Understanding Real Estate Due Diligence in Ontario

Buying property in Ontario comes with plenty of promise and plenty of pitfalls. Shockingly, even a single overlooked title issue or hidden defect can cost buyers thousands after closing. Most people think finding the right neighbourhood is the hard part, but it’s the behind-the-scenes detective work called real estate due diligence that actually protects you from disaster.

Table of Contents

- What Is Real Estate Due Diligence?

- Understanding The Core Purpose

- Financial And Legal Implications

- Why Real Estate Due Diligence Matters In Transactions

- Financial Protection And Risk Mitigation

- Legal And Structural Implications

- Key Components Of Real Estate Due Diligence

- Property Title And Legal Assessment

- Physical And Environmental Inspection

- How Real Estate Due Diligence Protects Buyers And Sellers

- Protection For Property Buyers

- Safeguarding Seller Interests

- Understanding Local Market Factors In Due Diligence

- Regional Economic Indicators

- Demographic And Neighbourhood Analysis

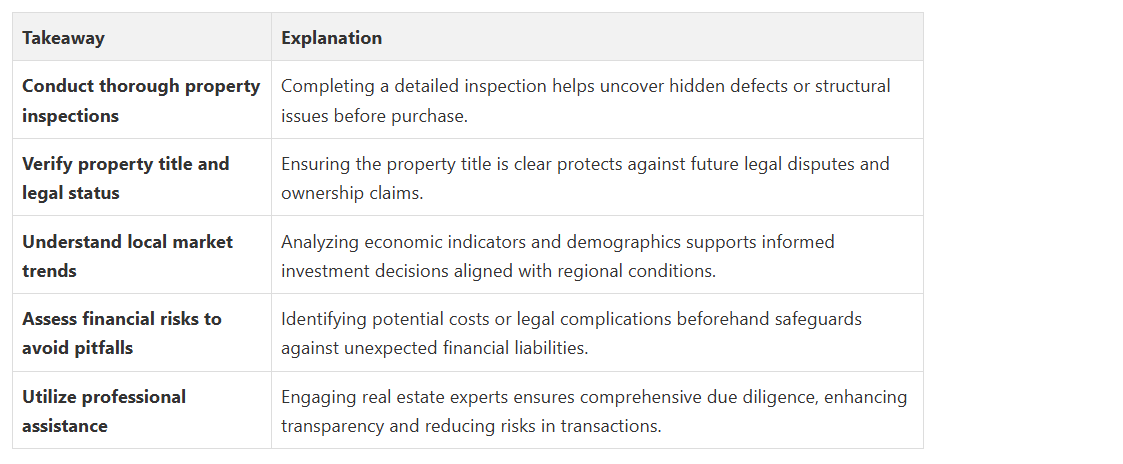

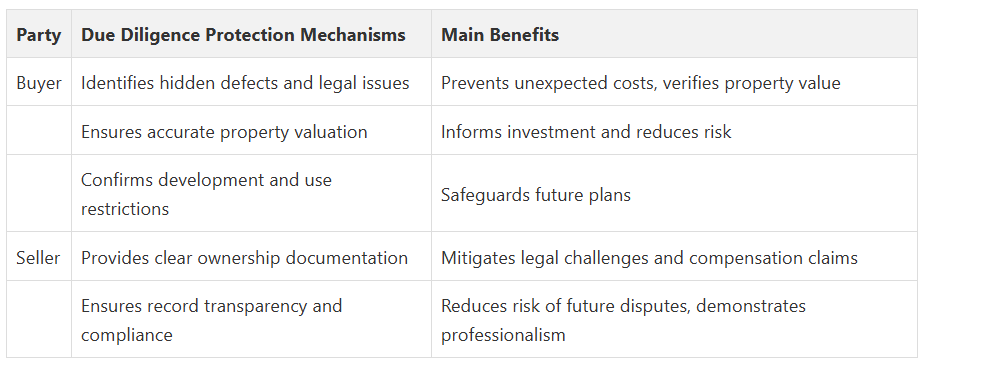

Quick Summary

What is Real Estate Due Diligence?

Understanding the Core Purpose

Key aspects of due diligence typically include:

- Verifying property ownership and legal title status

- Examining existing liens, encumbrances, or legal restrictions

- Assessing property condition through professional inspections

- Reviewing zoning regulations and potential land use limitations

- Investigating potential environmental concerns

Financial and Legal Implications

For real estate investors and homebuyers in the Durham Region and Greater Toronto Area, due diligence represents a critical risk management strategy. By conducting a meticulous examination of a property’s background, buyers can make more confident and informed decisions, potentially avoiding costly mistakes that could impact their financial future.

Why Real Estate Due Diligence Matters in Transactions

Financial Protection and Risk Mitigation

Potential financial risks that due diligence helps mitigate include:

- Unexpected repair or renovation costs

- Hidden structural damage

- Potential legal disputes with property boundaries

- Unresolved liens or encumbrances

- Zoning restrictions affecting property value

Legal and Structural Implications

- Outstanding mortgages or legal claims

- Potential easements or right-of-way restrictions

- Historical property use that might impact current valuation

- Environmental constraints or contamination risks

Key Components of Real Estate Due Diligence

The table below summarizes the key components of real estate due diligence in Ontario, highlighting their purpose and examples of what each entails.

Property Title and Legal Assessment

- Verifying a clear and marketable property title

- Checking for existing liens or legal encumbrances

- Confirming proper registered ownership

- Investigating potential legal disputes or restrictions

- Reviewing historical property transfers

Physical and Environmental Inspection

Key physical due diligence elements include:

- Comprehensive structural building inspection

- Evaluation of electrical, plumbing, and mechanical systems

- Soil and environmental contamination assessments

- Verification of building code compliance

- Assessment of potential environmental hazards

How Real Estate Due Diligence Protects Buyers and Sellers

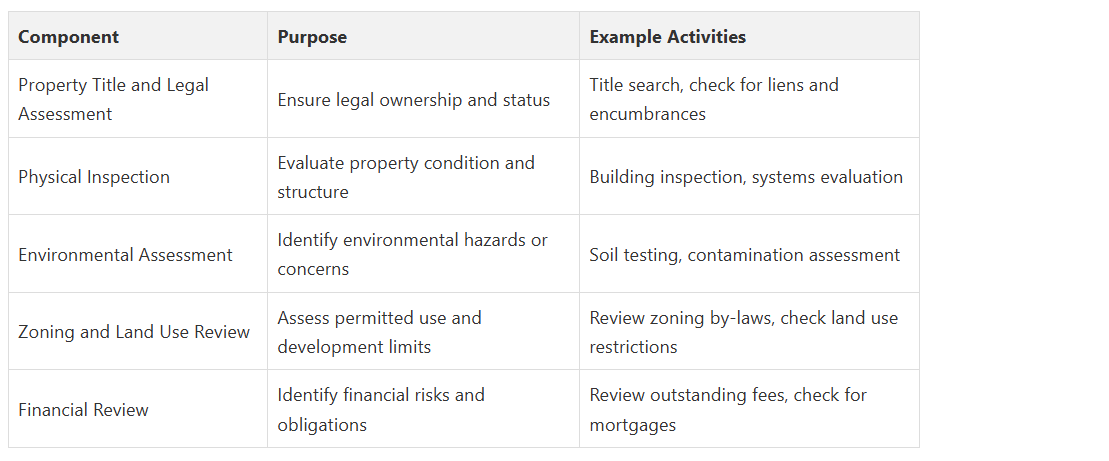

This comparison table outlines how real estate due diligence protects both buyers and sellers in property transactions, detailing the unique benefits for each party.

Protection for Property Buyers

- Identifying potential hidden property defects

- Revealing undisclosed legal encumbrances

- Preventing unexpected financial liabilities

- Verifying accurate property valuation

- Understanding potential future development restrictions

Safeguarding Seller Interests

Key protective aspects for sellers include:

- Establishing clear ownership documentation

- Mitigating potential post-sale legal challenges

- Demonstrating property value through comprehensive records

- Reducing the likelihood of future compensation claims

- Ensuring compliance with provincial real estate regulations

Understanding Local Market Factors in Due Diligence

- Local employment rate and job market stability

- Median household income trends

- Infrastructure development plans

- Commercial and industrial growth projections

- Municipal tax rate fluctuations

Demographic and Neighbourhood Analysis

emphasizing the importance of detailed demographic research. For a Real Estate Agent in Oshawa like Fanis Makrigiannis, understanding these nuanced local factors is crucial.

Critical demographic factors to investigate include:

- Population growth and migration patterns

- Age distribution of residents

- School district performance ratings

- Community amenities and future development plans

- Neighbourhood crime statistics and safety trends

Take the Uncertainty Out of Real Estate Due Diligence with Professional Guidance

Let Fanis Makrigiannis and the RE/MAX Rouge River Realty Ltd. team put your mind at ease. On our website, you will find tailored buying and selling guides, expert neighbourhood insights, and access to the support you need to secure your investment with confidence. Take the first step right now. Contact Fanis today and experience a smoother, safer transaction—your peace of mind starts with the right expertise.

Frequently Asked Questions

What are the key components of real estate due diligence?

How can buyers protect themselves through due diligence?

Why is understanding local market factors important in due diligence?

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

Real Estate Transaction Steps in Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Realtor® Tips—Land Titles in the Durham Region - Fanis Makrigiannis Realtor®

Common Documents That Require Notarization in Ontario - My Mobile Notary

The Complete Guide to Using an Online Notary Public for Affidavits and Declarations in Ontario (2025) - The Online Notary CA