Top Homebuyer Incentives in Toronto and the Durham Region

Buying a home in Toronto or Durham can feel daunting with rising prices and tight market competition. Yet the numbers tell a different story. First-time buyers may qualify for land transfer tax rebates worth nearly $9,000, plus federal support that cuts monthly mortgage payments. Most people believe these incentives are reserved for only a lucky few or buried in endless fine print. The reality is that homes could be more within your reach than you ever expected if you understand how to tap into these hidden savings.

Homebuyer incentives represent critical financial strategies that can significantly reduce the barriers to property ownership in the Toronto and Durham regions. These programs provide essential support for individuals looking to enter the real estate market, particularly first-time homebuyers who often face substantial financial challenges.

The Canadian government offers several targeted incentives designed to make homeownership more accessible. Learn more about first-time homebuyer strategies to navigate these complex financial landscapes. According to the Canada Revenue Agency, key programs include the First Home Savings Account (FHSA), which allows individuals to save up to $8,000 annually tax-free for home purchases. The Home Buyers’ Plan (HBP) permits first-time buyers to withdraw up to $35,000 from their Registered Retirement Savings Plan (RRSP) to fund their home purchase.

Durham Region demonstrates a proactive approach to housing affordability through targeted programs.

Government grants and rebate programs play a pivotal role in making homeownership more accessible and financially manageable for residents in Toronto and Durham Region. These strategic financial tools provide critical support to potential homebuyers, helping them overcome traditional financial barriers and achieve their property ownership goals.

Explore comprehensive first-time homebuyer resources to understand the nuanced landscape of government support. According to the Canada Mortgage and Housing Corporation, several key federal programs offer substantial financial assistance. The First-Time Home Buyer Incentive represents a revolutionary approach, allowing the government to share equity with homebuyers, effectively reducing monthly mortgage payments. This program enables first-time buyers to receive 5% or 10% of a home’s purchase price as a shared equity mortgage, providing immediate financial relief.

Ontario offers unique tax rebates that can significantly reduce the financial burden of home purchasing. The Province provides a Land Transfer Tax Rebate specifically designed for first-time homebuyers, allowing eligible individuals to recover a substantial portion of their land transfer taxes. In Toronto, this benefit is particularly valuable, as the city imposes an additional municipal land transfer tax. Qualified first-time homebuyers can receive rebates up to $4,475 for provincial taxes and an additional $4,475 for municipal taxes, representing a potential total savings of nearly $9,000.

The Toronto and Durham Region real estate markets present unique opportunities for home sellers and investors seeking strategic financial advantages. Understanding the various incentives and economic dynamics can significantly enhance investment potential and property transaction outcomes.

Discover expert home-selling strategies that maximize property value and market positioning. According to Site Selection Magazine, Durham Region has been recognized as one of Canada’s top 20 locations to invest in 2024. This prestigious ranking reflects the area’s robust economic environment, with non-residential building permits reaching an impressive $1.23 billion in 2023, signalling strong potential for real estate investments.

The Regional Municipality of Durham offers targeted incentives for real estate developers and investors through the At Home Incentive Program (AHIP). According to Durham Region’s official resources, this program provides capital grants and expedited planning approvals for projects incorporating affordable housing units. Both non-profit and for-profit developers can access forgivable capital loans secured against property titles, creating attractive investment opportunities in the affordable housing sector.

Qualifying for homebuyer savings requires strategic financial planning and a comprehensive understanding of available programs and eligibility requirements. Potential homebuyers in Toronto and Durham Region must navigate a complex landscape of financial incentives designed to support property ownership.

Explore comprehensive home-buying preparation techniques to maximize your financial potential. According to Savvy New Canadians, the First-Time Home Buyers’ Tax Credit (HBTC) allows individuals to claim up to $10,000 of their eligible home purchase, providing a one-time tax deduction of approximately $1,500. The First Home Savings Account (FHSA) offers another powerful savings mechanism, with an annual contribution limit of $8,000 and a lifetime maximum of $40,000. As detailed by Wikipedia, this account provides unique tax advantages similar to both Registered Retirement Savings Plans (RRSP) and Tax-Free Savings Accounts (TFSA).

Eligibility for homebuyer savings programs typically involves several key considerations. First-time homebuyers must meet specific income thresholds, which vary depending on the program and region. Documentation requirements are stringent, necessitating proof of income, credit history, and employment stability. Prospective buyers should prepare comprehensive financial records, including tax returns, employment verification, and detailed income statements.

What are homebuyer incentives available in Toronto and Durham Region?

Homebuyer incentives in Toronto and Durham Region include federal programs like the First-Time Home Buyer Incentive, the First Home Savings Account (FHSA), and provincial tax rebates for first-time buyers. These programs aim to reduce financial barriers associated with purchasing a home.

How can first-time homebuyers benefit from tax rebates?

First-time homebuyers can benefit from tax rebates by potentially receiving up to $9,000 in total rebates, including provincial and municipal land transfer tax rebates. These rebates help reduce the overall cost of purchasing a home in Toronto and the Durham Region.

What is the First-Time Home Buyer Incentive, and how does it work?

The First-Time Home Buyer Incentive allows eligible buyers to reduce their monthly mortgage payments by sharing equity with the government, which provides 5% or 10% of the home’s purchase price as a shared equity mortgage. This program helps make homeownership more affordable for first-time buyers.

What eligibility criteria exist for homebuyer incentive programs?

Eligibility criteria for homebuyer incentive programs typically include being a first-time homebuyer, meeting specific income thresholds, having a good credit history, and providing required documentation such as proof of employment and financial records.

Trying to decode government grants and rebates can be overwhelming, especially when navigating fierce competition and soaring prices across Toronto and the Durham Region. You might recognize the stress of sorting through eligibility rules or worrying about missing out on up to $9,000 in first-time buyer rebates. The article explains these incentives in detail, but unlocking their full value is often where buyers get stuck. Partnering with a trusted local Realtor® ensures you get every advantage, from land transfer tax rebates to tailored support through programs like the First Home Savings Account.

Top Common Homebuyer Questions in Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

How to Find a Dream Home in Toronto & Durham Region: 2025 Guide - Fanis Makrigiannis Realtor®

Durham Region Housing 2025: Opportunities for Buyers and Sellers - Fanis Makrigiannis Realtor®

Why Buy in Durham Region 2025 - Fanis Makrigiannis Realtor®

Quick Summary

Understanding Homebuyer Incentives in Toronto and Durham

Government Support for Home Purchasing

Regional Affordable Housing Initiatives

The At Home Incentive Program (AHIP) supports the development of affordable rental housing, indirectly creating opportunities for potential homebuyers by addressing broader housing market dynamics.

These initiatives aim to stabilize housing markets, reduce financial barriers, and create more accessible pathways to homeownership.

Navigating homebuyer incentives requires strategic planning and a comprehensive understanding.

Potential buyers must carefully assess eligibility criteria, financial implications, and long-term benefits of these programs. While incentives can provide significant financial relief, they are not one-size-fits-all solutions. Prospective homeowners should consult with financial advisors and real estate professionals to develop personalized strategies that align with their specific financial circumstances and homeownership goals.

“Confidence in real estate comes from having a clear plan and the right guide.” Fanis Makrigiannis, Real Estate Agent RE/MAX Rouge River Realty Ltd.

By leveraging these incentives effectively, homebuyers in Toronto and Durham can transform their property ownership dreams into tangible realities, making the journey to homeownership more achievable and financially manageable.

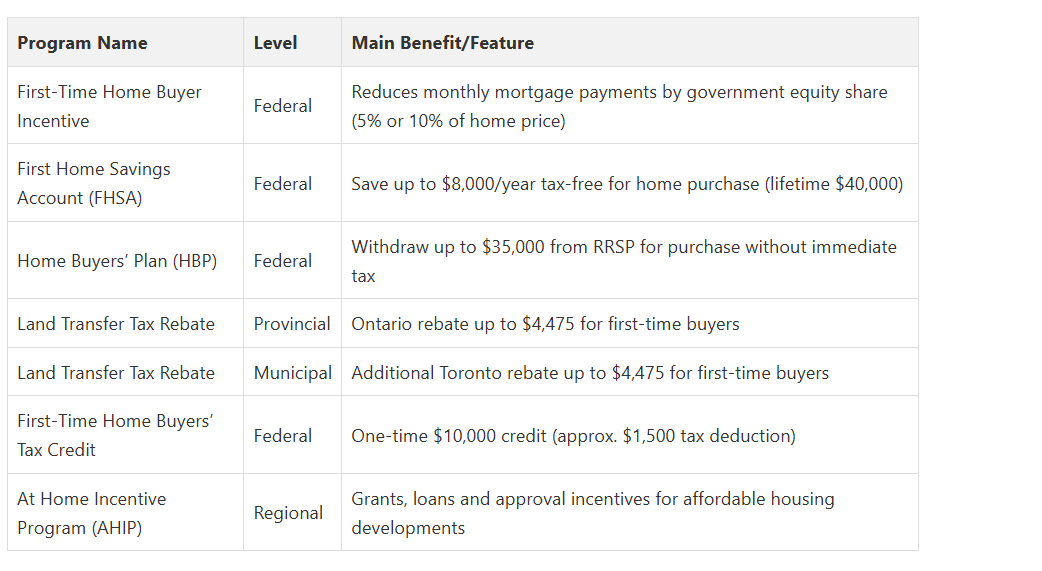

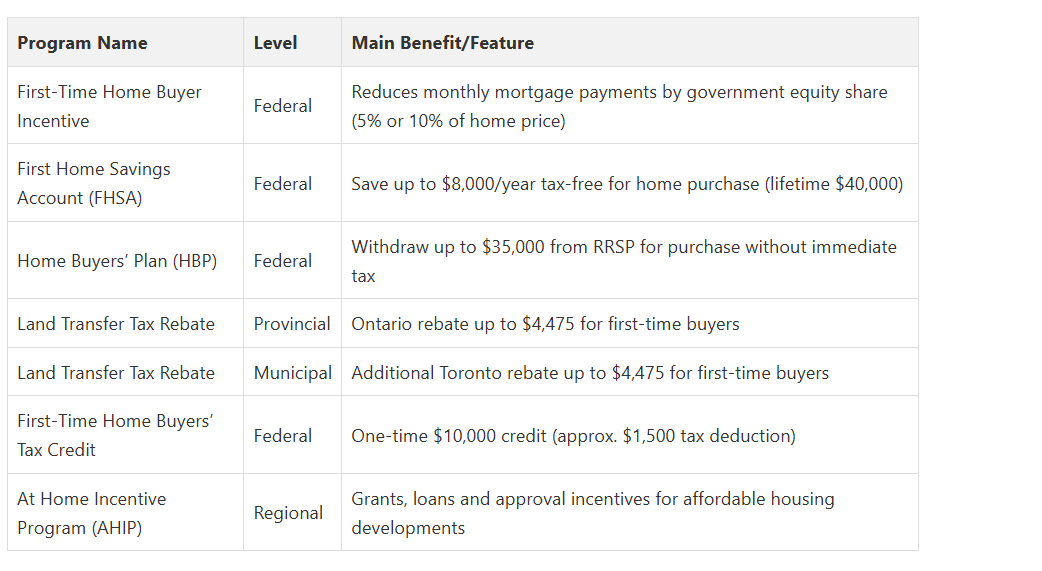

Here is a summary table outlining the key government homebuyer programs and their main features, to help readers easily compare incentives available at the federal, provincial, and municipal levels.

Government Grants and Rebate Programs Explained

Federal Homebuyer Incentive Programs

Provincial and Municipal Tax Rebates

Beyond direct financial incentives, these government programs demonstrate a comprehensive approach to supporting homeownership. They recognize the challenges faced by first-time buyers and create strategic pathways to reduce financial barriers. Potential homebuyers must carefully review eligibility criteria, understand program limitations, and consider long-term financial implications. Professional guidance from financial advisors and real estate experts can help individuals navigate these complex incentive structures effectively.

The intricate network of government grants and rebate programs reflects a broader commitment to making homeownership more attainable. By providing targeted financial support, these initiatives not only assist individual homebuyers but also contribute to the overall stability and growth of the Toronto and Durham Region real estate markets.

Incentives for Home Sellers and Real Estate Investors

Regional Investment Opportunities

Affordable Housing Development Incentives

Real estate investors and home sellers must recognize the evolving landscape of property markets in Toronto and Durham Region. The current economic climate demands strategic approaches that leverage local incentives, understand market trends, and capitalize on development opportunities. Successful investors focus not just on immediate returns but on long-term value creation through innovative housing solutions.

Collaborative approaches between private developers, non-profit organizations, and municipal authorities are increasingly important. The Durham Region’s AHIP program exemplifies this collaborative model, issuing annual Calls for Applications that invite developers to participate in affordable housing initiatives. These programs not only provide financial incentives but also contribute to addressing broader community housing needs.

Investors and home sellers should conduct comprehensive research, consult with local real estate professionals, and stay informed about emerging market trends. By understanding the nuanced incentive structures available in Toronto and Durham Region, stakeholders can make informed decisions that maximize their real estate investments and contribute to the region’s dynamic housing ecosystem.

How to Qualify and Apply for Homebuyer Savings

Tax Credit and Savings Account Strategies

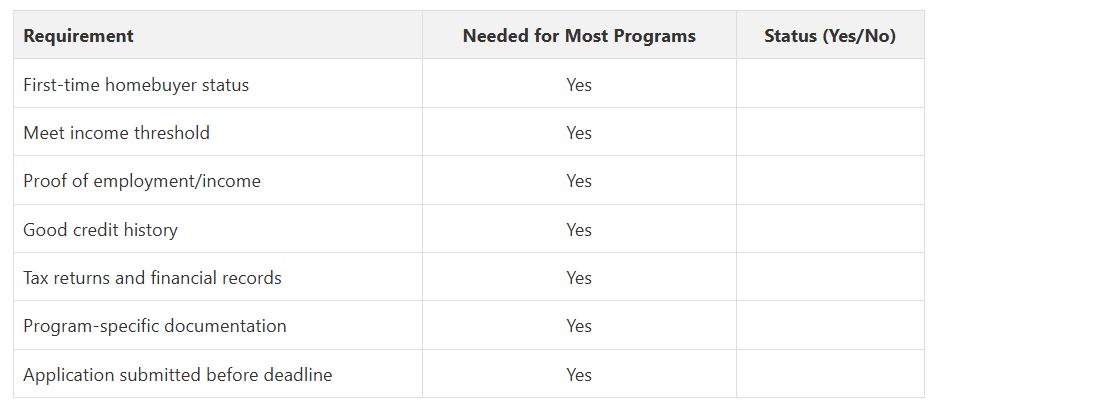

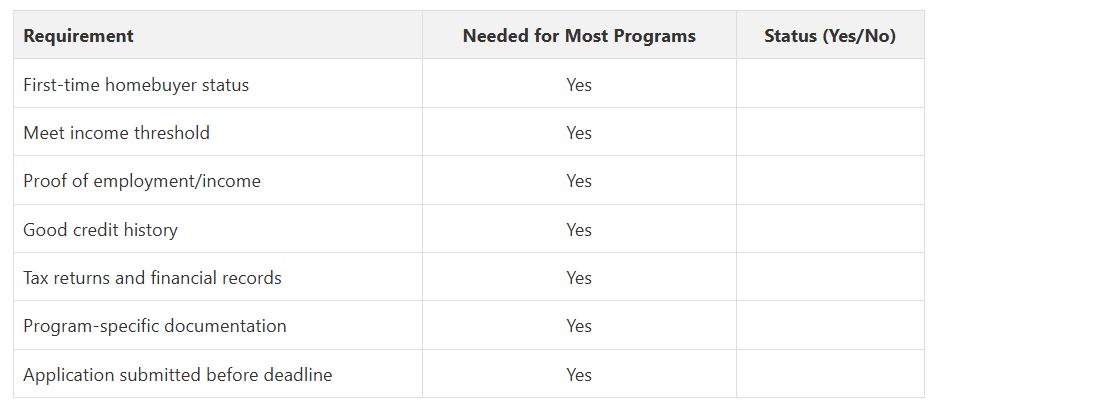

Qualifying Criteria and Application Process

The following checklist table summarizes essential eligibility and documentation requirements for most homebuyer incentive programs discussed in the article. Use this as a guide when preparing your application.

The application process demands meticulous attention to detail. Potential homebuyers must carefully review program-specific requirements, understanding nuanced eligibility criteria and submission deadlines. This often involves consulting with financial advisors, tax professionals, and real estate experts who can provide personalized guidance tailored to individual financial circumstances.

Navigating homebuyer savings programs requires a proactive and informed approach. Successful applicants typically demonstrate financial responsibility, stable income, and a clear understanding of their long-term housing goals. The most effective strategy involves comprehensive financial planning, including building a robust savings profile, maintaining an excellent credit score, and staying informed about evolving government incentives.

Real estate markets in Toronto and Durham Region present unique opportunities for strategic financial planning. By understanding and leveraging available homebuyer savings programs, individuals can significantly reduce the financial barriers to property ownership. Prospective homebuyers should approach these opportunities with careful research, professional guidance, and a long-term perspective on their housing and financial objectives.

Frequently Asked Questions

How can first-time homebuyers benefit from tax rebates?

What is the First-Time Home Buyer Incentive, and how does it work?

What eligibility criteria exist for homebuyer incentive programs?

Turn Homebuyer Incentives Into Real Savings—Let an Expert Guide the Way

If you are ready to move from research to real results, connect directly with Fanis Makrigiannis for one-on-one guidance. Discover current homes that qualify for maximum savings and get personalized answers to every question. Take the uncertainty out of buying and start your journey to ownership with a proven expert at your side. Visit https://fanis.ca or browse exclusive home buyer tips and tools today. The right advice can save you thousands—start now to secure your future in Toronto or Durham.

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region, is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

How to Find a Dream Home in Toronto & Durham Region: 2025 Guide - Fanis Makrigiannis Realtor®

Durham Region Housing 2025: Opportunities for Buyers and Sellers - Fanis Makrigiannis Realtor®

Why Buy in Durham Region 2025 - Fanis Makrigiannis Realtor®