Top Investment Property Tax Tips for Toronto and Durham 2025

Owning an investment property in Toronto or the Durham Region might seem straightforward at first. But here is a number that can change everything. The Canada Revenue Agency taxes 100 percent of rental income and at least 50 percent of your capital gains when selling. Most people think the real headaches come from tenants or repairs. The real challenge is knowing how the latest tax rules can either eat away your profit or quietly boost your returns if you know the right moves.

Understanding Investment Property Taxes in Ontario

Key Tax Considerations for Property Investors

According to the Canada Revenue Agency, rental income from investment properties is fully taxable. Investors must report all rental income and can offset this with eligible expenses, including mortgage interest, property taxes, insurance, maintenance costs, and utilities. This approach allows savvy investors to minimize their tax liability while maximizing potential returns.

Strategic Tax Planning for Real Estate Investments

Property investors in the Durham Region and Toronto should be aware of additional tax considerations. Multi-residential properties and commercial investment properties may have different tax treatment compared to single-family rental units. Local municipalities like Oshawa and Ajax have specific tax assessment protocols that can impact overall investment returns.

Tax deductions represent a powerful tool for investment property owners. Depreciation of the property, professional fees related to property management, and travel expenses associated with property maintenance can all potentially reduce tax liability. However, investors must maintain meticulous records and consult with tax professionals to ensure compliance with current regulations.

“Real estate is a long-term game. I’m here to help you win it with clarity and confidence.” Fanis Makrigiannis, Real Estate Agent RE/MAX Rouge River Realty Ltd.

The complexity of investment property taxes extends beyond simple income reporting. Foreign ownership rules, principal residence exemptions, and specific regional tax incentives can all play significant roles in an investor’s overall tax strategy. Investors in Whitby and Pickering, for instance, may encounter unique local tax considerations that require specialized knowledge.

Ultimately, successful real estate investment in Ontario demands a proactive approach to tax planning. Investors should consider working with qualified tax professionals who specialize in real estate investments. By understanding the intricate tax landscape, investors can develop strategies that maximize their returns while maintaining full compliance with provincial and federal tax regulations.

Pro tip: Keep detailed records of all property-related expenses and consult with a tax professional annually to ensure you’re optimizing your investment property tax strategy. The tax implications can significantly impact your overall investment returns in the Toronto and Durham Region real estate markets.

Top Deductions and Credits for Property Owners

Mortgage Interest and Financing Expenses

Interest paid on loans used to purchase, improve, or maintain rental properties can be fully deductible. However, investors must maintain precise documentation and ensure the expenses directly relate to income-generating properties. Fanis Makrigiannis Realty recommends working with tax professionals to navigate these complex deduction rules and maximize potential tax savings.

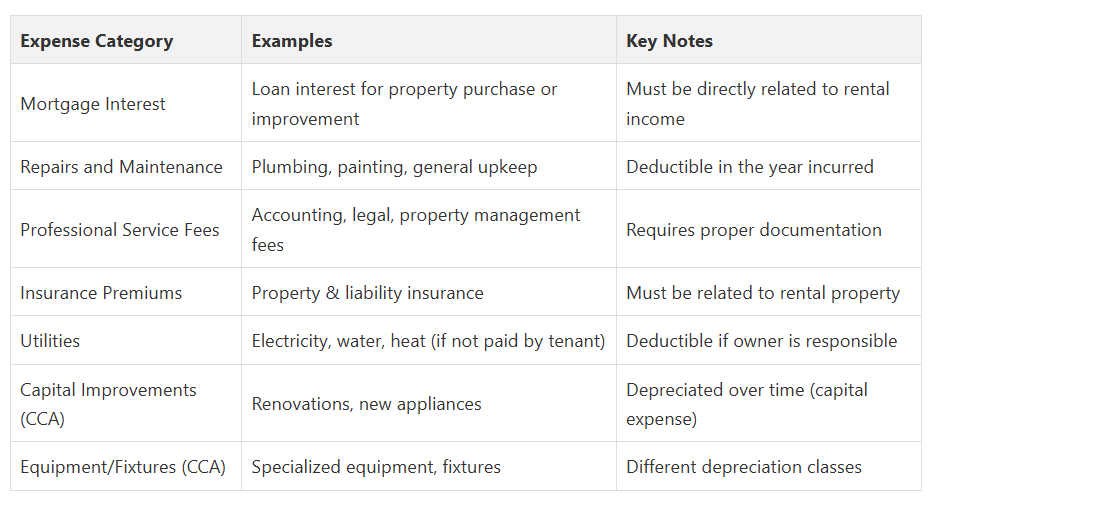

Property owners can leverage numerous deductions related to property management and maintenance. Eligible expenses include professional property management fees, repairs, maintenance costs, insurance premiums, and utilities paid for rental properties. The Canada Revenue Agency allows investors to deduct these expenses in the year they are incurred, providing immediate tax relief.

Specific deductible expenses encompass:

- Repair and maintenance costs: Fixing plumbing, electrical systems, painting, and general property upkeep

- Professional service fees: Accounting, legal, and property management expenses

- Insurance premiums: Property and liability insurance for rental units

- Utility expenses: Costs not recoverable from tenants

Capital Cost Allowance and Property Improvements

Important considerations for CCA include:

- Building depreciation: Typically calculated at 4% annually for residential rental properties

- Capital improvements: Significant renovations that enhance property value can be depreciated over time

- Equipment and fixtures: Specialized equipment in rental properties may have different depreciation rates

Property investors in the Durham Region should be particularly attentive to these deductions. While tax regulations can be complex, strategic planning can result in substantial financial benefits. Professional consultation ensures compliance and maximizes potential tax advantages.

Key recommendations for property owners include maintaining comprehensive financial records, tracking all expenses meticulously, and consulting with tax professionals who specialize in real estate investments. By understanding and implementing these deduction strategies, investors can optimize their tax positions and enhance the overall financial performance of their real estate portfolios.

Pro tip: Consider working with a certified tax professional who understands the nuanced tax landscape of investment properties in the Toronto and Durham Region. Their expertise can help you navigate complex deduction rules and identify opportunities for tax optimization.

To help property owners quickly reference the main deductible expenses and types of property improvements discussed above, the table below summarizes key deduction opportunities related to property ownership and management:

Tax Strategies for Buyers and Sellers in Durham Region

Strategic Property Acquisition Considerations

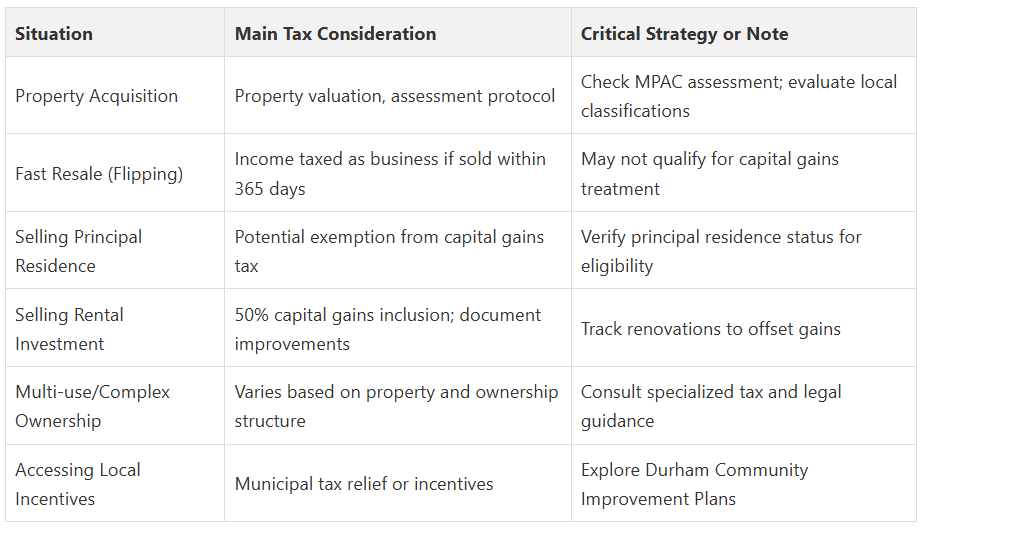

Special attention must be given to recent tax measures affecting real estate transactions. The Canada Revenue Agency has implemented rules targeting short-term property flipping, which means properties sold within 365 days of acquisition may be fully taxed as business income. This regulation significantly impacts investment strategies for properties in Toronto and the Durham Region.

Tax Optimization for Property Sellers

- Capital gains calculations: Understanding how to minimize taxable capital gains

- Principal residence exemption: Evaluating eligibility for tax-free property sales

- Documenting property improvements: Tracking expenses that can reduce capital gains tax

The municipal tax landscape in the Durham Region presents unique opportunities for tax optimization. Durham Region’s Community Improvement Plans offer financial incentives that can offset potential tax burdens for property investors and sellers.

Complex Tax Scenarios for Investors

The Canada Revenue Agency provides specific guidelines for reporting rental income and managing the tax implications of investment properties.

Key strategies for tax management include:

- Maintaining detailed financial records

- Understanding depreciation rules

- Tracking all property-related expenses

- Consulting with tax professionals specializing in real estate

Special consideration must be given to properties with multiple uses or complex ownership structures. The tax treatment can vary significantly based on whether a property is a primary residence, rental property, or mixed-use investment.

Investors in Whitby and Pickering should be particularly attentive to local tax assessment protocols. The Municipal Property Assessment Corporation (MPAC) plays a crucial role in determining property valuations, which directly impact tax liabilities.

Professional guidance is essential in navigating these complex tax strategies. Working with Fanis Makrigiannis Realty can provide investors with tailored advice specific to the Durham Region real estate market.

Pro tip: Always consult with a tax professional who specializes in real estate transactions in the Durham Region. The nuanced tax landscape requires expert navigation to optimize your financial outcomes and minimize potential tax liabilities.

To clarify and compare tax implications for property sellers, buyers, and complex investor scenarios in Durham Region, the table below summarizes the key tax strategies and special considerations:

Common Mistakes and Expert Advice for 2025

Overlooked Tax Reporting and Documentation Errors

Common documentation errors include:

- Incomplete expense tracking: Failing to record all deductible expenses

- Improper income reporting: Miscalculating rental income

- Inadequate receipt management: Not preserving financial documentation

Fanis Makrigiannis Realty recommends creating a systematic approach to financial record-keeping, including digital backup systems and professional consultation.

Strategic Investment Miscalculations

- Overlooking comprehensive market research

- Failing to account for potential market fluctuations

- Underestimating maintenance and operational costs

- Neglecting professional tax and legal advice

The Durham Region presents unique investment challenges. Investors must carefully evaluate local market conditions, municipal tax regulations, and potential growth areas in Oshawa, Ajax, Whitby, and Pickering.

Advanced Tax Planning and Compliance Strategies

Key strategies for avoiding common mistakes include:

- Consulting with tax professionals specializing in real estate

- Understanding current tax legislation and potential changes

- Implementing comprehensive financial tracking systems

- Regularly reviewing investment portfolio performance

Investors should be particularly attentive to recent changes in tax regulations affecting property investments. The implementation of new rules surrounding property flipping and rental income reporting requires careful navigation.

Professional guidance becomes crucial in mitigating potential risks. Fanis Makrigiannis Realty emphasizes the importance of working with experienced professionals who understand the nuanced tax landscape of the Toronto and Durham Region real estate market.

Emerging trends in real estate taxation suggest increasingly complex regulatory environments. Investors must remain adaptable, continuously educating themselves about changes in tax legislation, municipal regulations, and market dynamics.

Pro tip: Develop a comprehensive approach to investment property management that includes regular financial reviews, professional consultations, and a proactive strategy for tax optimization. The most successful investors treat their real estate investments as dynamic, evolving financial assets requiring continuous attention and strategic planning.

Frequently Asked Questions

Investment properties in Ontario are fully taxable for rental income, and 50% of capital gains from sales are also taxable. Understanding the assessed value and local regulations is crucial for managing tax liabilities.

How can I reduce my taxable rental income as a property owner?

What should I know about capital gains tax when selling an investment property?

Why is it important to keep detailed records of property-related expenses?

Ready to Maximize Your Investment Returns? Let Fanis Makrigiannis Guide You

Take control of your real estate journey right now. With Fanis Makrigiannis Realty, you get more than just property listings—you get a partner who knows the ins and outs of local property taxation, deductions, and smart selling strategies. Whether you are buying, selling, or exploring tax-optimized opportunities, visit https://fanis.ca to access tailored insights, request a personalized consultation, and move forward with confidence. Book your appointment today to avoid costly errors and turn your investment into lasting wealth.

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

Real Estate Investment Strategies: Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Why Real Estate Investing Matters in Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Real Estate Investment: Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Importance of Notarized Documents for Ontario Businesses 2025 - My Mobile Notary