Real Estate Transaction Steps in Toronto & Durham 2025

Buying or selling a home in Toronto or Durham is more complicated than ever. There are numerous steps vying for your attention, from legal forms to unexpected hidden costs. Yet, most buyers underestimate homeownership costs by thousands of dollars every year, making costly mistakes that could have been avoided with the right strategy. Knowing the real steps behind a successful real estate transaction could completely change your experience.

Understanding Real Estate Transaction Steps in Ontario

Real estate transactions in Ontario represent a complex journey involving multiple legal, financial, and administrative steps that require strategic navigation. The process demands careful attention to detail and understanding of provincial regulations that govern property transfers.

Legal Framework and Initial Considerations

Ontario's real estate transaction landscape is governed by specific provincial regulations that protect both buyers and sellers. According to the Real Estate Council of Ontario, real estate transactions must adhere to strict legal standards that ensure transparency and fairness.

Professional representation plays a critical role in these transactions. A licensed real estate agent understands the nuanced steps required to complete a successful property transfer. From initial property search to final closing, these professionals guide clients through intricate processes that can overwhelm inexperienced buyers and sellers.

Transaction Workflow and Key Milestones

Typical real estate transactions in Ontario follow a structured workflow that includes several essential stages.

Ontario Real Estate Association outlines a comprehensive process that involves:

Financial preparedness is crucial in Ontario's real estate market. Buyers must demonstrate financial capability through mortgage pre-approval, proof of funds, and a comprehensive understanding of associated transaction costs. Canada Mortgage and Housing Corporation recommends potential buyers assess their financial readiness by considering expenses beyond the purchase price, including land transfer taxes, legal fees, and potential home renovation costs.

Legal complexities demand professional guidance. Engaging a qualified real estate lawyer ensures all legal requirements are met, title searches are completed, and potential property encumbrances are identified. These professionals play a pivotal role in reviewing purchase agreements, conducting title searches, and facilitating smooth property transfers.

Discover how to navigate potential transaction challenges and leverage professional expertise to streamline your real estate journey in Ontario. Whether you are a first-time homebuyer or an experienced investor, comprehending these transaction steps is fundamental to making informed property investment decisions.

Real estate transactions in Toronto and Durham require strategic planning and precise execution. Buyers and sellers must navigate a complex landscape of market dynamics, legal requirements, and financial considerations unique to this region.

Successful real estate transactions begin with thorough market research. Toronto Real Estate Board reports that understanding local market trends is crucial for both buyers and sellers. In Toronto and Durham, property values fluctuate based on neighbourhood characteristics, economic conditions, and specific local developments.

Buyers should conduct comprehensive property assessments that go beyond surface-level evaluations. This includes:

Financial readiness is a critical component of real estate transactions in this competitive market. Canada Mortgage and Housing Corporation emphasizes the importance of robust financial planning. Buyers must secure mortgage pre-approval, demonstrating financial capability and strengthening their negotiation position.

Sellers need to strategically price their properties. This involves:

Negotiation represents a critical phase in Toronto and Durham real estate transactions. The Ontario Real Estate Association highlights the importance of professional guidance during this complex process. Buyers and sellers must be prepared to:

Real estate transactions in Toronto and Durham involve numerous potential challenges that can derail even the most carefully planned property transfer. Understanding these common pitfalls is crucial for both buyers and sellers to navigate the complex real estate landscape successfully.

Financial miscalculations represent one of the most significant risks in real estate transactions. Canada Mortgage and Housing Corporation warns that buyers often underestimate the total cost of homeownership. Beyond the purchase price, individuals must account for:

Legal oversights can create substantial risks in real estate transactions. The Ontario Real Estate Association emphasizes the importance of thorough documentation and legal review. Common legal pitfalls include:

Emotional impulses can significantly impact real estate transactions. Toronto Real Estate Board notes that buyers and sellers often make decisions based on emotional responses rather than objective market analysis. This can lead to:

Learn more about avoiding critical purchasing mistakes to protect your investment. Professional real estate agents play a crucial role in providing objective guidance, helping clients navigate emotional challenges and make informed decisions.

Successful real estate transactions require a strategic approach that balances financial prudence, legal thoroughness, and emotional intelligence. By understanding these common pitfalls, buyers and sellers can approach their property journey with confidence and minimize potential risks.

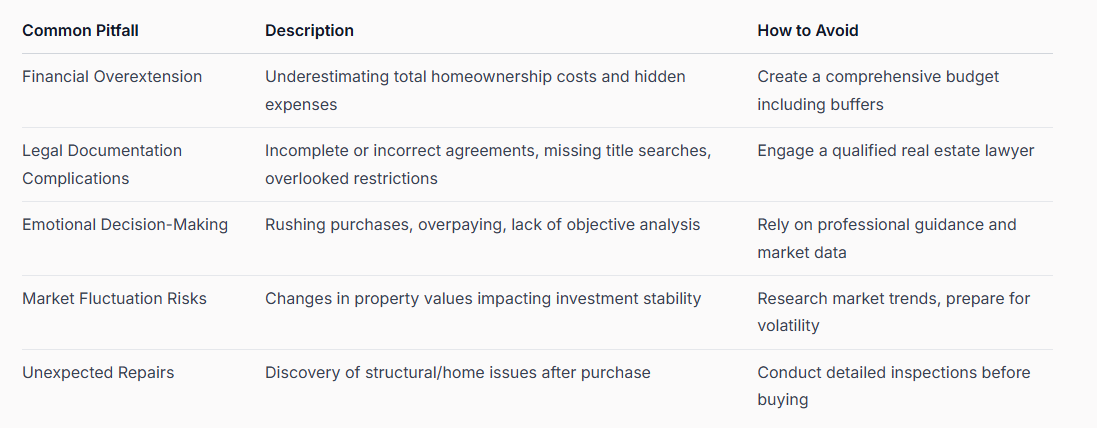

To highlight the main risks and prevention strategies, the table below summarizes common real estate transaction pitfalls and how to avoid them:

- Property Valuation: Determining accurate market value through professional appraisals and comparative market analysis

- Offer Preparation: Drafting legally binding purchase agreements with precise terms and conditions

- Negotiation: Strategic discussions between buyer and seller to reach mutually acceptable terms

Financial and Legal Considerations

Financial preparedness is crucial in Ontario's real estate market. Buyers must demonstrate financial capability through mortgage pre-approval, proof of funds, and a comprehensive understanding of associated transaction costs. Canada Mortgage and Housing Corporation recommends potential buyers assess their financial readiness by considering expenses beyond the purchase price, including land transfer taxes, legal fees, and potential home renovation costs.

Legal complexities demand professional guidance. Engaging a qualified real estate lawyer ensures all legal requirements are met, title searches are completed, and potential property encumbrances are identified. These professionals play a pivotal role in reviewing purchase agreements, conducting title searches, and facilitating smooth property transfers.

Discover how to navigate potential transaction challenges and leverage professional expertise to streamline your real estate journey in Ontario. Whether you are a first-time homebuyer or an experienced investor, comprehending these transaction steps is fundamental to making informed property investment decisions.

Essential Steps for Buyers and Sellers in Toronto and Durham

Real estate transactions in Toronto and Durham require strategic planning and precise execution. Buyers and sellers must navigate a complex landscape of market dynamics, legal requirements, and financial considerations unique to this region.

Comprehensive Property Assessment and Market Analysis

Successful real estate transactions begin with thorough market research. Toronto Real Estate Board reports that understanding local market trends is crucial for both buyers and sellers. In Toronto and Durham, property values fluctuate based on neighbourhood characteristics, economic conditions, and specific local developments.

Buyers should conduct comprehensive property assessments that go beyond surface-level evaluations. This includes:

- Detailed Home Inspections: Identifying potential structural issues and necessary repairs

- Neighbourhood Research: Analyzing local amenities, school districts, and future development plans

- Comparative Market Analysis: Understanding property values in specific Toronto and Durham neighbourhoods

Financial Preparation and Strategic Positioning

Financial readiness is a critical component of real estate transactions in this competitive market. Canada Mortgage and Housing Corporation emphasizes the importance of robust financial planning. Buyers must secure mortgage pre-approval, demonstrating financial capability and strengthening their negotiation position.

Sellers need to strategically price their properties. This involves:

- Understanding current market conditions

- Preparing properties for optimal presentation

- Setting competitive yet realistic pricing strategies

Negotiation and Closing Processes

Negotiation represents a critical phase in Toronto and Durham real estate transactions. The Ontario Real Estate Association highlights the importance of professional guidance during this complex process. Buyers and sellers must be prepared to:

- Navigate multiple offer scenarios

- Understand conditional clauses

- Manage potential counteroffers

Common Pitfalls and How to Avoid Them

Real estate transactions in Toronto and Durham involve numerous potential challenges that can derail even the most carefully planned property transfer. Understanding these common pitfalls is crucial for both buyers and sellers to navigate the complex real estate landscape successfully.

Financial Missteps and Overextension

Financial miscalculations represent one of the most significant risks in real estate transactions. Canada Mortgage and Housing Corporation warns that buyers often underestimate the total cost of homeownership. Beyond the purchase price, individuals must account for:

- Hidden Costs: Property taxes, maintenance expenses, and utility bills

- Unexpected Repairs: Potential structural issues or necessary home improvements

- Market Fluctuation Risks: Potential property value changes

Legal and Documentation Complications

Legal oversights can create substantial risks in real estate transactions. The Ontario Real Estate Association emphasizes the importance of thorough documentation and legal review. Common legal pitfalls include:

- Incomplete or improperly drafted purchase agreements

- Failure to conduct comprehensive title searches

- Overlooking potential property encumbrances or legal restrictions

Emotional Decision-Making and Market Misconceptions

Emotional impulses can significantly impact real estate transactions. Toronto Real Estate Board notes that buyers and sellers often make decisions based on emotional responses rather than objective market analysis. This can lead to:

- Overpaying for properties

- Making hasty decisions without proper due diligence

- Failing to negotiate effectively

Learn more about avoiding critical purchasing mistakes to protect your investment. Professional real estate agents play a crucial role in providing objective guidance, helping clients navigate emotional challenges and make informed decisions.

Successful real estate transactions require a strategic approach that balances financial prudence, legal thoroughness, and emotional intelligence. By understanding these common pitfalls, buyers and sellers can approach their property journey with confidence and minimize potential risks.

To highlight the main risks and prevention strategies, the table below summarizes common real estate transaction pitfalls and how to avoid them:

Choosing the Right Realtor for Your Transaction

Selecting the right realtor represents a critical decision that can significantly impact the success of your real estate transaction in Toronto and Durham. A skilled professional does more than facilitate a property transfer; they serve as a strategic partner, navigating complex market dynamics.

Professional Credentials and Market Expertise

The foundation of an exceptional realtor lies in their professional credentials and deep market understanding.

Real Estate Council of Ontario emphasizes the importance of working with licensed professionals who demonstrate proven expertise in local market conditions.

Key attributes to consider when evaluating a realtor include:

Key attributes to consider when evaluating a realtor include:

- Local Market Knowledge: Comprehensive understanding of Toronto and Durham region neighbourhood trends

- Transaction Experience: Proven track record of successful property transactions

- Professional Certifications: Additional qualifications beyond standard licensing

Communication and Strategic Approach

Effective communication distinguishes exceptional realtors from average practitioners. The Ontario Real Estate Association highlights that successful real estate professionals must demonstrate:

- Clear and transparent communication

- Proactive problem-solving skills

- Ability to negotiate effectively

- Responsiveness to client needs

Technology and Marketing Capabilities

In the digital age, a realtor's technological proficiency can significantly impact transaction success. Toronto Real Estate Board indicates that modern realtors must leverage advanced digital tools for marketing, client communication, and market analysis.

Critical technological capabilities include:

- Advanced property listing platforms

- Digital marketing strategies

- Virtual tour technologies

- Data analytics for pricing and market trends

Ultimately, choosing the right realtor is about finding a trusted advisor who combines local expertise, communication skills, and technological capabilities to transform your real estate goals into successful outcomes.

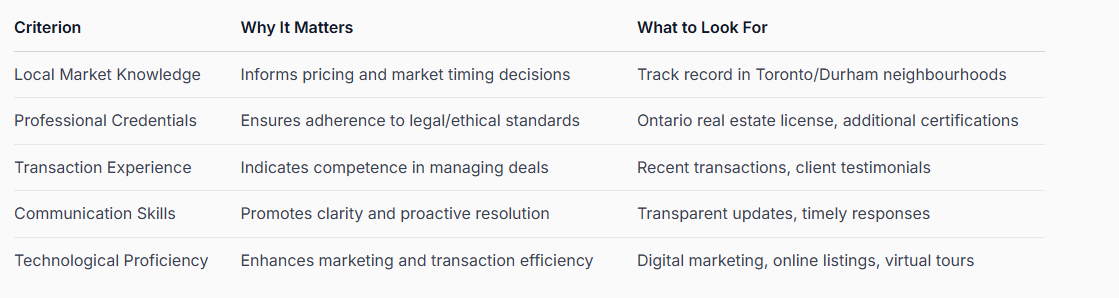

Below is a summary table of key criteria to consider when evaluating a realtor for your transaction in Toronto and Durham:

Frequently Asked Questions

What are the main steps in a real estate transaction in Toronto and Durham?

The main steps include understanding the legal framework, conducting property assessments, financial preparations, negotiating offers, and completing the closing processes.

How do I prepare financially for buying a home in Toronto or Durham?

To prepare financially, secure a mortgage pre-approval, create a comprehensive budget that factors in all potential costs, and ensure you account for hidden expenses like property taxes and maintenance fees.

Why is it important to choose a qualified realtor in Toronto and Durham?

A qualified realtor brings market expertise, helps navigate complex legal requirements, and effectively communicates to ensure a smooth transaction, making them a valuable asset during your real estate journey.

What are some common pitfalls to avoid in real estate transactions?

Common pitfalls include financial overextension, legal documentation complications, emotional decision-making, and underestimating hidden costs. Engaging professionals and conducting thorough research helps mitigate these risks.

Ready to Navigate Toronto & Durham Real Estate With Confidence?

If you are feeling overwhelmed by the complex steps, hidden costs and legal details described in this article, you are not alone. Many homebuyers and sellers in Toronto and Durham face common challenges like unexpected expenses, unclear market conditions and confusing paperwork. These issues can lead to costly mistakes or missed opportunities, especially if you do not have the right local guidance. At fanis.ca, you will find solutions designed to guide you through every phase of your real estate journey. Our platform offers:

- Professional home evaluations to accurately determine property value

- In-depth neighbourhood and market insights specific to Toronto and Durham

- Step-by-step buying and selling guides tailored to current regulations

- Trusted support from Fanis Makrigiannis, who brings proven experience and personalized strategies

Take charge of your next move and avoid transaction pitfalls. Connect with Fanis today to get expert advice or arrange a no-obligation property evaluation. Your successful home buying or selling story in the Toronto and Durham Region starts here. Explore our detailed first-time home buyer checklist for Toronto and Durham to plan your next step with confidence.

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Realtor®

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

How to Plan a Home Sale in Toronto & Durham for 2025 - Fanis Makrigiannis Realtor®

Real Estate Investment: Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Why Real Estate Investing Matters in Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Real Estate Investment Strategies: Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

The Complete Guide to Using an Online Notary Public for Affidavits and Declarations in Ontario (2025) - The Online Notary CA