Selling Home for Retirement in Toronto & Durham 2025

Retiring in Toronto or Durham comes with some big decisions, and selling your family home can change everything. Yet, surprising as it sounds, downsizing can slash expenses and free up thousands of dollars every year, giving you new financial options most people overlook. Here’s what people miss: the real advantage is not just cashing out, but reshaping your lifestyle and security for years to come.

Why Sell Your Home for Retirement in Ontario?

Retirement represents a significant life transition that often prompts strategic financial decisions, with selling your home emerging as a powerful option for Ontario seniors seeking financial flexibility and lifestyle optimization. The decision to sell your home during retirement is not just about moving but about creating a sustainable and comfortable future.

Financial Liberation Through Home Equity

Selling your home in Ontario provides a remarkable opportunity to unlock substantial financial resources. Research from FirstOntario reveals that downsizing can significantly reduce living expenses by lowering utility bills, property taxes, and maintenance costs. For many retirees, their home represents their most valuable asset, and converting this equity into liquid funds can transform retirement planning.

The financial benefits extend beyond immediate cash influx. By strategically selling your home, you can:

- Reduce Ongoing Expenses: Smaller living spaces mean lower maintenance and utility costs

- Generate Investment Income: Reinvest home sale proceeds into income-generating assets

- Create Financial Cushion: Build a robust emergency fund for unexpected healthcare or personal expenses

Lifestyle and Accessibility Considerations

Ontario offers diverse housing options for retirees, from compact condominiums in urban centers to retirement communities designed with senior-friendly features. These alternatives provide not just a living space but a lifestyle that prioritizes comfort, safety, and social engagement.

The geographical flexibility of selling your home also allows you to potentially relocate closer to family, healthcare facilities, or regions with lower living costs. This strategic move can enhance both financial stability and personal well-being.

While selling a long-held family home is emotionally complex, it represents an opportunity for renewal. Research on home equity suggests that many retirees find the process liberating, viewing it as a chance to simplify their lives and focus on experiences rather than property maintenance.

To make this transition smoother, consider working with a local real estate professional who understands retirement dynamics. An experienced realtor can help navigate market conditions, pricing strategies, and find housing solutions that align with your retirement goals.

Ultimately, selling your home for retirement in Ontario is a multifaceted decision that balances financial pragmatism with personal aspirations. By approaching this transition thoughtfully, you can transform a property sale into a strategic step towards a more comfortable, secure, and fulfilling retirement.

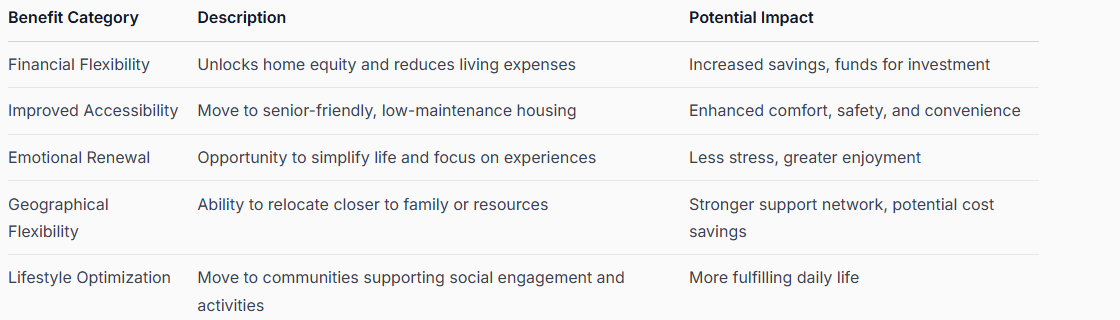

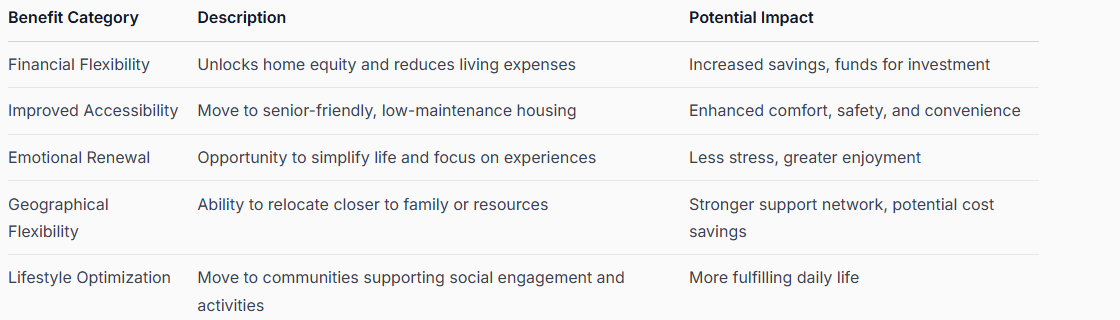

To help compare the main advantages of selling your home for retirement, here’s a summary table that outlines key benefits and their impact:

Selling a home in the Toronto and Durham regions requires strategic planning, meticulous preparation, and a comprehensive understanding of the local real estate market. For retirees looking to transition smoothly, navigating the selling process demands careful attention to multiple critical factors that can significantly impact the success of your property sale.

The Financial Consumer Agency of Canada recommends gathering essential documentation before listing your property. Critical documents include property deeds, survey plans, recent property tax receipts, renovation contracts, transferable warranties, and comprehensive inspection reports. These documents not only streamline the selling process but also provide potential buyers with transparency and confidence.

Preparing your home for sale involves more than paperwork. Consider these strategic steps:

Determining the right sale price is crucial in the competitive Toronto and Durham real estate markets. Research indicates that accurate pricing requires comprehensive market analysis, considering recent comparable sales, current market trends, and unique property characteristics.

Consider engaging a professional real estate appraiser who understands the nuanced local market dynamics. Learn more about selling your home efficiently in this region to maximize your property's potential value.

Beyond the sale itself, successful home selling for retirees involves carefully planned logistical transitions. City of Toronto guidelines recommend proactively managing several administrative tasks:

The Toronto and Durham regions offer unique opportunities for retirees looking to sell their homes. By approaching the process systematically, understanding local market dynamics, and preparing comprehensively, you can transform your home sale into a strategic step towards an exciting new chapter of retirement living.

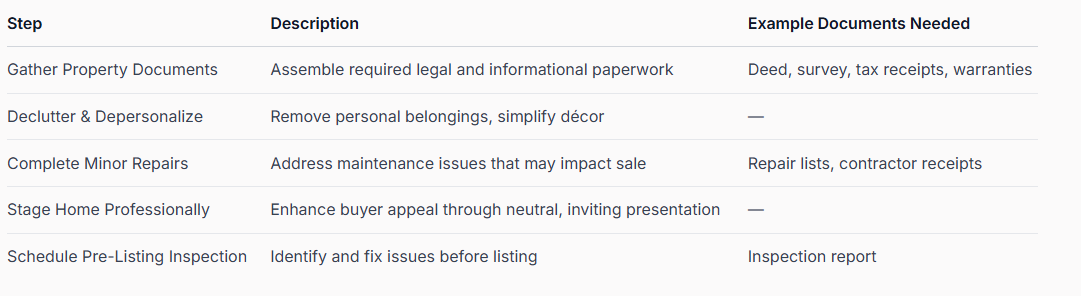

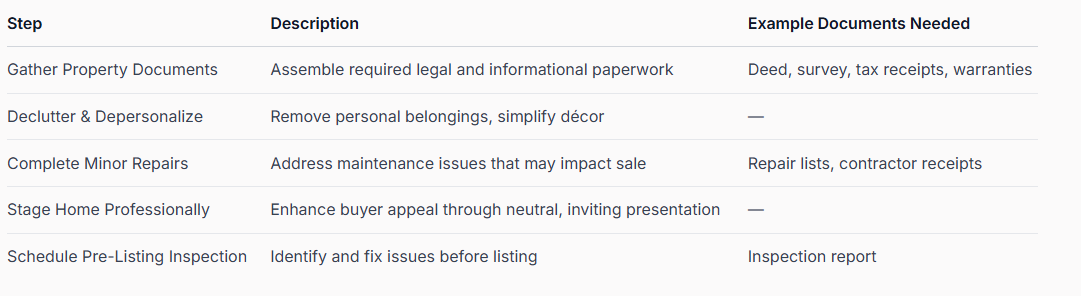

Below is a table outlining the essential preparation steps and documentation to streamline your home-selling process:

As retirees prepare to sell their homes in the competitive Toronto and Durham real estate markets, strategic improvements can significantly enhance property value and attract potential buyers. Understanding how to maximize your home's financial potential requires a thoughtful approach that balances cost-effective upgrades with meaningful value enhancement.

The Canada Greener Homes Loan offers an innovative opportunity for homeowners to invest in energy-efficient upgrades that can simultaneously increase property value and appeal to environmentally conscious buyers. These improvements not only make your home more attractive but can also provide potential tax incentives and lower utility costs.

The geographical flexibility of selling your home also allows you to potentially relocate closer to family, healthcare facilities, or regions with lower living costs. This strategic move can enhance both financial stability and personal well-being.

Emotional and Practical Transition

While selling a long-held family home is emotionally complex, it represents an opportunity for renewal. Research on home equity suggests that many retirees find the process liberating, viewing it as a chance to simplify their lives and focus on experiences rather than property maintenance.

To make this transition smoother, consider working with a local real estate professional who understands retirement dynamics. An experienced realtor can help navigate market conditions, pricing strategies, and find housing solutions that align with your retirement goals.

Ultimately, selling your home for retirement in Ontario is a multifaceted decision that balances financial pragmatism with personal aspirations. By approaching this transition thoughtfully, you can transform a property sale into a strategic step towards a more comfortable, secure, and fulfilling retirement.

To help compare the main advantages of selling your home for retirement, here’s a summary table that outlines key benefits and their impact:

Key Steps to Selling in Toronto and Durham

Selling a home in the Toronto and Durham regions requires strategic planning, meticulous preparation, and a comprehensive understanding of the local real estate market. For retirees looking to transition smoothly, navigating the selling process demands careful attention to multiple critical factors that can significantly impact the success of your property sale.

Comprehensive Property Preparation

The Financial Consumer Agency of Canada recommends gathering essential documentation before listing your property. Critical documents include property deeds, survey plans, recent property tax receipts, renovation contracts, transferable warranties, and comprehensive inspection reports. These documents not only streamline the selling process but also provide potential buyers with transparency and confidence.

Preparing your home for sale involves more than paperwork. Consider these strategic steps:

- Declutter and Depersonalize: Remove personal items to help potential buyers envision themselves in the space

- Complete Minor Repairs: Address small maintenance issues that could deter buyers

- Professional Staging: Create an inviting atmosphere that highlights your home's best features

Pricing and Market Strategy

Determining the right sale price is crucial in the competitive Toronto and Durham real estate markets. Research indicates that accurate pricing requires comprehensive market analysis, considering recent comparable sales, current market trends, and unique property characteristics.

Consider engaging a professional real estate appraiser who understands the nuanced local market dynamics. Learn more about selling your home efficiently in this region to maximize your property's potential value.

Logistical Transition Planning

Beyond the sale itself, successful home selling for retirees involves carefully planned logistical transitions. City of Toronto guidelines recommend proactively managing several administrative tasks:

- Notify utility companies about your address change

- Cancel existing home insurance upon property closing

- Schedule professional movers well in advance

- Update address with financial institutions, government agencies, and personal contacts

The Toronto and Durham regions offer unique opportunities for retirees looking to sell their homes. By approaching the process systematically, understanding local market dynamics, and preparing comprehensively, you can transform your home sale into a strategic step towards an exciting new chapter of retirement living.

Below is a table outlining the essential preparation steps and documentation to streamline your home-selling process:

Maximizing Your Home's Value Before Selling

As retirees prepare to sell their homes in the competitive Toronto and Durham real estate markets, strategic improvements can significantly enhance property value and attract potential buyers. Understanding how to maximize your home's financial potential requires a thoughtful approach that balances cost-effective upgrades with meaningful value enhancement.

Strategic Home Improvements

The Canada Greener Homes Loan offers an innovative opportunity for homeowners to invest in energy-efficient upgrades that can simultaneously increase property value and appeal to environmentally conscious buyers. These improvements not only make your home more attractive but can also provide potential tax incentives and lower utility costs.

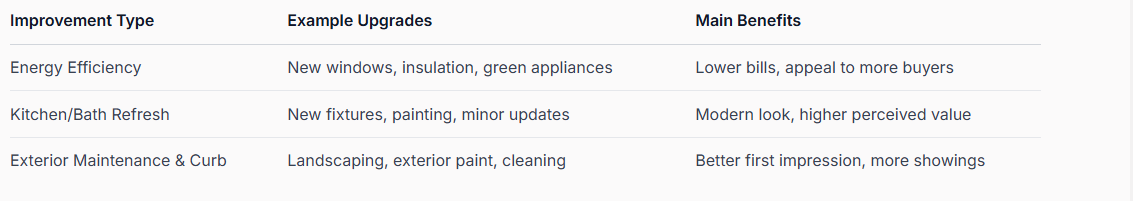

Consider these targeted improvements that offer a strong return on investment:

- Energy Efficiency Upgrades: Replace old windows, improve insulation

- Kitchen and Bathroom Refreshes: Update fixtures and minor cosmetic elements

- Exterior Maintenance: Enhance curb appeal through landscaping and painting

Professional Valuation and Pricing

The Financial Consumer Agency of Canada recommends a comprehensive approach to determining your home's market value. Professional appraisers can provide an objective assessment that considers current market conditions, recent comparable sales, and your property's unique characteristics.

Key considerations for accurate pricing include:

- Recent neighbourhood sales

- Current market trends

- Unique property features

- Seasonal market variations

Presentation and Marketability

Beyond physical improvements, how you present your home can dramatically impact its perceived value. Decluttering strategies can make spaces appear larger and more appealing to potential buyers. Professional staging can help buyers envision themselves in the space, potentially increasing both interest and sale price.

Psychological preparation is equally important. Understand that your home is now a product to be marketed, requiring emotional detachment and strategic presentation. Remove personal items, create neutral spaces, and highlight the property's most attractive features.

Retirees have a unique advantage in the real estate market. Years of careful maintenance and meaningful improvements can translate into tangible value. By approaching the sale strategically, you can maximize your home's potential, secure a competitive price, and smooth the transition into your next life chapter.

Remember, the goal is not just to sell a house, but to present a desirable home that reflects its true value and potential for future owners.

The following table summarizes the most effective home improvement strategies before selling and their benefits:

Choosing the Right Realtor for Your Retirement Move

Selecting the ideal real estate professional for your retirement home sale represents a critical decision that can significantly impact your financial outcome and overall transition experience. The right realtor does more than sell a property; they become a strategic partner, navigating the complex landscape of retirement real estate transactions.

Specialized Expertise for Retirement Transitions

Research indicates that certain real estate professionals hold specialized designations like Accredited Senior Agent (ASA) or Seniors Real Estate Specialist (SRES).

These credentials signify advanced training in addressing the unique challenges seniors face during property sales, including downsizing strategies, estate planning considerations, and emotional support throughout the transition.

Key qualifications to seek in a retirement-focused realtor include:

Forbes advises that interviewing multiple real estate agents is crucial to finding the right fit. This process allows you to assess not just professional credentials, but also personal compatibility and understanding of your specific retirement goals.

Recommended interview questions include:

- Market Knowledge: Deep understanding of Toronto and Durham region real estate trends

- Empathy and Communication: Ability to listen and address senior-specific concerns

- Network of Support: Connections with moving services, financial advisors, and senior resources

Comprehensive Interview and Selection Process

Forbes advises that interviewing multiple real estate agents is crucial to finding the right fit. This process allows you to assess not just professional credentials, but also personal compatibility and understanding of your specific retirement goals.

Recommended interview questions include:

- How many retirement-age clients have you successfully assisted?

- What strategies do you use to maximize property value for seniors?

- Can you provide references from recent senior clients?

Beyond the Transaction: Holistic Support

An exceptional realtor for retirement moves offers more than just transactional services. They provide a comprehensive support system that addresses the emotional and logistical complexities of transitioning from a long-held family home.

Look for a real estate professional who offers:

- Detailed market analysis specific to senior sellers

- Recommendations for home preparation and staging

- Connections to supportive services like downsizing specialists

- Transparent communication and patient guidance

By carefully selecting a realtor who combines specialized knowledge, empathy, and professional expertise, you can transform the potentially stressful process of selling your home into a smooth, empowering experience that sets the stage for an exciting new chapter of retirement living.

Frequently Asked Questions

Why should I consider selling my home for retirement in Ontario?

Selling your home for retirement can unlock significant financial resources, reduce ongoing expenses, and enable you to invest in income-generating assets, creating greater financial security for your future.

What should I do to prepare my home for sale in Toronto or Durham?

To prepare your home for sale, gather essential documents, declutter and depersonalize your space, complete minor repairs, and consider professional staging to boost market appeal and attract potential buyers.

How can I maximize my home's value before selling?

You can maximize your home's value by making strategic improvements like energy-efficient upgrades, refreshing kitchen and bathroom fixtures, and enhancing curb appeal with landscaping and exterior maintenance.

What should I look for in a realtor when selling my home for retirement?

When selecting a realtor, look for specialized expertise in retirement transitions, strong market knowledge, an empathetic approach, and a comprehensive support network to assist with the emotional and logistical aspects of downsizing.

Make Your Retirement Move Count With Proven Local Expertise

Transitioning to retirement is a big step, and selling your home in Toronto or Durham should feel empowering, not overwhelming. Many retirees worry about maximizing their home's value, preparing the right documents, and choosing a professional who truly understands their needs. You want reduced expenses, a smoother transition, and the confidence that your next step is the right one—these are real-life goals we hear every day.

At Fanis.ca, get access to in-depth market insights that put your interests first. Explore our selling guide for practical tips or request your free home evaluation so you can move ahead with certainty. Partner with a realtor who specializes in retirement transitions and receive step-by-step support from listing to moving day. Visit Fanis.ca now and secure your peace of mind while the market is in your favour.

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended Articles:

How to Plan a Home Sale in Toronto & Durham for 2025 - Fanis Makrigiannis Realtor®

Home Selling Tips for Toronto and Durham 2025 - Fanis Makrigiannis Realtor®

How to Prepare for a Home Sale in Toronto & Durham for 2025 - Fanis Makrigiannis Realtor®

Selling Your Home Faster in Toronto & Durham 2025 - Fanis Makrigiannis Realtor®