Real Estate and Inflation: What Homebuyers and Sellers Need to Know

Home prices across Toronto and Durham have shifted in a way few could have predicted. House values have more than doubled compared to family incomes since 2005, and not a single market in Southern Ontario is considered affordable anymore. Oddly enough, higher prices are just part of a bigger story. Because inflation is rewriting every rule, what used to be a safe move in real estate could now mean taking a serious financial risk.

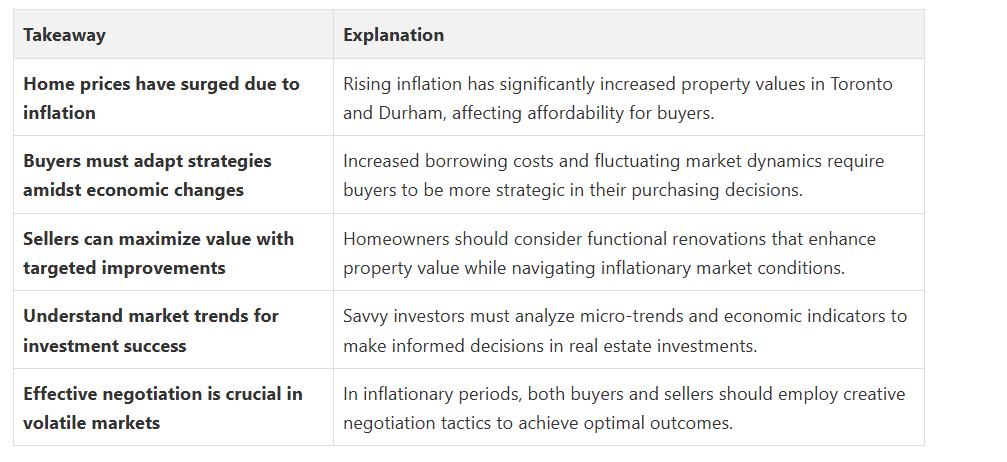

Quick Summary

How Inflation Impacts Home Prices in Toronto and Durham Region

The Inflation-Driven Price Surge

For homeowners in cities like Ajax, Whitby, and Oshawa, this means property values have not just increased but have fundamentally transformed. Inflation has acted as a powerful multiplier, pushing real estate prices to levels that challenge traditional affordability metrics. Fanis Makrigiannis Realty has observed these trends closely, understanding how macroeconomic forces reshape local housing landscapes.

Purchasing Power and Market Adaptations

In Pickering and Toronto, this means potential homeowners are facing a dual challenge: escalating property prices and potentially higher borrowing costs. The traditional calculus of home affordability has been dramatically disrupted. Investors and first-time homebuyers alike must now consider not just the current market value, but potential future inflationary impacts.

Strategic Considerations for Buyers and Sellers

The key is recognizing that inflation isn’t just a number—it’s a dynamic force reshaping entire communities. Whether you’re looking to buy in Oshawa or sell in Toronto, understanding these broader economic trends becomes crucial. Homeowners and potential buyers must view real estate not just as a transaction, but as a strategic financial decision deeply intertwined with broader economic cycles.

Selling Your Home: Maximizing Value During Inflation

Property Valuation in an Inflationary Market

Fanis Makrigiannis Realty recommends a comprehensive approach to property valuation. This means looking beyond current market prices and understanding how economic indicators impact long-term property worth. Strategic improvements and precise timing can significantly enhance your home’s marketability during inflationary periods.

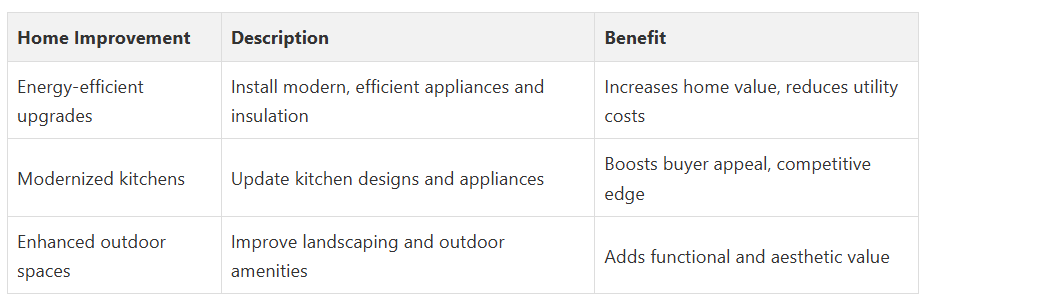

Strategic Home Improvements

Key improvements might include energy-efficient upgrades, modernized kitchens, and enhanced outdoor spaces. These investments not only increase home value but also provide resilience against inflationary market pressures. Learn more about maximizing your home’s selling potential with our comprehensive guide.

Here’s a summary of strategic home improvements recommended for increasing property value during inflationary periods. This table highlights specific upgrades mentioned and their potential financial benefits.

Timing and Negotiation Strategies

Pricing strategy becomes paramount. Overpricing can deter potential buyers, while underpricing might result in significant financial loss. Professional appraisals, market comparisons, and understanding broader economic trends become crucial. Fanis Makrigiannis Realty specializes in helping homeowners navigate these intricate market conditions, ensuring optimal financial outcomes.

Ultimately, selling a home during inflationary periods is about strategic positioning. Homeowners must view their property not just as a living space but as a dynamic financial asset. By understanding market trends, making targeted improvements, and working with experienced professionals, sellers can transform economic challenges into opportunities for substantial financial gain.

Investment Opportunities: Navigating Real Estate and Inflation

Strategic Investment Approaches

Fanis Makrigiannis Realty recommends a multi-faceted approach to real estate investment. This means looking beyond traditional residential properties and exploring diverse investment strategies. Multi-unit properties, commercial real estate, and strategic renovation projects can provide multiple income streams and hedge against inflationary pressures.

Analyzing Market Micro-Trends

Different investment strategies emerge during inflationary periods. Some investors focus on rental properties, recognizing that rising property values combined with increased rental rates can create substantial passive income. Others look towards properties with potential for significant value appreciation through strategic improvements. Explore our comprehensive guide to confident real estate investing.

Risk Management and Long-Term Planning

Investors must develop flexible strategies that adapt to changing market conditions.

Financial planning takes center stage. Working with experienced professionals like those at Fanis Makrigiannis Realty can help investors develop nuanced approaches that balance potential risks with promising opportunities.

This might involve leveraging low-interest periods, understanding tax implications, and creating long-term investment portfolios that can withstand economic fluctuations.

“The best time to start building your future is now — the second best is yesterday.” Fanis Makrigiannis, Real Estate Agent RE/MAX Rouge River Realty Ltd.

Ultimately, real estate investment during inflationary periods is about strategic vision. By understanding market trends, maintaining financial flexibility, and working with knowledgeable professionals, investors can transform economic challenges into opportunities for substantial wealth creation. The key lies in education, careful analysis, and a willingness to adapt to the ever-changing economic landscape.

Expert Tips for Buyers and Sellers in an Inflationary Market

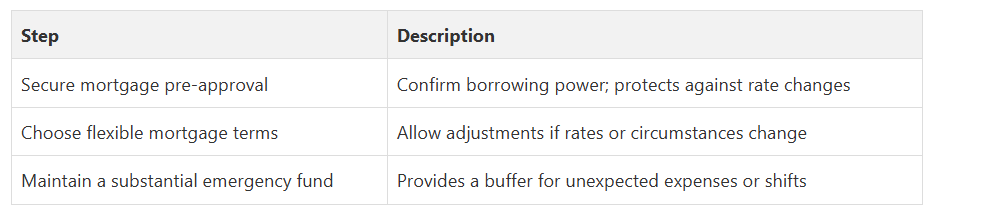

Financial Preparation and Strategy

Fanis Makrigiannis Realty recommends several key financial preparation steps. First, buyers should secure mortgage pre-approval with flexible terms. This provides a clear understanding of borrowing capacity and protects against potential rate increases. Additionally, maintaining a substantial emergency fund becomes crucial, offering a financial buffer against unexpected market shifts.

Below is a table summarizing key financial preparation steps for buyers in an inflationary real estate market, as outlined in the article.

Strategic Negotiation Techniques

Sellers must be prepared to be flexible with terms and pricing. This might involve creative strategies like seller financing or including additional value-added features to make properties more attractive. Buyers, conversely, should focus on properties with intrinsic value and potential for long-term appreciation. Discover advanced negotiation strategies for the current market.

Risk Mitigation and Long-Term Planning

For buyers in the Durham Region, this translates to thorough property research. Look beyond surface-level characteristics and evaluate properties based on potential future value. Consider factors like proximity to public transit, planned community developments, and potential for value-adding renovations.

Fanis Makrigiannis Realty emphasizes the importance of working with experienced real estate professionals who understand complex market dynamics. A knowledgeable realtor can provide insights into micro-market trends, help navigate negotiation complexities, and develop personalized strategies tailored to individual financial goals.

Ultimately, success in an inflationary real estate market comes down to education, flexibility, and strategic thinking. By understanding economic indicators, maintaining financial resilience, and working with experienced professionals, buyers and sellers can transform challenging market conditions into opportunities for substantial financial growth.

Frequently Asked Questions

What strategies should buyers consider during inflationary periods?

How can sellers maximize their home’s value in an inflationary market?

Sellers can enhance property value through strategic home improvements, such as energy-efficient upgrades and modernizing kitchens. Accurate property valuation and timing the market effectively are also key strategies.

What investment opportunities arise from real estate during inflation?

Investors can exploit inflationary periods by diversifying their portfolios, focusing on multi-unit properties, and keeping a close eye on local market trends. Strategic renovations can also lead to substantial gains in property value.

Navigate Inflation With Confidence: Expert Real Estate Solutions in Toronto and Durham

Every market has hidden potential, even in times of inflation. Work with a local expert who understands the details behind property values, strategic renovations, neighbourhood trends and advanced negotiation tactics. Take your next step with the personalized services and home evaluation tools at Fanis Makrigiannis Realty. Curious about your home’s current worth or your buying power today? Contact us now and build your strategy for a strong financial future.

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

Will Real Estate Prices Drop in 2025? - Fanis Makrigiannis Realtor®

Buying Real Estate with Confidence - Fanis Makrigiannis Realtor®

Buy vs Renting in Toronto 2025: A Guide for Homebuyers & Sellers - Fanis Makrigiannis Realtor®