The Home Buying Timeline in Ontario

Buying a home in Ontario is never just about finding the right house. The timeline from your first search to finally holding the keys can stretch for several weeks to months, according to the Financial Consumer Agency of Canada. Most people expect a simple countdown, but the truth is that every step depends on shifting markets, legal hurdles, and personal decisions that can speed things up or slow them way down. Missing even one detail can add weeks to your journey when a better plan could put you ahead.

Table of Contents

- What Is The Home Buying Timeline?

- The Conceptual Framework Of Home Buying

- Understanding Market Dynamics

- Why Understanding The Home Buying Timeline Is Essential

- Strategic Financial Planning

- Risk Mitigation And Informed Decision Making

- Psychological And Emotional Preparedness

- Key Phases Of The Home Buying Timeline

- Financial Preparation And Pre-Approval

- Property Search And Evaluation

- Negotiation And Closing

- Factors That Influence The Home Buying Timeline

- Market Conditions And Economic Dynamics

- Personal Financial And Lifestyle Considerations

- Regulatory And Administrative Factors

- Real-World Context Of The Home Buying Timeline In Ontario

- Regional Market Realities

- Legal And Administrative Complexities

- Practical Navigational Strategies

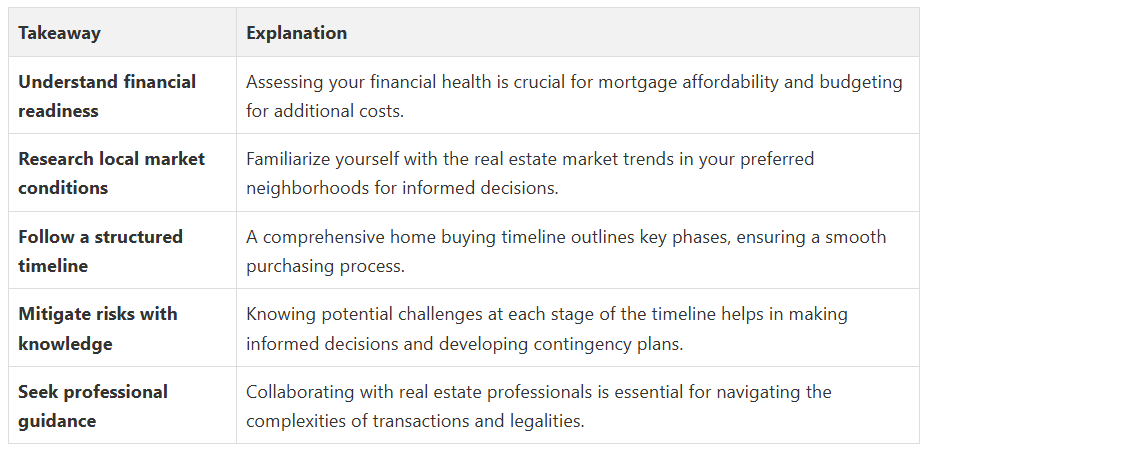

Quick Summary

What is the Home Buying Timeline?

The Conceptual Framework of Home Buying

Key Components of the Home Buying Timeline:

- Financial readiness and mortgage pre-approval

- Property search and evaluation

- Making competitive offers

- Negotiation and conditional periods

- Closing and transfer of ownership

Understanding Market Dynamics

The timeline is influenced by factors such as:

- Current market inventory

- Financing options

- Personal financial readiness

- Specific neighbourhood preferences

- Individual negotiation strategies

Why Understanding the Home Buying Timeline is Essential

Strategic Financial Planning

Critical Financial Considerations:

- Assessing mortgage affordability

- Budgeting for additional purchasing costs

- Understanding credit requirements

- Planning for potential market fluctuations

- Anticipating potential financial challenges

Risk Mitigation and Informed Decision Making

For residents in Toronto, Oshawa, Whitby, Ajax, Pickering, and surrounding areas, this understanding becomes crucial in a dynamic real estate market. Our comprehensive guide to home buying challenges provides deeper insights into navigating potential obstacles.

Psychological and Emotional Preparedness

Whether you are a first-time buyer or an experienced investor in the Durham Region, a comprehensive understanding of the home-buying timeline is your strongest asset in achieving real estate success.

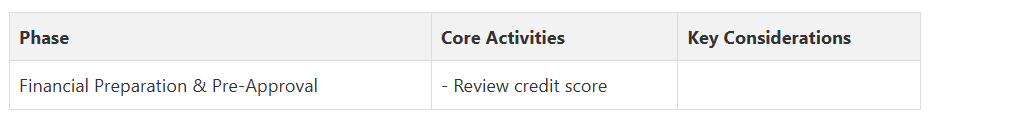

Key Phases of the Home Buying Timeline

Financial Preparation and Pre-Approval

Key Financial Preparation Steps:

- Conducting a comprehensive credit score review

- Calculating total purchasing budget

- Gathering necessary financial documentation

- Obtaining mortgage pre-approval

- Establishing emergency housing funds

Property Search and Evaluation

Once financial preparations are complete, potential homeowners enter the property search and evaluation phase. This stage involves extensive market research, property viewings, and strategic assessment of potential investments. According to the Ontario Land Tribunal, understanding local land use regulations and potential valuation considerations becomes paramount during this phase.

Critical Evaluation Criteria:

- Neighbourhood infrastructure

- Property condition and potential renovation needs

- Long-term appreciation potential

- Proximity to essential services

- Alignment with personal lifestyle requirements

Negotiation and Closing

The final phase encompasses negotiation, conditional periods, and ultimately, property transfer. This stage requires careful legal and financial navigation. Potential homeowners must collaborate closely with real estate professionals to ensure smooth transaction completion. Our home-selling tips provide additional insights into successfully managing this complex process.

Each phase of the home-buying timeline demands meticulous attention, strategic planning, and informed decision-making.

To help clarify the major steps in Ontario’s home-buying journey, the table below outlines the key phases along with their essential activities and considerations.

- Set purchase budget

- Gather documents

- Get pre-approved

- Emergency fund | Mortgage affordability, documentation, credit health | | Property Search & Evaluation | - Market research

- View properties

- Assess neighbourhoods

- Inspect conditions | Proximity, infrastructure, renovation needs | | Negotiation & Closing | - Submit offers

- Negotiate terms

- Meet legal requirements

- Finalize purchase | Legal complexity, closing costs, timelines | By understanding these interconnected stages, buyers can transform what might seem like an overwhelming journey into a structured, achievable goal.

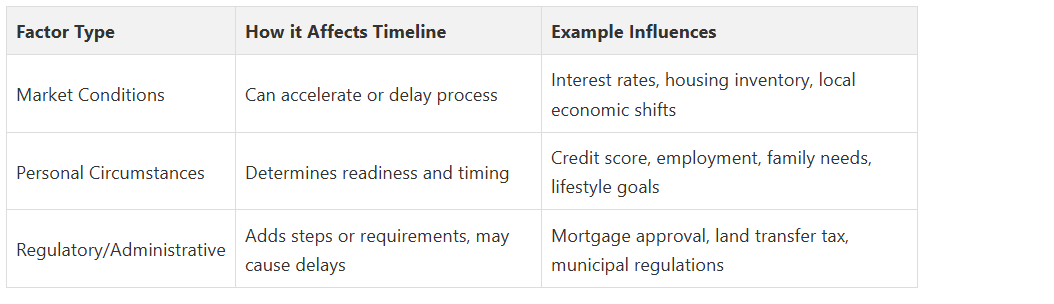

Factors That Influence the Home Buying Timeline

Market Conditions and Economic Dynamics

Critical Market Influence Factors:

- Interest rate fluctuations

- Local housing inventory levels

- Regional economic performance

- Seasonal real estate trends

- Broader provincial economic indicators

Personal Financial and Lifestyle Considerations

Key Personal Determinants:

- Credit score and financial readiness

- Employment stability

- Family size and future growth plans

- Specific neighbourhood preferences

- Budget constraints and flexibility

Regulatory and Administrative Factors

The Ontario real estate landscape involves intricate regulatory frameworks that can influence transaction timelines. Factors such as mortgage approval processes, land transfer regulations, and municipal administrative procedures can extend or contract the overall home-buying journey.

Ultimately, successful navigation of the home-buying timeline requires a holistic understanding of these interconnected factors. Potential homeowners who approach the process with flexibility, comprehensive research, and professional guidance can effectively manage the inherent complexities of property acquisition in Ontario.

The following table compares some of the main factors that influence the home-buying timeline in Ontario, highlighting how different categories affect the process and what examples are cited in the article.

Real-World Context of the Home Buying Timeline in Ontario

Regional Market Realities

Key Regional Market Characteristics:

- Varying property values across different municipalities

- Localized economic development patterns

- Neighbourhood-specific demand fluctuations

- Infrastructure investment impacts

- Municipal regulatory differences

Critical Legal Considerations:

- Land transfer tax implications

- First-time homebuyer refund eligibility

- Municipal zoning regulations

- Property tax assessment procedures

- Title registration requirements

Practical Navigational Strategies

Potential homeowners must recognize that the real-world home-buying timeline is fluid, influenced by interconnected personal, economic, and regulatory factors. Professional guidance, thorough research, and adaptive strategies are essential in transforming complex procedural landscapes into successful property acquisitions.

Ultimately, the Ontario home buying journey represents a sophisticated interplay of individual aspirations and systemic frameworks, demanding a nuanced understanding and strategic navigation.

Ready to Master Your Ontario Home Buying Journey?

Bring clarity and confidence to your home-buying timeline today. Team up with Fanis Makrigiannis for guided support at every stage. Dive into our step-by-step home buying guide to get immediate answers, then search for your ideal home using our powerful property listings. Make your next move with expert insight—visit https://fanis.ca now to book a consultation and secure the best outcome in this competitive market.

What are the key phases of the home-buying timeline?

The key phases of the home-buying timeline include financial preparation and pre-approval, property search and evaluation, and negotiation and closing. Each phase is interconnected and requires thorough planning and informed decision-making.

Frequently Asked Questions

How can I ensure financial readiness for buying a home?

What factors influence the home-buying timeline?

How can I mitigate risks during the home-buying process?

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

How to Sell Fast: Strategies for Homeowners in Ontario - Fanis Makrigiannis Realtor®

Top Common Homebuyer Questions in Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Real Estate Transaction Steps in Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

How to Get Documents Notarized Online in Ontario 2025 – The Online Notary

Notary Near Me, Notary Public Near Me - My Mobile Notary