Understanding Mortgage Options Explained for Canadians

Choosing a mortgage is one of the most important financial decisions Canadian homebuyers will ever make. A fixed-rate sounds safe and predictable, while a variable rate tempts with possible savings. But over 70 percent of Canadians still pick a 5-year fixed mortgage even when rates are low. Is playing it safe actually costing homeowners more than they think? The numbers might just surprise you.

Table of Contents

- What Are Mortgage Options?

- Types Of Mortgage Structures

- Mortgage Term Considerations

- Why Mortgage Options Matter For Homebuyers And Sellers

- Financial Flexibility And Risk Management

- Impact On Property Value And Market Dynamics

- How Mortgage Options Work In Canada

- Mortgage Approval Process

- Regulatory Framework And Interest Dynamics

- Key Concepts Of Mortgage Types And Terms

- Mortgage Term And Amortization Fundamentals

- Interest Rate Structures And Implications

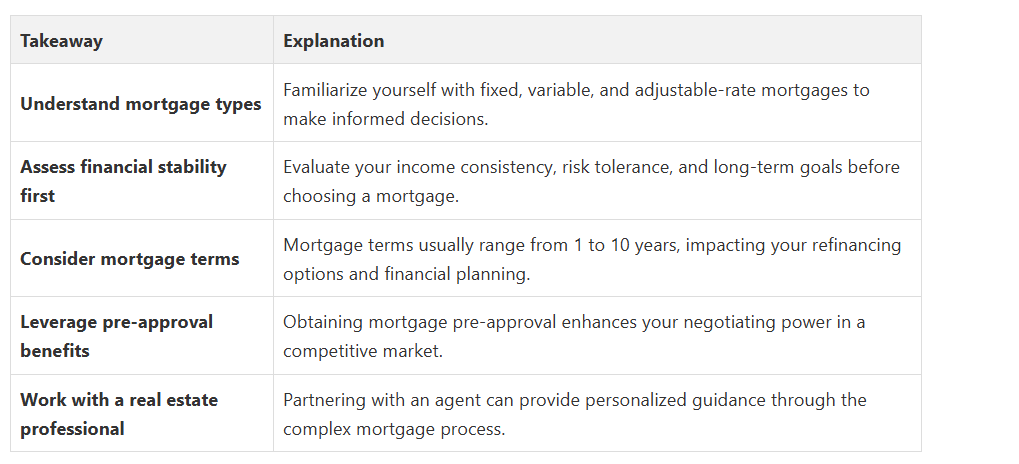

Quick Summary

What are Mortgage Options?

Types of Mortgage Structures

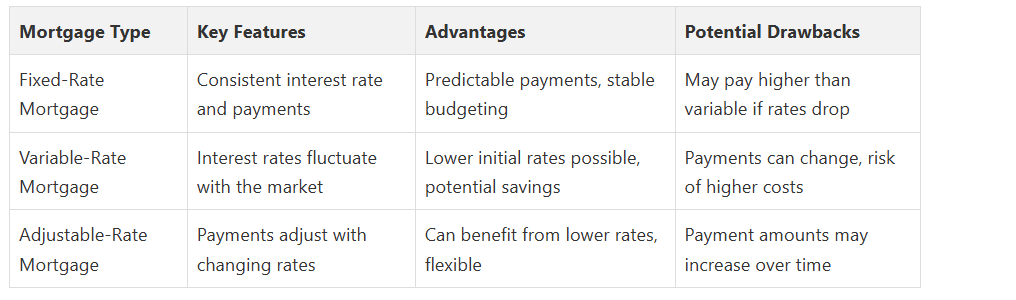

- Fixed-Rate Mortgages: Provide consistent interest rates and predictable payments throughout the loan term

- Variable-Rate Mortgages: Interest rates fluctuate based on market conditions, potentially offering lower initial rates

- Adjustable-Rate Mortgages: Allow changes in monthly payment amounts corresponding to interest rate shifts

Mortgage Term Considerations

When evaluating mortgage options in Toronto, Oshawa, Whitby, Ajax, Pickering, and surrounding areas, potential homebuyers should carefully assess their financial stability, income consistency, and long-term housing objectives. Working with a Real Estate Agent in Oshawa, like Fanis Makrigiannis, can provide personalized guidance through this complex decision-making process.

Key factors to consider when selecting mortgage options include:

- Current personal financial health

- Expected income stability

- Long-term housing goals

- Risk tolerance for potential interest rate changes

- Total borrowing costs over the mortgage lifetime

To help you compare the most common mortgage types in Canada, the following table summarizes key features, advantages, and potential drawbacks for fixed-rate, variable-rate, and adjustable-rate mortgages.

Why Mortgage Options Matter for Homebuyers and Sellers

Financial Flexibility and Risk Management

Key financial advantages of understanding mortgage options include:

- Potential long-term interest savings

- Improved budgeting and financial planning

- Enhanced negotiation power in real estate transactions

- Reduced risk of financial overextension

Impact on Property Value and Market Dynamics

According to Canada Mortgage and Housing Corporation research, mortgage terms and conditions can affect property valuation and sale potential. Buyers with pre-approved, flexible mortgage options are often more attractive to sellers, potentially securing better purchase terms.

Considerations for both buyers and sellers include:

- Understanding current market interest rates

- Evaluating personal financial risk tolerance

- Recognizing how mortgage structures impact overall transaction attractiveness

- Consulting with professional real estate agents familiar with local market conditions

How Mortgage Options Work in Canada

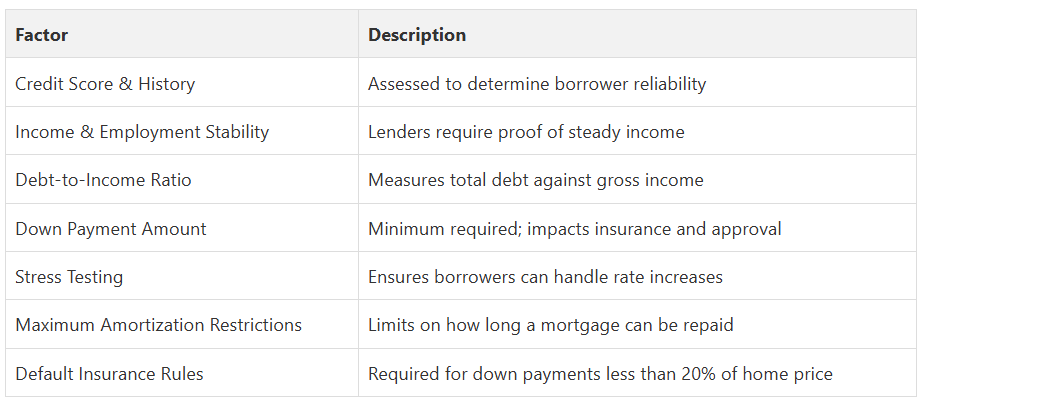

Mortgage Approval Process

- Credit score and credit history

- Current income and employment stability

- Debt-to-income ratio

- Down payment amount

- Property value and potential

This approach helps maintain financial system stability while providing opportunities for diverse homebuyers.

Key regulatory considerations include:

- Mandatory stress testing for mortgage applicants

- Minimum down payment requirements

- Maximum amortization period restrictions

- Mortgage default insurance regulations

Working with a Real Estate Agent in Oshawa, like Fanis Makrigiannis, can provide personalized guidance through this intricate process. Professional insight helps navigate the nuanced landscape of mortgage options, ensuring you select a financing strategy that aligns with your unique financial goals and local market conditions.

The table below outlines key regulatory and approval factors that influence Canadian mortgage eligibility and affordability, making it easier to understand the approval landscape and compliance requirements homebuyers must consider.

Key Concepts of Mortgage Types and Terms

Mortgage Term and Amortization Fundamentals

Key characteristics of mortgage terms include:

- Length of initial contract period

- Fixed interest rate during the term

- Opportunity to renegotiate or renew at term end

- Potential penalties for early contract termination

- Impact on overall borrowing costs

Interest Rate Structures and Implications

Fixed-rate mortgages provide predictability with a constant interest rate throughout the term, allowing for precise budget planning.

Variable-rate mortgages fluctuate with market conditions, potentially offering lower initial rates but introducing an element of financial uncertainty.

Variable-rate mortgages fluctuate with market conditions, potentially offering lower initial rates but introducing an element of financial uncertainty.Considerations for selecting mortgage types include:

- Personal risk tolerance

- Current market interest rates

- Long-term financial goals

- Potential for interest rate fluctuations

- Individual income stability

Take The Uncertainty Out of Choosing Your Mortgage

Connect with Fanis Makrigiannis, a trusted Realtor® dedicated to simplifying every step of your journey in Toronto, Durham, and surrounding areas. Get real answers to your questions so you can navigate everything from mortgage pre-approval to selecting your perfect property. Make your next move today by visiting https://fanis.ca. Opportunity in the market never waits, and the right advice is just a click away.

Frequently Asked Questions

How long do typical mortgage terms last in Canada?

What factors should I consider when choosing a mortgage option?

How does the mortgage approval process work in Canada?

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

Mortgage Pre-Approval in Toronto and Durham Guide 2025 - Fanis Makrigiannis Realtor®

Whitby Real Estate Agent—Calculating Your Mortgage Payment - Fanis Makrigiannis Realtor®

Avoiding Mortgage Scams In Ontario - Fanis Makrigiannis Realtor®

En Begynderguide til Boliglån og Afdrag - Brikk