financial evaluation. Canadian Real Estate Magazine recommends considering multiple financial factors beyond purchase price:

- Initial purchase and closing costs

- Potential renovation expenses

- Ongoing maintenance requirements

- Property tax implications

- Insurance and utility expenses

- Potential rental income

Location and Market Dynamics Analysis

Location remains the cornerstone of property valuation. Canadian Real Estate Magazine underscores the critical role of neighbourhood characteristics in determining investment potential. Key evaluation criteria include:

- Proximity to public transportation

- Local employment market strength

- School district quality

- Future urban development plans

- Demographic trends

- Economic growth indicators

Working with a Local Realtor for Best Results

Working with a local realtor represents a strategic advantage for investors navigating the complex Toronto and Durham real estate markets. A knowledgeable local professional can transform your investment journey, providing insights and expertise that significantly impact your property acquisition success.

Market Expertise and Insider Knowledge

Choosing the right real estate agent involves understanding the profound value they bring to investment strategies.

According to Scott and Maddie Real Estate, local agents possess comprehensive insights into neighbourhood-specific trends, property values, and community amenities that can dramatically influence investment decisions.

Key advantages of local market expertise include:

- Precise Neighbourhood Analysis: Identifying emerging investment hotspots

- Trend Forecasting: Understanding future development potential

- Micro-Market Intelligence: Recognizing subtle value variations across different areas

Professional Network and Transaction Support

Home selling tips and professional resources highlight the importance of a realtor's professional network. Joan and Mel Real Estate emphasizes that local agents maintain critical connections with essential service providers, including:

- Mortgage advisors

- Home inspectors

- Legal professionals

- Contractors and renovation specialists

- Property management experts

Strategic Investment Guidance

Beyond transactional support, a local realtor offers strategic investment guidance tailored to your specific financial goals. They can help investors:

- Analyze potential rental income

- Assess property appreciation potential

- Navigate complex market regulations

- Identify properties with optimal return on investment

- Provide an objective market perspective

The right realtor does more than facilitate a transaction; they become a strategic advisor who helps you navigate the intricate Toronto and Durham real estate markets with confidence and precision.

Frequently Asked Questions

What are the current trends in the Toronto and Durham real estate markets for 2025?

In 2025, the Toronto real estate market is experiencing significant activity, with sales hitting a five-month high. However, Durham offers more affordable options, with home prices averaging 18% less than Toronto, making it an attractive investment choice.

How can I prepare financially to buy an investment property in Ontario?

To prepare financially, you should secure a mortgage pre-approval, ensure your monthly housing costs are manageable, plan for a minimum 20% down payment, and maintain an emergency fund for unexpected expenses.

What are the key property valuation methods for assessing investment properties?

Key property valuation methods include Comparative Market Analysis (CMA), which evaluates similar recently sold properties; Income Approach, which focuses on potential rental income; and Cost Approach, which estimates construction costs for comparable properties.

Why is it important to work with a local realtor when investing in Toronto and Durham?

Working with a local realtor provides access to market expertise and insider knowledge, a robust professional network for transaction support, and strategic investment guidance tailored to your financial goals, which can significantly enhance your investment success.

Make Your Investment in Toronto & Durham Count in 2025

Are you struggling to find the right investment property while navigating the differences between the Toronto and Durham markets? The article showed how fast-changing prices, neighbourhood trends, and buyer competition can leave even seasoned investors feeling unsure about their next move. If you want data-backed insights, up-to-date listings, and a tailored approach for maximizing your return on investment, you deserve an expert in your corner.

Start your property search with confidence. At Fanis.ca, you will find exclusive access to the latest Toronto and Durham listings, detailed neighbourhood guides, and custom advice for both new and experienced investors. Explore our step-by-step buying guide for local expertise that fits your goals and get in touch for personal support. Opportunities are moving quickly this year. Connect with Fanis today and let a trusted professional help you turn insight into real results.

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended Articles:

Real Estate Investment Strategies: Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Real Estate Investment: Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Home Buying Process in Toronto & Durham Region for 2025 - Fanis Makrigiannis Realtor®

How to Find a Dream Home in Toronto & Durham Region: 2025 Guide - Fanis Makrigiannis Realtor®

How to Plan a Home Sale in Toronto & Durham for 2025 - Fanis Makrigiannis Realtor®

Why Buy in Toronto: Real Estate Opportunities in 2025 - Fanis Makrigiannis Realtor®