Key Economic Factors Real Estate Buyers and Sellers Should Know

Toronto and Durham real estate markets are constantly shaped by economic forces that most people overlook. You might think soaring prices or rapid growth mean one thing, but the true story hides in the stats. Toronto is expected to see significant population growth over the next two decades, putting massive pressure on housing demand, yet it’s the shifting patterns in employment and consumer confidence that have the final say on which way the market turns.

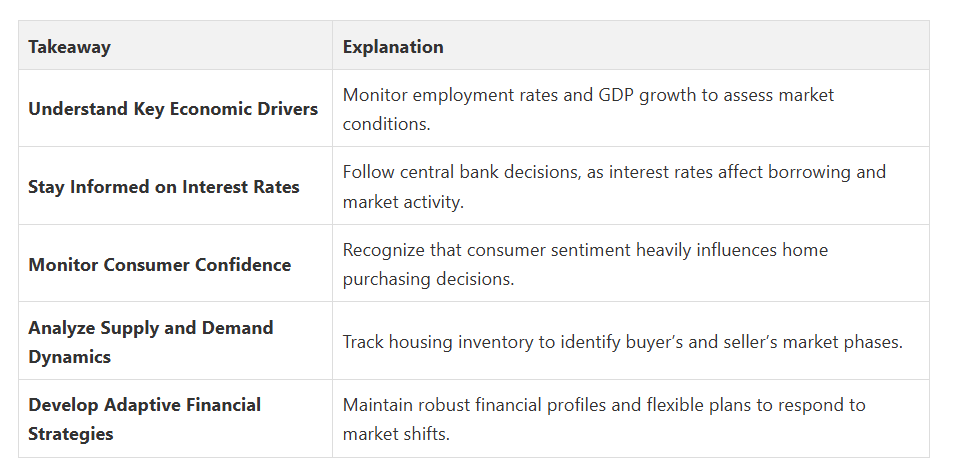

Quick Summary

Understanding Economic Factors in Real Estate

The Fundamental Economic Drivers

Employment trends significantly influence real estate dynamics. When job markets in the Durham Region expand, particularly in sectors like manufacturing, technology, and services, housing demand typically increases. This growth translates into higher property values and more competitive real estate markets. Professionals working with Fanis Makrigiannis Realty understand how local economic indicators shape buying and selling strategies.

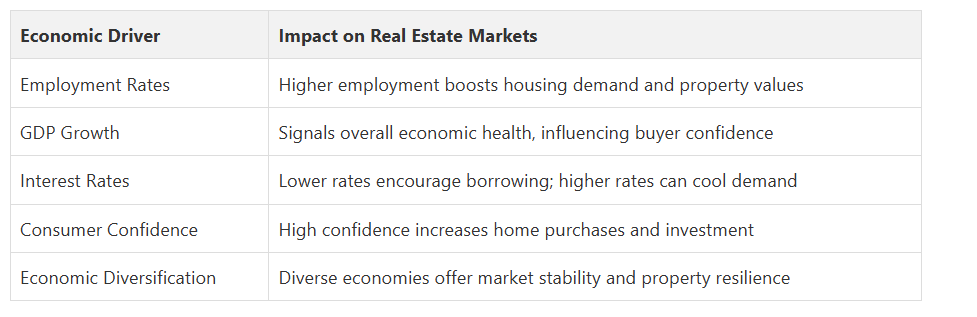

To help readers quickly compare the main economic drivers influencing the Toronto and Durham real estate markets, the following table summarizes their impacts as discussed in the article:

Interest Rates and Investment Potential

In the Toronto and Durham Region markets, these economic fluctuations can mean the difference between a buyer’s market and a seller’s market. Investors and homeowners must stay attuned to these shifts, understanding how macroeconomic trends translate into local real estate opportunities. Whether you’re considering a property in Pickering or evaluating an investment in Ajax, recognizing these economic signals becomes paramount.

Consumer Confidence and Market Sentiment

In regions like the Durham Region, consumer confidence can be influenced by factors such as regional economic development, job market stability, and broader provincial economic health. Real estate professionals like those at Fanis Makrigiannis Realty track these nuanced indicators to provide clients with strategic insights.

Understanding economic factors isn’t just about interpreting numbers—it’s about comprehending the intricate relationships between various economic elements and their direct impact on real estate markets. For buyers, sellers, and investors in Toronto and surrounding areas, this knowledge transforms decision-making from reactive to strategic.

How Economic Trends Impact Property Values in Toronto and Durham

Population Growth and Housing Demand

This expansion creates substantial pressure on housing markets in regions like Oshawa, Ajax, Whitby, and Pickering.

The Neptis Foundation research reveals that migration patterns are heavily influenced by economic factors such as employment rates and housing affordability.

When job markets in the Durham Region strengthen, they attract more residents, consequently driving up property values. Professionals at Fanis Makrigiannis Realty understand how these demographic shifts translate into real estate opportunities.

Employment and Economic Diversification

“Behind every great deal is a clear plan and a steady hand.” Fanis Makrigiannis, Real Estate Agent RE/MAX Rouge River Realty Ltd.

When companies establish or expand operations in areas like Ajax and Whitby, they create employment clusters that directly impact housing demand. This economic activity attracts professionals seeking proximity to work, driving up property values and creating competitive real estate environments. Investors and homeowners must carefully monitor these employment ecosystem transformations.

Infrastructure and Regional Development

These developments create ripple effects across property markets. Neighbourhoods near new transit lines or emerging economic zones often experience accelerated property value appreciation. For instance, areas in Oshawa and Pickering benefiting from strategic infrastructure investments become increasingly attractive to potential buyers and investors.

Understanding economic trends requires more than surface-level analysis. It demands a nuanced approach that considers interconnected factors such as population dynamics, employment trends, and regional development strategies. For real estate participants in the Toronto and Durham Region, this comprehensive perspective transforms investment decisions from reactive responses to strategic maneuvers.

Vital Market Indicators for Homebuyers and Sellers

Housing Supply and Inventory Dynamics

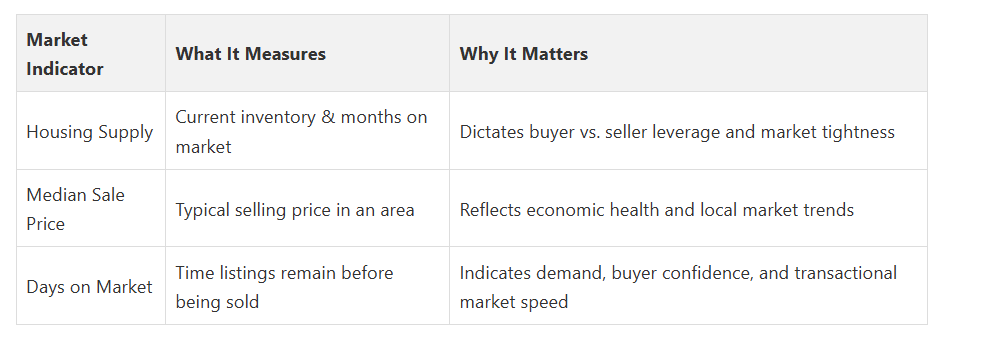

A balanced real estate market typically maintains approximately four to six months of housing inventory. When inventory drops below this threshold, it signals a seller’s market, characterized by increased competition and potentially higher property values. Conversely, extended inventory periods suggest a buyer’s market, where negotiation leverage shifts towards purchasers. Professionals at Fanis Makrigiannis Realty closely monitor these inventory trends to provide strategic guidance.

Price Trends and Median Sale Prices

Real estate professionals analyze price trends across different neighbourhoods, understanding that areas like Ajax and Whitby might exhibit distinct pricing patterns. Factors such as proximity to transit lines, local employment centers, and infrastructure developments can create microeconomic variations within broader regional trends. Buyers and sellers must look beyond surface-level price points and understand the underlying economic narratives driving these valuations.

For buyers and sellers wanting to understand essential market indicators, this table organizes the main indicators, what they measure, and their significance based on the article content:

Days on Market and Transaction Velocity

In the Durham Region, transaction velocity can vary significantly between different municipalities. Oshawa might demonstrate different market speeds compared to Pickering, influenced by local economic factors, employment opportunities, and community developments. Real estate participants must understand these nuanced local variations to make informed decisions.

Mastering market indicators requires more than statistical analysis; it demands a comprehensive understanding of interconnected economic factors. For Toronto and Durham Region real estate participants, these indicators transform from abstract numbers into strategic decision-making tools. By comprehending housing supply, price trends, and transaction velocities, buyers and sellers can navigate complex market landscapes with increased confidence and precision.

Practical Tips for Navigating Economic Changes in Real Estate

Adapting to Credit Market Fluctuations

Professionals at Fanis Makrigiannis Realty recommend maintaining robust financial profiles to navigate credit market shifts. This involves maintaining strong credit scores, diversifying financial resources, and developing flexible investment strategies. In areas like Oshawa, Ajax, Whitby, and Pickering, adaptability can mean the difference between missed opportunities and successful real estate investments.

Strategic Financial Planning

Real estate participants should focus on developing flexible financial strategies. This might involve maintaining emergency funds, exploring diverse investment vehicles, and regularly reassessing property portfolios. In the Durham Region, where economic landscapes can shift rapidly, such strategic planning becomes essential for long-term success.

Monitoring Economic Indicators

For buyers and sellers in Toronto and surrounding areas, this means developing a comprehensive approach to information gathering. Regularly analyzing market reports, attending professional seminars, and consulting with experienced real estate professionals can provide competitive advantages. Understanding subtle economic shifts in municipalities like Pickering and Ajax allows for more precise investment and selling strategies.

Navigating economic changes in real estate requires more than reactive responses. It demands proactive, informed strategies that anticipate market movements and leverage emerging opportunities. By understanding credit dynamics, implementing strategic financial planning, and consistently monitoring economic indicators, real estate participants can transform economic uncertainties into strategic advantages.

Frequently Asked Questions

How do interest rates affect real estate transactions?

Why is consumer confidence important in the real estate market?

How can I monitor market indicators when buying or selling a home?

Turn Economic Insights Into Smart Real Estate Moves in Toronto & Durham

Take control of your property journey with expert guidance from Fanis Makrigiannis Realty. Visit our homepage to start exploring up-to-date listings, personalized neighbourhood advice, and exclusive market resources shaped by local expertise. Benefit from tailored strategies that help you confidently respond to every economic factor discussed in the article. Get in touch today so you can maximize your results while others wait for the next market change.

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region, is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

Buying Real Estate with Confidence - Fanis Makrigiannis Realtor®

Real Estate Market Trends 2025: What To Expect - Fanis Makrigiannis Realtor®

Will Real Estate Prices Drop in 2025? - Fanis Makrigiannis Realtor®