7 Key Challenges in Home Buying and How to Overcome Them

Buying a home in Oshawa, Whitby, Ajax, or Pickering can feel overwhelming and exciting all at once. People often hear about bidding wars and skyrocketing prices. Yet, over 60% of Canadian homebuyers stumble because they underestimate the hidden costs that arise after purchase. Most surprises do not come from the sticker price. The real challenge is about understanding what lies beneath the surface and making smart choices before you sign anything.

Table of Contents

Navigating The Real Estate Market Trends

Choosing The Right Neighbourhood For Your Needs

Dealing With Home Inspections And Repairs

Securing Financing And Managing Budget Constraints

Competing Against Other Buyers

Understanding The Closing Process And Hidden Costs

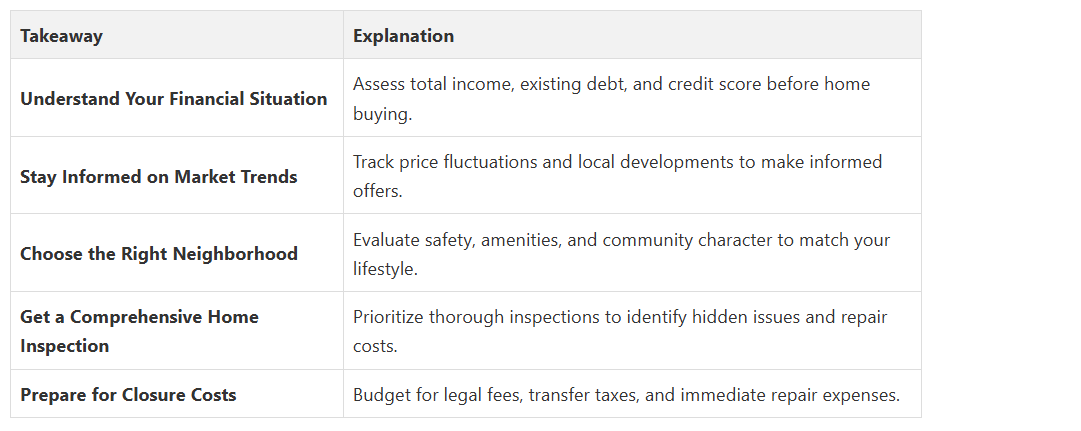

Quick Summary

1: Understanding Your Financial Situation

Financial preparedness is the cornerstone of successful home buying. This involves critically evaluating your current financial health, income stability, credit profile, and long-term affordability. A realistic assessment helps prevent potential financial strain and ensures a smoother home purchasing journey.

Key financial considerations for potential homebuyers include:

- Total Income: Calculate your reliable monthly earnings from all sources

- Existing Debt: Assess current debt levels, including student loans, credit card balances, and car payments

- Credit Score: Review your credit report and understand how it impacts mortgage qualification

- Down Payment: Determine how much you can realistically save for your initial home investment

Additionally, factor in additional homeownership costs beyond the mortgage. These include property taxes, home insurance, potential maintenance expenses, and utility costs. Creating a comprehensive budget that accounts for these expenses will provide a more accurate picture of your home-buying readiness.

Remember, financial preparation is not about perfection but about making informed, strategic decisions that align with your long-term goals and current economic reality.

2: Navigating the Real Estate Market Trends

Successful home buying demands a nuanced understanding of current market dynamics. This involves tracking price fluctuations, inventory levels, and local economic indicators that impact property values. Buyers must remain flexible and informed to make sound investment decisions.

Key market trend considerations include:

- Seasonal Variations: Recognize how buying patterns change throughout the year

- Local Development: Monitor infrastructure and community projects that might affect property values

- Economic Indicators: Track employment rates and regional economic health

- Comparative Market Analysis: Understand pricing trends in specific neighbourhoods

A Real Estate Agent in Oshawa, like Fanis Makrigiannis, can provide invaluable local market insights. They understand nuanced trends that might not be immediately apparent to individual buyers. Local agents track granular data about neighbourhood price movements, upcoming developments, and potential investment opportunities.

Understanding market trends also means looking beyond current conditions. Buyers should consider long-term potential, examining factors like:

- Future neighbourhood development plans

- Proximity to public transportation

- School district quality

- Potential for property value appreciation

3: Choosing the Right Neighbourhood for Your Needs

Neighbourhood selection requires a comprehensive approach that balances personal preferences, lifestyle needs, and practical considerations. Professional real estate services can provide invaluable insights into local community dynamics that might not be immediately apparent to potential homebuyers.

Critical factors to evaluate when choosing a neighbourhood include:

- Safety and Crime Rates: Research local crime statistics and community security

- Proximity to Essential Services: Assess access to healthcare, schools, shopping, and public transportation

- Future Development Potential: Understand planned infrastructure and community improvements

- Community Character: Evaluate the social atmosphere and demographic composition

A Real Estate Agent in Oshawa, like Fanis Makrigiannis, can provide localized insights into neighbourhood nuances that online research might miss. They understand the subtle differences between community clusters in the Durham Region.

Consider conducting thorough research through multiple channels:

- Visit potential neighbourhoods at different times of day

- Speak with residents about community experiences

- Review municipal development plans

- Check walkability and transportation infrastructure

Remember, the right neighbourhood is a personal decision that balances objective research with your unique lifestyle and future aspirations. Take time to explore, ask questions, and trust your instincts in finding a community that feels like home.

4: Dealing with Home Inspections and Repairs

Professional home inspections go far beyond a casual walkthrough. They involve meticulous examination of fundamental home systems, identifying potential problems that might not be visible to untrained eyes. A thorough inspection can save you thousands in unexpected repair costs and provide critical negotiation leverage.

Key aspects to prioritize during home inspections include:

- Structural Integrity: Assess foundation, roof, walls, and load-bearing elements

- Electrical Systems: Check wiring, panel capacity, and potential safety hazards

- Plumbing Infrastructure: Evaluate pipe conditions, water pressure, and potential leak risks

- HVAC Performance: Examine heating, ventilation, and cooling system functionality

A Real Estate Agent in Oshawa, like Fanis Makrigiannis, can recommend reputable home inspectors and help interpret inspection reports. Their expertise proves invaluable in understanding the implications of discovered issues and developing strategic repair negotiations.

Important repair considerations for potential homebuyers include:

- Estimating repair costs accurately

- Determining which issues are negotiable with current owners

- Understanding which repairs are immediate versus long-term priorities

- Evaluating potential impact on property value

Remember, a home inspection is an investment in your future. It provides peace of mind and helps you understand the true condition of your potential new home, preventing costly surprises down the road.

5: Securing Financing and Managing Budget Constraints

Mortgage preparation goes beyond simply securing funds. It involves creating a holistic financial strategy that aligns with your long-term economic goals and current financial capacity. Potential homebuyers must carefully balance their desired property aspirations with realistic financial limitations.

Key financial considerations for mortgage preparation include:

- Credit Score Management: Maintain and improve credit rating before application

- Debt-to-Income Ratio: Calculate and optimize your current financial standing

- Down Payment Strategy: Develop a systematic savings approach

- Emergency Fund Development: Establish a financial buffer beyond mortgage costs

A Real Estate Agent in Oshawa, like Fanis Makrigiannis, can provide valuable guidance in connecting with mortgage professionals who understand local market nuances. They often have established relationships with financial institutions that can streamline the financing process.

Additional budget management strategies include:

- Exploring first-time homebuyer programs

- Understanding different mortgage term options

- Calculating total ownership costs beyond monthly payments

- Preparing for potential interest rate fluctuations

Remember, successful home financing requires patience, thorough research, and a realistic approach to your financial capabilities. By preparing comprehensively and seeking professional guidance, you can transform the complex mortgage landscape into a manageable, strategic process.

Competitive positioning requires a multifaceted approach that goes beyond simply offering the highest price. Successful buyers understand the nuanced dynamics of real estate negotiations and prepare comprehensive strategies to make their offers more attractive.

Key strategies for competing effectively include:

- Financial Preparedness: Demonstrate strong mortgage pre-approval

- Flexibility on Closing Dates: Align with seller’s preferred timeline

- Minimal Conditional Offers: Reduce potential deal-breaking contingencies

- Personal Connection: Write a compelling letter explaining your genuine interest

A Real Estate Agent in Oshawa, like Fanis Makrigiannis, becomes invaluable in navigating complex competitive scenarios. They can provide strategic insights, help craft compelling offers, and leverage professional networks to understand unspoken seller motivations.

Additional competitive offer considerations:

Emotional discipline matters as much as financial strategy. Avoid getting caught in bidding wars that exceed your predetermined budget. Strategic restraint prevents potential financial overextension and maintains long-term fiscal health.

- Understand current market value through comparative market analysis

- Consider offering slightly above the list price strategically

- Minimize unnecessary conditions

- Provide a substantial deposit to demonstrate commitment

Remember, winning a competitive offer is not just about price. Sellers often evaluate offers holistically, considering factors like buyer reliability, flexibility, and genuine connection to the property. Preparation, professionalism, and strategic thinking can transform your home-buying experience from challenging to successful.

7: Understanding the Closing Process and Hidden Costs

Closing preparedness requires meticulous attention to detail and a comprehensive understanding of potential expenses beyond the initial property price. Buyers must anticipate and budget for a range of additional costs that can significantly impact overall financial investment.

Key expenses to anticipate during closing include:

- Legal Fees: Professional legal representation and documentation processing

- Land Transfer Taxes: Provincial and municipal taxation requirements

- Home Insurance: Mandatory coverage for mortgage approval

- Property Inspection Reports: Final professional assessment costs

A Real Estate Agent in Oshawa, like Fanis Makrigiannis, can provide invaluable guidance through this intricate process, helping clients navigate potential pitfalls and understand comprehensive closing requirements.

Additional critical closing considerations:

- Verify all documentation accuracy

- Confirm final mortgage terms

- Understand prorated expense calculations

- Prepare certified funds for closing

Remember, successful closing is not just about signing documents. It represents the culmination of your home-buying journey, transforming your careful planning and strategic decisions into tangible property ownership. Approach this final stage with patience, thorough preparation, and professional guidance.

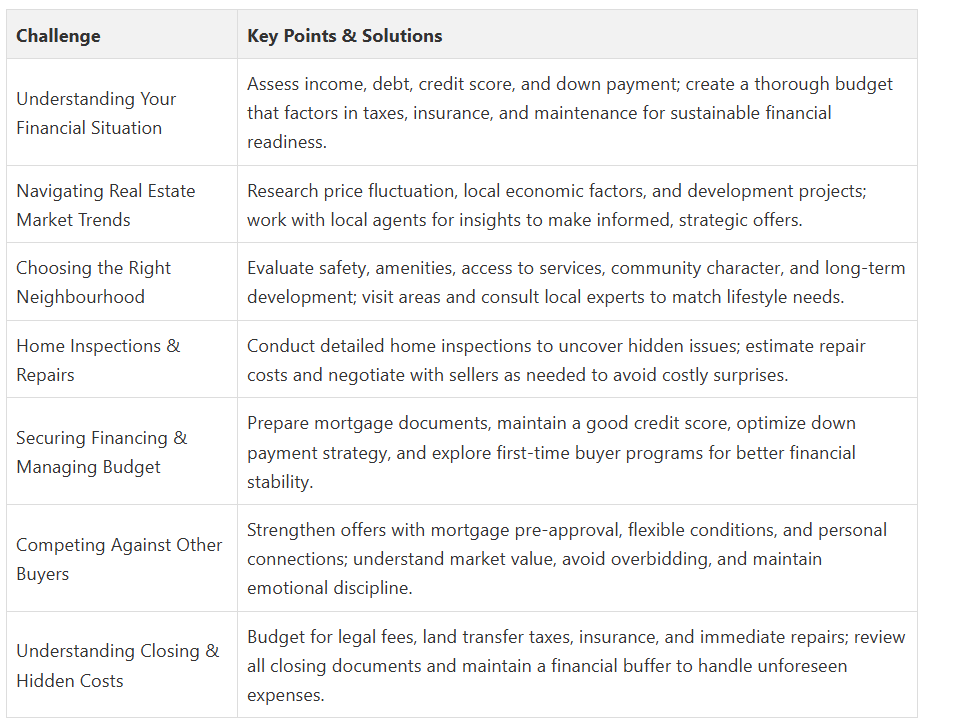

Below is a comprehensive summary table highlighting the seven key challenges of home buying discussed in the article and practical ways to overcome them in the Durham Region.

Turn Home Buying Obstacles Into Opportunities with Fanis Makrigiannis

It is time to take the next step with confidence. Explore the expertly curated property listings, exclusive neighbourhood insights, and hands-on support available through Fanis Makrigiannis’ official site. As a local Realtor® focused on personalized service, Fanis helps you overcome the exact challenges outlined in this article. Take charge of your property journey today with trusted real estate solutions that show you what is possible in Toronto and the Durham Region. Connect now and turn these challenges into your competitive advantage.

Frequently Asked Questions

How can I navigate the real estate market trends in the Durham Region?

What are the essential factors to consider when choosing a neighbourhood?

How do I prepare for hidden costs in the closing process?

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca