Understanding Property Taxes Ontario: A Guide for Buyers and Sellers

Property taxes in Ontario might seem straightforward and just part of owning a home, but the numbers can surprise even the savviest buyer or seller. Some homeowners in Toronto face annual property tax bills that swing from $3,000 to $6,000 for a $500,000 house, depending on their municipality. What most people miss is how these taxes can quietly make or break your deal when it comes time to buy or sell, shaping everything from your monthly budget to a home’s spot on the market.

Property taxes in Ontario represent a fundamental financial mechanism that funds municipal services and infrastructure. Ontario’s municipal taxation system operates through a structured process that determines how much homeowners contribute based on their property’s assessed value and local tax rates.

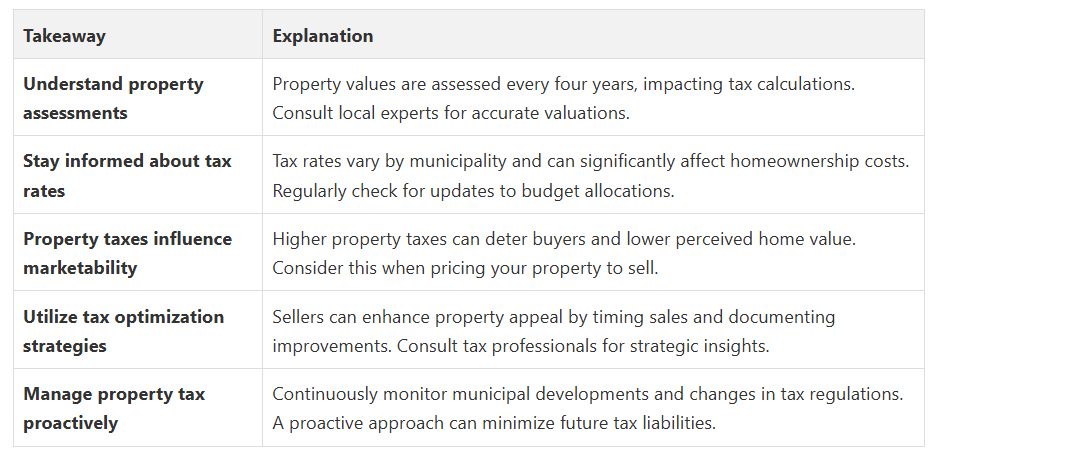

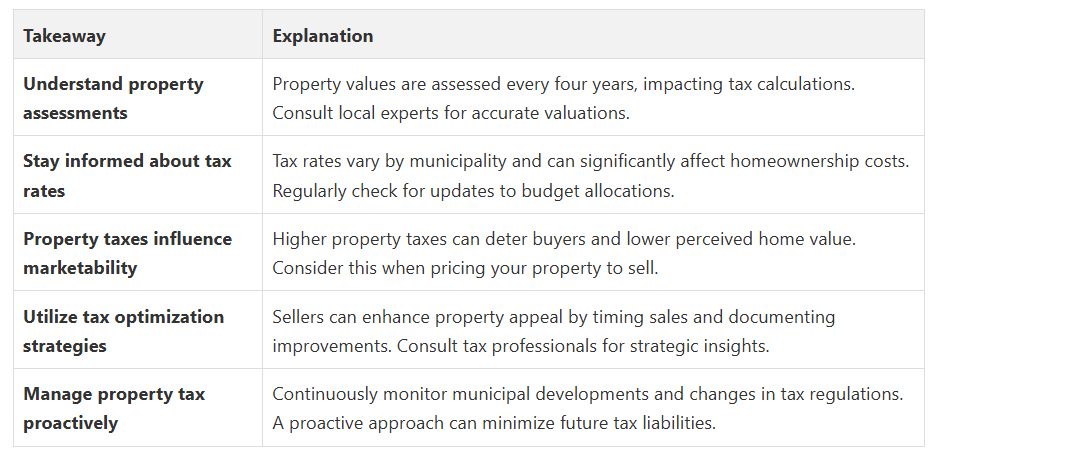

The Municipal Property Assessment Corporation (MPAC) plays a critical role in determining property values across Ontario. Every four years, MPAC conducts comprehensive property assessments that establish the baseline for tax calculations. For homeowners in cities like Toronto, Oshawa, Ajax, Whitby, and Pickering, this means your property’s market value becomes the foundation for tax calculations.

These assessments ensure a standardized approach to determining property values across different municipalities in the Durham Region and Greater Toronto Area.

Once MPAC establishes a property’s assessed value, local municipalities apply their specific tax rates to generate revenue. According to the Ontario Municipal Management Association, these rates vary by municipality and are designed to fund essential community services such as:

For property owners working with Fanis Makrigiannis Realtor®, understanding these tax calculations becomes crucial when evaluating potential real estate investments or home purchases in Ontario.

Beyond basic municipal taxes, Ontario homeowners must also account for education levies and potential special area charges. These additional assessments can significantly impact overall property tax obligations. Investors and homebuyers should carefully review current tax rates and potential future adjustments when making real estate decisions in regions like the Durham Region or Toronto.

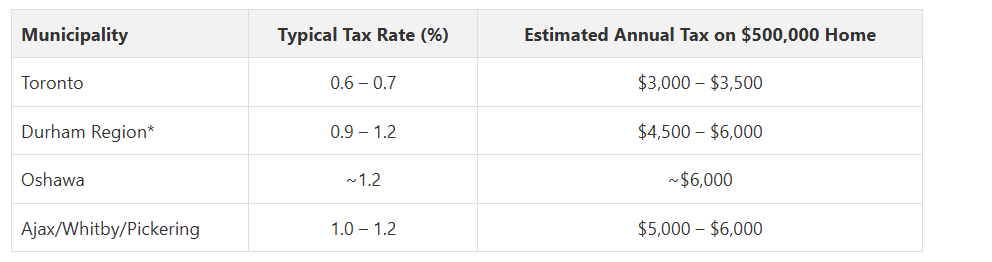

Property tax rates in Toronto and the Durham Region represent a complex financial landscape that significantly impacts homeowners and real estate investors. The City of Toronto’s property tax framework demonstrates substantial variations across different property classifications, making it crucial for potential buyers and sellers to understand these nuanced calculations.

In the Greater Toronto Area, residential property tax rates exhibit notable differences between municipalities. Toronto, as the largest urban center, maintains a distinct tax structure compared to surrounding Durham Region communities like Oshawa, Ajax, Whitby, and Pickering. Durham Region’s annual property tax study reveals that residential tax rates are carefully calculated based on assessed property values and municipal budget requirements.

Beyond standard municipal property taxes, homeowners in Toronto and Durham Region must also account for education levies and potential special area charges. These additional assessments can incrementally increase overall tax obligations. Some municipalities implement targeted levies for specific infrastructure or community development projects, which can marginally adjust the total tax burden.

Property taxes play a crucial role in shaping real estate market dynamics, directly influencing home values and selling strategies across Ontario. The Ontario Real Estate Association emphasizes that potential buyers carefully evaluate property tax implications when considering a home purchase, making these financial factors a critical component of real estate transactions.

When preparing to sell a home, understanding the tax implications becomes paramount. Fanis Makrigiannis, Realtor®, recommends proactively addressing property tax concerns to maximize home value. This might involve:

Some municipalities offer property tax relief or reassessment opportunities that can potentially improve a home’s marketability. Sellers who can demonstrate favourable tax positioning may attract more competitive offers from potential buyers.

Property taxes are more than just an annual expense; they represent a critical factor in long-term real estate investment strategy. Homeowners in the Durham Region and Greater Toronto Area must consider how changing tax landscapes can impact property appreciation. Our guide on increasing property value provides additional insights into managing this complex aspect of home ownership.

The relationship between property taxes and home value is intricate and dynamic. Potential sellers must recognize that prospective buyers will scrutinize not just the current tax burden, but also potential future tax implications. Working with experienced real estate professionals like Fanis Makrigiannis Realty can provide crucial guidance in navigating these complex financial considerations.

Navigating property taxes in Ontario requires strategic planning and informed decision-making for homebuyers, sellers, and real estate investors. The Ontario government’s official homebuying guide emphasizes the importance of comprehensive financial understanding before entering the real estate market.

Buyers in cities like Toronto, Oshawa, Ajax, Whitby, and Pickering must conduct thorough due diligence regarding property tax implications.

Sellers and investors can leverage several strategic approaches to minimize tax implications and maximize property value. The Financial Consumer Agency of Canada provides critical insights into managing tax responsibilities during property transactions.

Successful real estate engagement in Ontario requires ongoing tax management and strategic planning. Fanis Makrigiannis, Realtor®, recommends a proactive approach to understanding and anticipating property tax changes.

Working with experienced professionals like Fanis Makrigiannis Realty can provide invaluable guidance in navigating the complex landscape of property taxes. Their expertise helps clients make informed decisions, minimize tax liabilities, and maximize real estate investment potential.

How are property taxes calculated in Ontario?

Property taxes in Ontario are calculated based on the assessed value of a property and the municipal tax rate. The formula used is: Assessed Property Value × Municipal Tax Rate = Annual Property Tax.

What factors influence property assessments in Ontario?

Property assessments consider various factors, including location, property size, building type, recent comparable sales in the area, and any specific property improvements or renovations.

Why do property tax rates vary between municipalities in Ontario?

Property tax rates vary between municipalities in Ontario because each municipality sets its tax rates based on budgetary requirements, local services needed, and infrastructure maintenance costs.

How can property taxes affect the value of a home when selling?

Higher property taxes can deter potential buyers and may lower a home’s perceived market value. Sellers need to address property tax concerns and consider their impact on marketability when pricing a property.

You have just learned how unpredictable property taxes in Ontario affect your decision to buy, sell or invest. From shifting assessments in Toronto to increasing tax rates across Durham Region, the uncertainty can quickly become overwhelming and impact both your home’s market appeal and your long-term investment plans. The complexity of assessments, municipal levies and budget adjustments means ignoring the details can cost you — but the right strategy can help you save and even boost your home’s value.

Top Investment Property Tax Tips for Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Avoiding Common Mistakes When Purchasing a Home in Ontario - Fanis Makrigiannis Realtor®

Your Step-by-Step Guide to Buying a Home - Fanis Makrigiannis Realtor®

What are Real Estate Fees in Ontario? - Fanis Makrigiannis Realtor®

Quick Summary

How Property Taxes Work in Ontario

Property Assessment and Valuation

Property assessments consider multiple factors, including:

- Location and neighbourhood characteristics

- Property size and dimensions

- Building type and construction quality

- Recent comparable sales in the area

- Specific property improvements or renovations

These assessments ensure a standardized approach to determining property values across different municipalities in the Durham Region and Greater Toronto Area.

Tax Rate Calculation and Municipal Budgeting

- Public infrastructure maintenance

- Emergency services

- Local schools

- Public transportation

- Community recreation programs

For property owners working with Fanis Makrigiannis Realtor®, understanding these tax calculations becomes crucial when evaluating potential real estate investments or home purchases in Ontario.

Additional Tax Considerations

Homeowners can typically expect their property tax bills to be calculated through a straightforward formula: Assessed Property Value × Municipal Tax Rate = Annual Property Tax. However, nuances in local regulations and assessment practices mean that consulting with local real estate professionals can provide more precise insights into specific tax implications.

Understanding property taxes requires ongoing attention. Tax rates can change annually, and property assessments occur periodically, meaning homeowners must stay informed about potential shifts in their financial obligations. For those navigating the complex Ontario real estate market, working with experienced professionals like those at Fanis Makrigiannis Realty can provide valuable guidance in understanding these intricate tax mechanisms.

Property Tax Rates in Toronto and Durham Region

Residential Tax Rate Structures

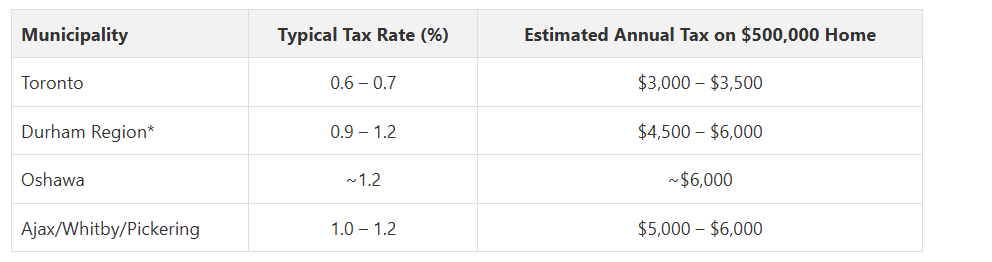

Typical residential tax rates in the region range between 0.6% to 1.2% of a property’s assessed value, with specific percentages varying by municipality. For instance, a home valued at $500,000 might incur annual property taxes between $3,000 and $6,000, depending on the exact location and local municipal rates.

To better understand how residential property tax rates differ across municipalities in the Greater Toronto Area and Durham Region, refer to the summary table below. This table outlines typical annual property taxes for a $500,000 home in select cities, based on information discussed in the article.

Commercial and Investment Property Considerations

Investment properties and commercial real estate face substantially different tax rate structures. Commercial properties often experience significantly higher tax rates, sometimes three to four times the residential rate. Fanis Makrigiannis, Realtor®, recommends that investors carefully analyze these differential rates when evaluating potential real estate investments in Toronto and Durham Region.Key factors influencing commercial property tax rates include:

- Property classification

- Specific municipal economic development strategies

- Location within the urban or suburban landscape

- Current market valuation trends

Additional Tax Levy Insights

Homeowners should anticipate annual variations in tax rates. Municipal budgets, infrastructure needs, and broader economic conditions can prompt adjustments to property tax calculations. Staying informed about these potential changes requires ongoing attention and periodic consultation with local real estate professionals.

For potential homebuyers and current property owners in cities like Toronto, Oshawa, Ajax, Whitby, and Pickering, understanding these intricate tax rate mechanisms is essential. Working with experienced real estate professionals at Fanis Makrigiannis Realty can provide invaluable insights into navigating the complex property tax landscape of Ontario’s dynamic real estate market.

How Property Taxes Impact Home Value and Selling

Property Tax Burden and Market Perception

In cities like Toronto, Oshawa, Ajax, Whitby, and Pickering, property tax rates can significantly impact a home’s marketability. Higher property tax rates can potentially deter buyers or reduce a property’s perceived value. Research from the Canada Mortgage and Housing Corporation indicates that properties with excessive tax burdens may experience slower sales and lower market valuations.Homeowners should consider several key factors that influence how property taxes affect home value:

- Comparative tax rates in neighbouring municipalities

- Recent tax assessment changes

- Potential future municipal infrastructure projects

- Local school district quality

- Overall community development plans

Strategic Selling and Tax Considerations

- Obtaining a recent property assessment

- Understanding potential tax reassessment impacts

- Highlighting any recent improvements that might positively influence tax valuation

Some municipalities offer property tax relief or reassessment opportunities that can potentially improve a home’s marketability. Sellers who can demonstrate favourable tax positioning may attract more competitive offers from potential buyers.

Long-Term Value and Tax Strategy

Investors and homeowners should track several key indicators:

- Municipal budget allocations

- Potential tax rate adjustments

- Neighbourhood infrastructure developments

- Economic growth projections for specific areas

The relationship between property taxes and home value is intricate and dynamic. Potential sellers must recognize that prospective buyers will scrutinize not just the current tax burden, but also potential future tax implications. Working with experienced real estate professionals like Fanis Makrigiannis Realty can provide crucial guidance in navigating these complex financial considerations.

Ultimately, a strategic approach to understanding and managing property taxes can significantly enhance a home’s marketability and potential sale price. Homeowners who remain informed and proactive about their property tax situation are better positioned to make successful real estate decisions in Ontario’s competitive market.

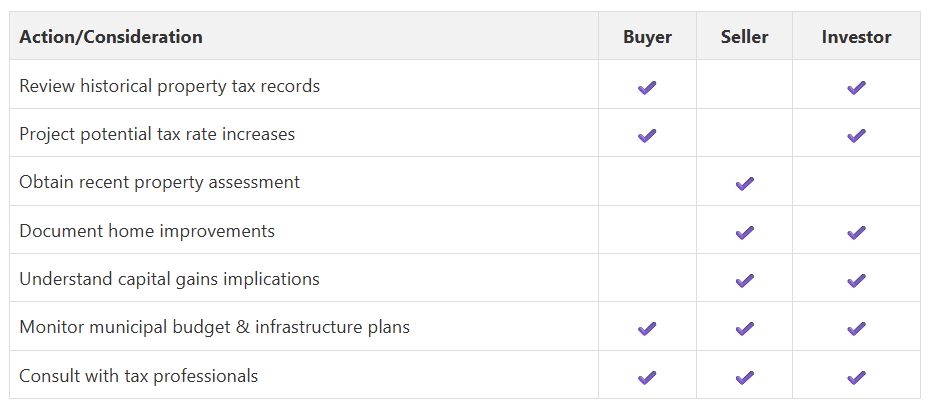

Tips for Homebuyers, Sellers and Investors

Strategic Property Tax Planning for Buyers

Buying real estate with confidence involves more than evaluating the property’s purchase price; understanding potential tax burdens is crucial.

Key considerations for prospective homebuyers include:

- Reviewing historical property tax records

- Projecting potential tax rate increases

- Assessing municipal infrastructure development plans

- Calculating total ownership costs beyond mortgage payments

- Understanding assessment value versus market value

Tax Optimization Strategies for Sellers and Investors

Effective strategies include:

- Timing property sales to optimize tax positioning

- Documenting home improvements that might positively impact assessed value

- Understanding capital gains implications

- Maintaining comprehensive financial records

- Consulting with tax professionals before significant real estate transactions

“A smart move in real estate starts with the right conversation.” Fanis Makrigiannis, Real Estate Agent RE/MAX Rouge River Realty Ltd.

Long-Term Property Tax Management

Investors and homeowners should:

- Monitor municipal budget discussions

- Stay informed about local economic development plans

- Regularly reassess property valuations

- Consider potential tax implications of renovation projects

- Develop a comprehensive long-term real estate financial strategy

Working with experienced professionals like Fanis Makrigiannis Realty can provide invaluable guidance in navigating the complex landscape of property taxes. Their expertise helps clients make informed decisions, minimize tax liabilities, and maximize real estate investment potential.

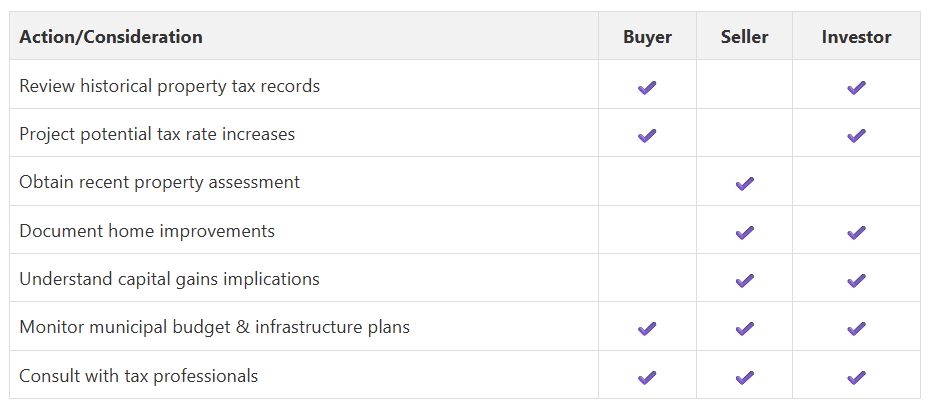

Here is a checklist summarizing important steps and considerations for buyers and sellers to effectively manage property taxes, as described throughout this guide:

Use this checklist as a quick reference to ensure you are prepared for common property tax considerations during the buying, selling, or investing process.

Whether you are a first-time homebuyer in the Durham Region, an investor in the Greater Toronto Area, or a homeowner preparing to sell, understanding property tax dynamics is essential. By remaining informed, strategic, and proactive, you can effectively manage your real estate investments and minimize unexpected financial challenges.

Frequently Asked Questions

What factors influence property assessments in Ontario?

Why do property tax rates vary between municipalities in Ontario?

How can property taxes affect the value of a home when selling?

Make Property Taxes Work for You with Local Real Estate Expertise

Take control of your next move with Fanis Makrigiannis Realtor®. Access tailored advice that clarifies your true property tax burden, maximizes your sale price, and shelters you from costly surprises. Explore our home buying and selling guides and reach out for a personalized property evaluation today. With expert insight into both the Durham Region and Greater Toronto Area, your property taxes don’t have to be a guessing game. Act now to secure a strategy that puts every dollar to work for you. Visit Fanis Makrigiannis Realty and see the advantage local expertise brings to every step of your real estate journey.

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

Avoiding Common Mistakes When Purchasing a Home in Ontario - Fanis Makrigiannis Realtor®

Your Step-by-Step Guide to Buying a Home - Fanis Makrigiannis Realtor®

What are Real Estate Fees in Ontario? - Fanis Makrigiannis Realtor®