Real Estate Commissions in Toronto & Durham 2025 Guide

Real estate commissions in Toronto and Durham are grabbing everyone’s attention right now as homes change hands at record prices. Most people expect to pay a flat rate without a second thought, but the truth is, commissions are almost always up for negotiation. The standard real estate commission ranges from 4% to 5% of your home’s price, but a shift to alternative structures could save sellers up to $12,000 on an $800,000 property. Dig a little deeper and you’ll find that the most surprising part is not just what you pay, but who really covers the cost in the end.

Understanding Real Estate Commissions in Ontario

How Real Estate Commissions Work in Ontario

In the Ontario real estate market, commissions typically range between 4% to 5% (there is no fixed amount) of the property’s total sale price. According to the Standing Committee on Public Accounts, these rates are generally negotiable between consumers and their real estate professionals. The commission is usually split equally between the seller’s agent and the buyer’s agent, meaning each side receives approximately 2% to 2.5% of the sale price.

In the Ontario real estate market, commissions typically range between 4% to 5% (there is no fixed amount) of the property’s total sale price. According to the Standing Committee on Public Accounts, these rates are generally negotiable between consumers and their real estate professionals. The commission is usually split equally between the seller’s agent and the buyer’s agent, meaning each side receives approximately 2% to 2.5% of the sale price.For homeowners in cities like Oshawa, Whitby, and Ajax, understanding this structure is essential. The commission covers a wide range of services, including market analysis, property marketing, negotiation, paperwork management, and guiding clients through complex real estate transactions.

Regulatory Oversight and Consumer Protection

In the Toronto and Durham regions, real estate agents must adhere to strict guidelines. These professionals are required to be transparent about commission structures, provide clear representation agreements, and act in the best interests of their clients. Consumers can access detailed information about real estate practices through RECO’s Information Guide, which offers insights into the benefits of working with a licensed real estate agent.

While commissions might seem straightforward, they can vary based on multiple factors such as property type, market conditions, and individual agent agreements. Homeowners and buyers in the Durham region should always discuss commission structures explicitly with their chosen real estate professional before signing any agreements.

For those looking to understand more about the financial aspects of real estate transactions, our comprehensive guide on real estate fees provides additional in-depth information about the costs associated with buying and selling properties in Ontario.

Who Pays Real Estate Commissions When Buying or Selling

Seller’s Role in Commission Payment

In cities like Oshawa, Whitby, and Ajax, this approach means that while sellers technically pay the commission, the cost is indirectly absorbed by the buyer through the property’s selling price. The standard commission rate of 4% to 5% is divided equally, with approximately 2% to 2.5% going to each agent involved in the transaction.

Buyer’s Indirect Commission Contribution

The commission is built into the overall transaction, meaning buyers are indirectly funding the agents’ services through their home purchase.

Our comprehensive guide on home-selling costs provides more insights into how these financial aspects work.

The recent legal settlement has introduced significant changes to how real estate commissions are structured.

Agents are now required to have written agreements with buyers, ensuring more transparency and allowing for individual negotiation of fees.

“In real estate, confidence and clarity lead to success — let’s make your next step your best one.” Fanis Makrigiannis, Real Estate Agent RE/MAX Rouge River Realty Ltd

Homeowners and potential buyers in the Durham region should understand that while the seller pays the commission, this cost is strategically incorporated into the property’s selling price. This means buyers are essentially sharing the cost through their home purchase.

Professional real estate agents provide valuable services that justify these commissions, including market analysis, negotiation support, paperwork management, and guiding clients through complex transactions.

Both buyers and sellers need to discuss commission structures explicitly with their real estate professionals. Understanding these financial dynamics helps ensure a transparent and smooth real estate transaction in the competitive markets of Toronto and the Durham region.

Typical Commission Rates in Toronto and Durham Region

Standard Commission Percentages

However, commission rates are not set in stone. Real estate professionals in the Durham region recognize that these percentages can be negotiable based on specific circumstances, property types, and the range of services provided. Our comprehensive guide on selling a home offers deeper insights into the financial considerations of real estate transactions.

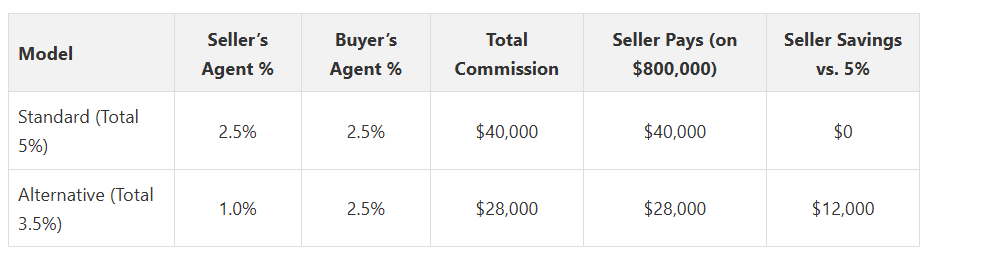

Some real estate professionals in the Durham region offer alternative commission models to attract sellers. As Matt Phillips, a local real estate expert, explains, some agents provide full services at reduced rates. In these scenarios, a listing agent might charge 1%, while the buyer’s agent still receives the standard 2.5%, resulting in a total commission of 3.5%.

For a property valued at $800,000, this alternative structure could save the seller approximately $12,000 compared to the traditional 5% commission. This approach demonstrates the flexibility within the local real estate market and the importance of discussing commission structures directly with potential agents.

While commission rates are crucial, homeowners and buyers should prioritize the quality of service, market knowledge, and negotiation skills of their chosen real estate professional. The lowest commission does not always equate to the best value or most successful property transaction.

Homeowners in Toronto and the Durham region should carefully evaluate their specific needs, property characteristics, and the comprehensive services offered by real estate agents. Transparent discussions about commission structures, expected services, and marketing strategies can help ensure a smooth and financially sound property transaction.

Here’s a table comparing standard and alternative commission structures using the $800,000 property example, which can help clarify potential seller savings:

How to Negotiate Real Estate Commissions and Save Money

Researching Market Rates and Service Offerings

Comparing multiple real estate agents allows sellers to understand the range of services offered at different price points. Some agents provide full-service packages at reduced rates, while others might offer à la carte services that can help minimize overall commission expenses. Requesting detailed service breakdowns helps homeowners understand the value proposition of each agent.

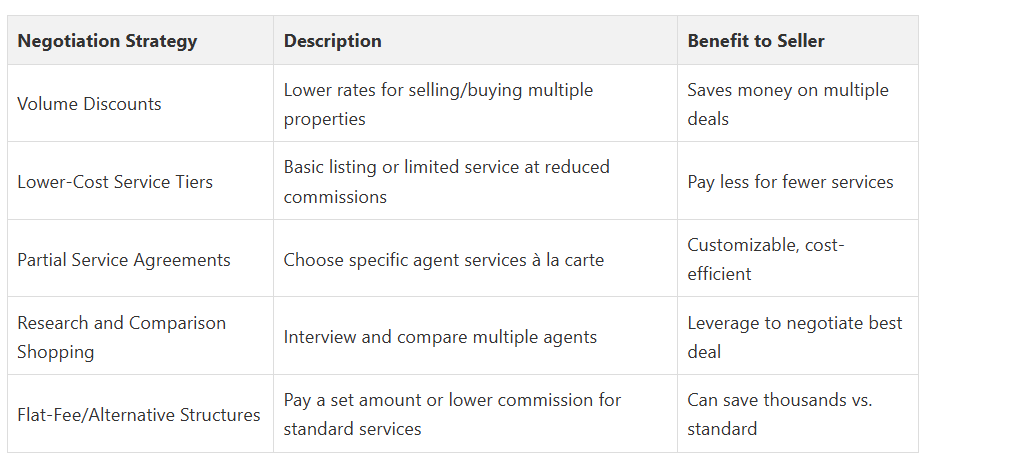

Strategies for Commission Negotiation

- Volume Discounts: Agents working with multiple properties from the same client may offer reduced rates.

- Lower-Cost Service Tiers: Some agents provide basic listing services at lower commission rates.

- Partial Service Agreements: Negotiating specific service components can help reduce overall costs.

The key is to balance cost savings with the quality of service. A slightly higher commission might result in a faster sale or better final price, ultimately providing more financial benefit.

Below is a table summarizing the main strategies for negotiating commissions and potential advantages:

Exploring Alternative Commission Structures

- Flat-fee services for standard listing packages

- Tiered commission structures based on sale price

- Reduced rates for properties in specific price ranges

Homeowners in the Toronto and Durham region should have open, transparent conversations about commission structures. Understanding the hidden costs of selling a home can provide additional context for these negotiations.

It’s crucial to remember that the lowest commission doesn’t always translate to the best outcome. The most effective approach involves selecting an agent who demonstrates:

- Strong market knowledge

- Proven track record of successful sales

- Comprehensive marketing strategies

- Effective negotiation skills

Homeowners should view commission negotiations as a collaborative process. A skilled real estate professional brings significant value through market insights, pricing strategies, and negotiation expertise. The goal is not simply to reduce costs but to maximize the overall value of the real estate transaction.

Frequently Asked Questions

The typical real estate commission rate in Toronto and Durham ranges from 4% to 5% of the property’s total sale price. This fee is commonly split between the seller’s and buyer’s agents.

Who pays the real estate commission when buying or selling a property?

Sellers generally pay the entire real estate commission, which is then included in the final sale price. Although sellers write the check, buyers indirectly cover these costs through their purchase price.

Can real estate commissions be negotiated in Toronto and Durham?

Yes, real estate commissions are negotiable. Sellers might explore alternative commission structures or negotiate rates based on the services provided by the real estate agents.

What are alternative commission structures available for sellers?

Alternative commission structures may include reduced rates, flat fees, or tiered commission percentages based on the sale price. These options can significantly lower the overall commission costs for sellers.

Navigating real estate commissions in Toronto and Durham can feel overwhelming, especially when every dollar matters during a major home sale or purchase. The article explains that commission rates are negotiable, but many homeowners are still unsure how to get the best value without sacrificing service. If you want to unlock savings or take advantage of alternative commission structures, working with the right real estate professional is crucial. At Fanis.ca, we help you simplify each step by offering transparent guidance, personalized market insights, and strategies that save you money.

Tired of Uncertainty About Real Estate Commissions?

Stop guessing about costs and start maximizing your results. Discover how our full-service approach delivers both savings and peace of mind, whether you are selling, buying, or simply exploring your options. Ready for a home evaluation or want to learn more? Visit our guides or go straight to Fanis.ca today to connect with an experienced local expert. Take the next step toward a smarter real estate decision now.

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

How to Plan a Home Sale in Toronto & Durham for 2025 - Fanis Makrigiannis Realtor®

How to Choose a Real Estate Agent in Toronto and Durham in 2025 - Fanis Makrigiannis Realtor®

How to Market a Home in Toronto & Durham: 2025 Realtor® Guide - Fanis Makrigiannis Realtor®

The Complete Guide to Using an Online Notary Public for Affidavits and Declarations in Ontario (2025) - The Online Notary CA

What Is a Real Estate Lead? Guide for Agents and Teams 2025 - Lead Linker