Diversifying Real Estate Investments

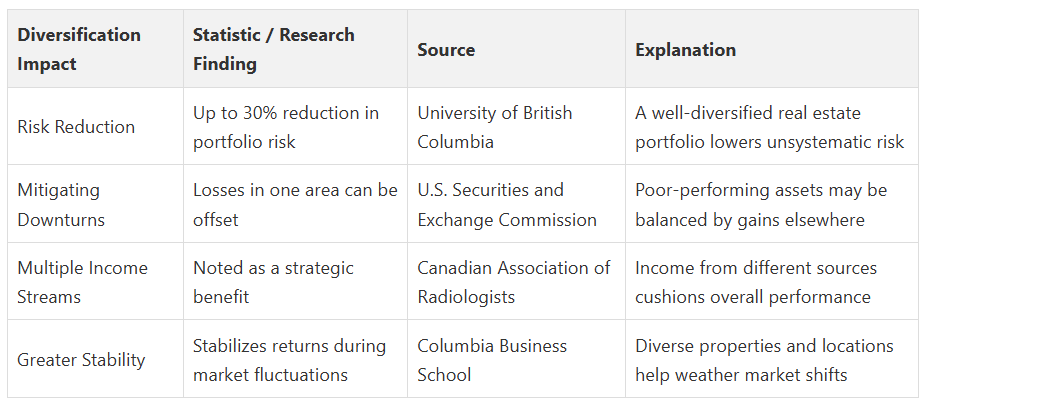

Investing in real estate often sounds like a safe bet, and many think that buying a few properties in your neighbourhood is all it takes to build wealth. But here is a shocker. A diversified real estate portfolio can reduce risk by up to 30 percent, according to recent university research. Most investors in Toronto and Durham still stack their chips on one type of property or a single location. The real opportunity is hiding in mixing different property types and areas, and the numbers prove it.

Table of Contents

- What Does Diversifying Real Estate Mean?

- Understanding Property Portfolio Diversification

- Strategic Investment Approaches

- Why Is Diversification Important In Real Estate?

- Risk Mitigation And Financial Stability

- Strategic Benefits Of Investment Diversification

- How Does Diversification Reduce Risk In Real Estate Investments?

- Market Correlation And Risk Mitigation

- Strategic Risk Reduction Mechanisms

- Key Strategies For Effective Real Estate Diversification

- Property Type And Geographic Diversification

- Strategic Investment Approaches

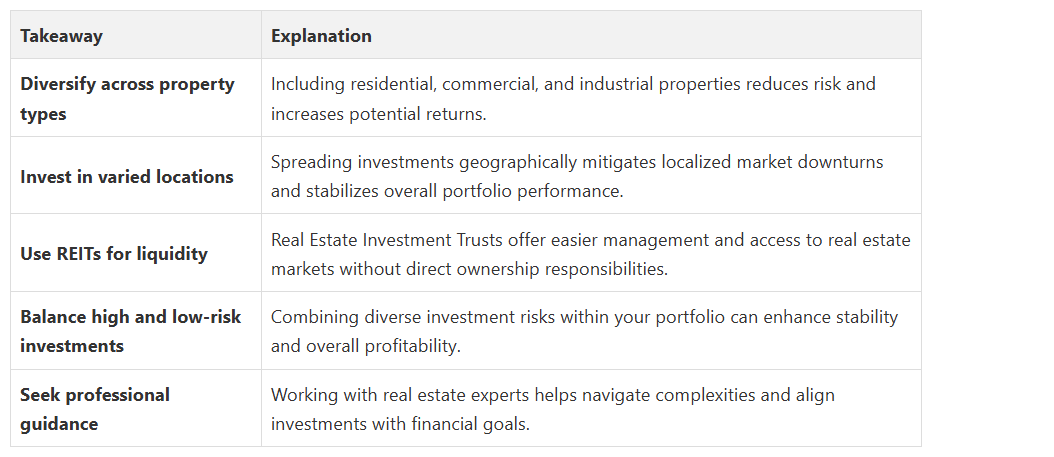

Quick Summary

What Does Diversifying Real Estate Mean?

Understanding Property Portfolio Diversification

According to research from the University of British Columbia, a well-diversified real estate portfolio can significantly reduce unsystematic investment risks. The study highlights that investors who spread their investments across different property types and geographical regions can mitigate potential market fluctuations.

Strategic Investment Approaches

- Investing in properties across different municipalities in the Durham Region

- Mixing residential and commercial real estate holdings

- Incorporating REITs for increased liquidity and reduced direct management responsibilities

By implementing a diversified approach, real estate investors in the Greater Toronto Area can potentially reduce risk, stabilize returns, and create more resilient investment portfolios that can weather market uncertainties.

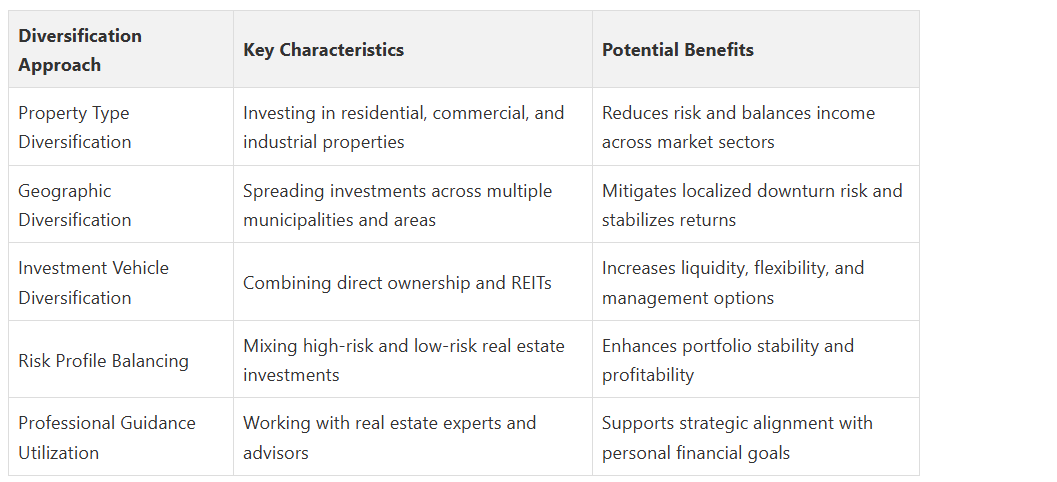

Below is a summary table highlighting the primary types of real estate diversification, their characteristics, and key potential benefits for investors in the Greater Toronto Area and Durham Region.

Why is Diversification Important in Real Estate?

Risk Mitigation and Financial Stability

According to the Canadian Association of Radiologists, diversification helps investors avoid concentrated risks by not placing all financial resources into a single asset class or market segment. This approach provides multiple layers of protection against potential market volatilities.

Strategic Benefits of Investment Diversification

- Minimizing potential losses from localized market downturns

- Creating multiple income streams from different property types

- Balancing portfolio performance across various real estate sectors

By strategically diversifying real estate investments, investors can build more robust, flexible, and potentially more profitable investment portfolios that can withstand economic fluctuations and market uncertainties.

How Does Diversification Reduce Risk in Real Estate Investments?

Market Correlation and Risk Mitigation

According to the U.S. Securities and Exchange Commission, strategic diversification allows investors to minimize the impact of poor-performing investments by spreading resources across multiple assets.

This approach creates a financial buffer that protects against concentrated market risks.

Strategic Risk Reduction Mechanisms

- Investing across different property classes (residential, commercial, industrial)

- Geographic distribution of real estate holdings

- Incorporating various investment vehicles like REITs and direct property ownership

By implementing comprehensive diversification strategies, real estate investors can create more stable, adaptive investment portfolios that potentially generate consistent returns while minimizing exposure to significant financial risks.

The following table presents research-backed impacts of real estate diversification on investment risk, summarizing numerical findings and explanations provided in the article.

Key Strategies for Effective Real Estate Diversification

Property Type and Geographic Diversification

This approach allows investors to mitigate risks associated with localized market fluctuations and sector-specific challenges.

By carefully selecting properties in different municipalities and property classes, investors can create a more balanced and stable investment portfolio.

According to Columbia Business School’s research, strategic diversification goes beyond simple asset allocation. It requires a nuanced understanding of market dynamics, property valuations, and potential growth trajectories across different real estate segments.

Strategic Investment Approaches

- Mixing residential, commercial, and industrial property investments

- Investing across different geographical zones within the Durham Region

- Incorporating various investment vehicles like direct property ownership and REITs

- Balancing high-risk and low-risk property investments

By implementing thoughtful diversification strategies, real estate investors can build resilient portfolios that adapt to changing market conditions and potentially generate consistent long-term returns.

Build a Safer, Smarter Real Estate Portfolio With Fanis Makrigiannis

If you are ready to make your investments safer and more resilient, let Fanis Makrigiannis Realty help you craft a tailored diversification strategy. Benefit from our local insights on the basics of real estate or learn more about managing risks in today’s market. Take the next step to protect your future. Connect now for your custom portfolio plan on https://fanis.ca and let our team guide you from the first question to your next closing.

Frequently Asked Questions

How does diversification reduce risk in real estate investments?

What are the key benefits of diversifying my real estate portfolio?

What strategies can I use to effectively diversify my real estate investments?

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

Why Real Estate Investing Matters in Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Real Estate Investment: Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Why Real Estate Matters in Toronto & Durham Region in 2025 - Fanis Makrigiannis Realtor®

How to Choose Rental Insurance: A Complete Guide for Landlords - Rental Income Insurance