How to Budget Homebuying: A Step-by-Step Guide

Thinking about buying a home in Toronto or the Durham Region sounds exciting, right? But did you know that closing costs alone can eat up 2-5% of your home’s purchase price, often adding thousands to your upfront expenses. Most people focus on the sticker price or their monthly mortgage, but it’s usually these hidden extra costs that catch buyers off guard and cause the most stress. So if you think your down payment is the only hurdle, you might be in for a big surprise.

Table of Contents

- Step 1: Assess Your Financial Situation

- Step 2: Research the Real Estate Market

- Step 3: Set a Realistic Budget for Homebuying

- Step 4: Factor in Additional Expenses

- Step 5: Consult with Real Estate Professionals

- Step 6: Review and Adjust Your Budget Plan

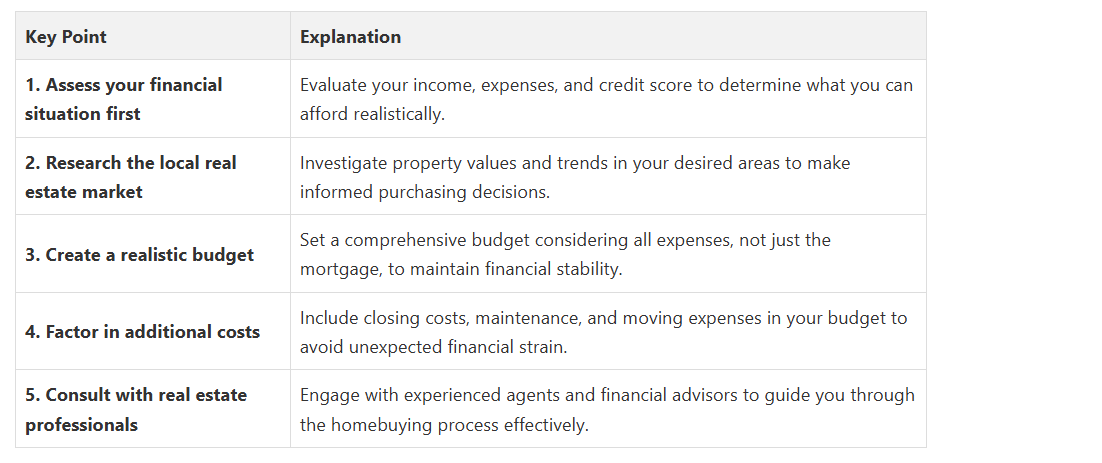

Quick Summary

Step 1: Assess Your Financial Situation

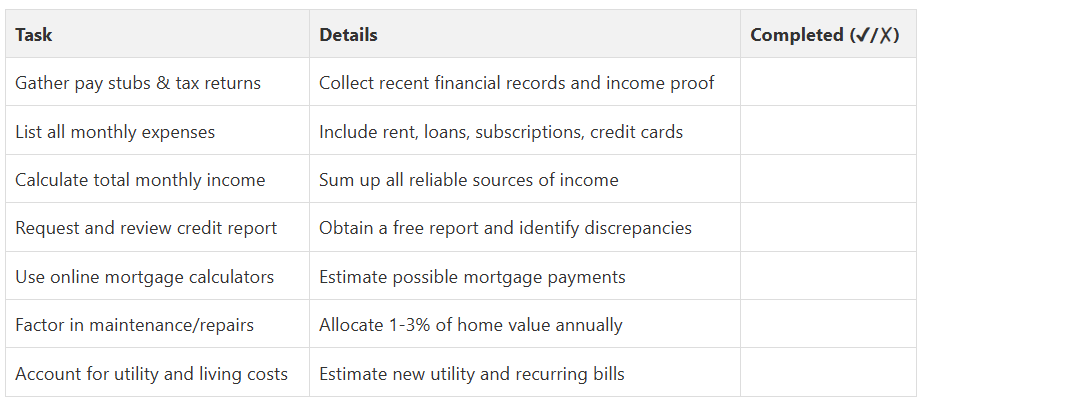

Starting your homebuying journey requires a comprehensive financial self-assessment. Begin by gathering all your financial documents, including recent pay stubs, tax returns, bank statements, and a detailed list of your monthly expenses. Credit score plays a pivotal role in this process, as it directly impacts your mortgage eligibility and interest rates. Request a free credit report and carefully review it for any discrepancies or areas that might need improvement.

Calculate your total monthly income and subtract all existing financial obligations. This includes rent, car payments, student loans, credit card debt, and other recurring expenses. Financial experts recommend that your total housing costs should not exceed 28-30% of your gross monthly income. For potential homebuyers in Oshawa, Whitby, Ajax, Pickering, and surrounding areas, this means carefully balancing your current lifestyle with your home ownership aspirations.

Consider using online mortgage calculators to get a preliminary understanding of what you might qualify for. These tools can help you estimate potential monthly payments, including principal, interest, property taxes, and home insurance. Learn more about home-buying preparation to ensure you’re fully equipped for this significant financial decision.

Don’t forget to factor in additional costs beyond the mortgage. Home maintenance, potential renovations, utilities, and unexpected repairs can add significant expenses to your monthly budget. A general rule of thumb is to set aside 1-3% of your home’s value annually for maintenance and repairs. By thoroughly assessing your financial situation upfront, you’ll be better prepared to navigate the exciting journey of home ownership in the Durham Region.

Here is a checklist to help you thoroughly assess your financial situation before starting your homebuying journey. Use this table to ensure no key financial aspect is overlooked.

Step 2: Research the Real Estate Market

Begin by exploring neighbourhood trends and property values across the Durham Region. Local market conditions can vary significantly between communities, so pay close attention to specific area dynamics. Look into recent sales data, average home prices, and price trends for different property types. Online real estate platforms, municipal websites, and local real estate insights can provide valuable information about current market conditions.

Consider the unique characteristics of different neighbourhoods that might impact your purchasing decision. Factors like proximity to schools, public transportation, local amenities, and future development plans can significantly influence property values. For instance, areas in Oshawa or Whitby might offer different investment potential compared to more central Toronto locations. Pay attention to local infrastructure projects, upcoming community developments, and economic indicators that could affect long-term property values.

Reach out to local real estate professionals who specialize in the Durham Region. A Real Estate Agent Oshawa can provide insider knowledge about market trends, upcoming listings, and neighbourhood-specific insights that might not be immediately apparent from online research. These professionals can help you understand nuanced market conditions, including potential negotiation strategies and hidden opportunities in the local real estate landscape.

Document your research systematically. Create a spreadsheet tracking neighbourhood statistics, average price points, and potential properties that catch your eye. This approach will help you compare different areas objectively and make a more informed decision when you’re ready to move forward with your home purchase.

Step 3: Set a Realistic Budget for Homebuying

Mortgage affordability becomes your primary focus at this stage. Most financial experts recommend following the 28/36 rule, which suggests that your monthly mortgage payment should not exceed 28% of your gross monthly income and your total debt.

Payments should not surpass 36%. This approach helps ensure you maintain financial flexibility while pursuing homeownership. For potential buyers in Oshawa, Whitby, Ajax, and surrounding areas, this means carefully balancing your home purchase with other financial commitments.

Beyond the basic mortgage calculation, factor in additional expenses that come with homeownership. Explore comprehensive home-buying tips to understand the full financial landscape. These often-overlooked costs include property taxes, home insurance, potential homeowners' association fees, maintenance expenses, and utility bills. A good rule of thumb is to budget an additional 1-3% of your home’s value annually for maintenance and unexpected repairs. This cushion prevents financial strain and helps you maintain your new property without stress.

Consider getting pre-approved for a mortgage, which provides a clear picture of what lenders believe you can afford. This step goes beyond simple online calculators by giving you a professional assessment of your borrowing capacity. Pre-approval also demonstrates to sellers that you’re a serious buyer, potentially giving you an edge in competitive markets like Toronto and the Durham Region. Remember that just because you’re approved for a certain amount doesn’t mean you should max out your budget. Leave room for financial comfort and unexpected life changes, ensuring your new home remains a source of joy rather than financial pressure.

Step 4: Factor in Additional Expenses

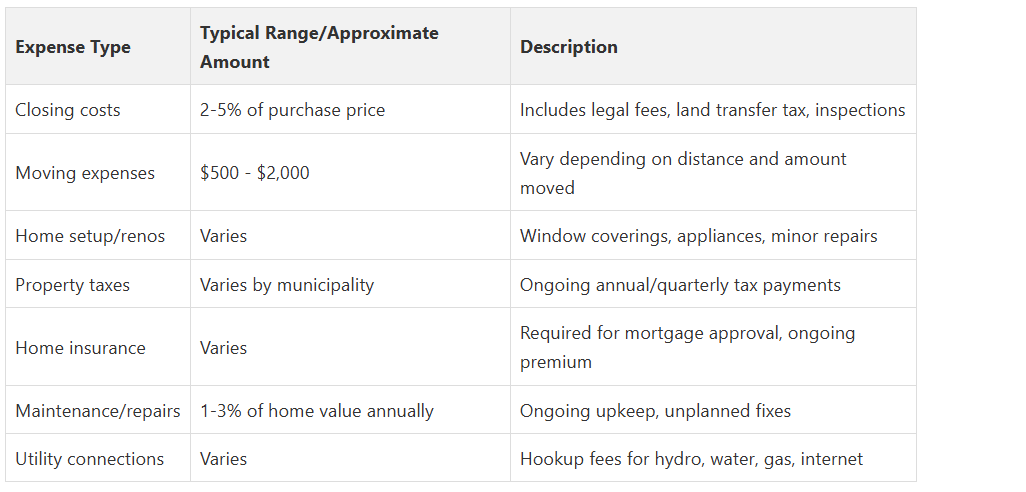

Closing costs represent a significant initial expense that many first-time homebuyers overlook. These typically range from 2-5% of your home’s purchase price and include legal fees, land transfer taxes, home inspection costs, and mortgage registration expenses. In municipalities like Oshawa, Whitby, and Ajax, these costs can vary, so it’s essential to budget accordingly. Learn more about navigating closing expenses to ensure you’re fully prepared for these financial obligations.

Moving expenses and initial home setup represent another substantial financial consideration. Professional movers in the Greater Toronto Area can cost between $500 - $2,000, depending on the volume of belongings and distance. Additionally, new homeowners often need to budget for immediate essentials like window treatments, minor repairs, appliance purchases, and potential renovations. A Real Estate Agent in Oshawa can provide localized insights into typical setup costs for homes in different neighbourhoods.

Don’t forget ongoing expenses that extend beyond your mortgage payment. Property taxes, home insurance, utility connections, and potential homeowners' association fees can add hundreds of dollars to your monthly expenses. For properties in areas like Pickering or Whitby, these costs can fluctuate based on specific neighbourhood characteristics. Experts recommend setting aside an additional 1-3% of your home’s value annually for maintenance and unexpected repairs. This financial buffer ensures you’re prepared for everything from minor fixes to potential major home systems replacements, providing peace of mind in your new home ownership journey.

The following table outlines several additional expenses to budget for beyond the initial home price. Refer to this summary to avoid unexpected costs during your home purchase process.

Step 5: Consult with Real Estate Professionals

Selecting the right Real Estate Agent in Oshawa is crucial to your home-buying success. A knowledgeable local professional brings invaluable insights into neighbourhood dynamics, pricing trends, and negotiation strategies specific to areas like Whitby, Ajax, Pickering, and surrounding communities. Explore the journey of working with a professional Realtor to understand the comprehensive support they can provide throughout your home purchasing process.

Beyond a real estate agent, consider assembling a team of financial professionals. A mortgage broker can help you understand various financing options, compare rates, and potentially secure better terms than you might find independently. Mortgage professionals understand the nuanced lending landscape in the Greater Toronto Area and can provide tailored advice based on your specific financial situation. Similarly, a real estate lawyer becomes essential during the closing process, helping you navigate complex legal documentation, reviewing purchase agreements, and ensuring all financial and legal requirements are met.

When consulting these professionals, come prepared with a comprehensive list of questions and your financial documentation. Be transparent about your budget, desired locations, and long-term housing goals. A professional real estate team can provide strategic advice that goes beyond simple transaction support, helping you make a purchase that serves both your immediate needs and future financial objectives. Remember, the right professionals don’t just facilitate a transaction; they become partners in your homebuying journey, offering expertise that can save you time, money, and potential future complications.

Step 6: Review and Adjust Your Budget Plan

A comprehensive financial reassessment involves more than simply checking numbers. Start by creating a detailed spreadsheet that tracks your current income, existing expenses, anticipated home-related costs, and potential changes in your financial landscape. Explore strategies for maintaining a flexible home-buying budget to understand how dynamic financial planning can support your goals. Pay special attention to potential shifts in your income, unexpected expenses, or changes in the real estate market that might impact your purchasing power in areas like Oshawa, Whitby, Ajax, and Pickering.

Consider conducting a quarterly budget review that examines your savings progress, investment performance, and any significant life changes that might affect your homebuying strategy. A Real Estate Agent in Oshawa can provide valuable insights into local market trends that might influence your budgeting decisions. This might include shifts in property values, emerging neighbourhood developments, or changes in mortgage rates that could impact your overall financial strategy. Be prepared to make strategic adjustments, such as increasing your savings rate, reducing discretionary spending, or exploring alternative financing options if your initial plan no longer aligns with your current financial reality.

Remember that budgeting for homeownership is not a one-time activity but an ongoing process of adaptation and strategic planning. Your ability to remain flexible, informed, and proactive will ultimately determine your success in navigating the complex real estate landscape of the Greater Toronto Area. By maintaining a dynamic approach to your financial planning, you’ll be better equipped to turn your homeownership dreams into a sustainable, long-term reality.

Ready to Take the Guesswork Out of Homebuying in Toronto and Durham?

Experience stress-free homebuying with professional advice and real, local insights.

- Visit our home buying tips page for practical advice tailored to Oshawa, Whitby, Toronto, and Durham Region.

- Discover the latest real estate insights and market trends so you can make informed decisions.

- Partner with Fanis Makrigiannis for personalized guidance, property evaluations, and exclusive listings—just steps away at https://fanis.ca.

Frequently Asked Questions

How can I research the real estate market effectively?

What additional expenses should I budget for when buying a home?

Why is it important to consult with real estate professionals during the homebuying process?

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region, is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

Your Step-by-Step Guide to Buying a Home - Fanis Makrigiannis Realtor®

Avoiding Common Mistakes When Purchasing a Home in Ontario - Fanis Makrigiannis Realtor®

7 Essential Tips for New Homeowners in Canada - Fanis Makrigiannis Realtor®

Budgeting for Real Estate Agents: Essential Tips for 2025 - Lead Linker

The Basics of Estate Planning for New Homeowners - Law Office of Eric Ridley