Building Passive Income with Real Estate

Passive income in real estate sounds like a dream for many investors and for good reason. In Canada, over $207 billion in real estate investment trusts (REITs) are currently held by individuals seeking regular earnings with less hands-on effort. Most people think property investment means constant work and problems with tenants. In reality, the smartest investors have found ways to earn steady returns while barely lifting a finger.

Table of Contents

- What Is Passive Income In Real Estate?

- Understanding The Passive Income Model

- Key Characteristics Of Passive Real Estate Income

- Why Building Passive Income In Real Estate Matters

- Financial Independence And Wealth Accumulation

- Strategic Long-Term Financial Planning

- How Passive Income Real Estate Works: Key Concepts

- Revenue Generation Mechanisms

- Investment Structure And Risk Management

- Types Of Real Estate Investments For Passive Income

- Residential Rental Property Investments

- Advanced Passive Real Estate Investment Vehicles

- Evaluating Market Factors For Real Estate Success

- Economic And Demographic Indicators

- Localized Market Analysis

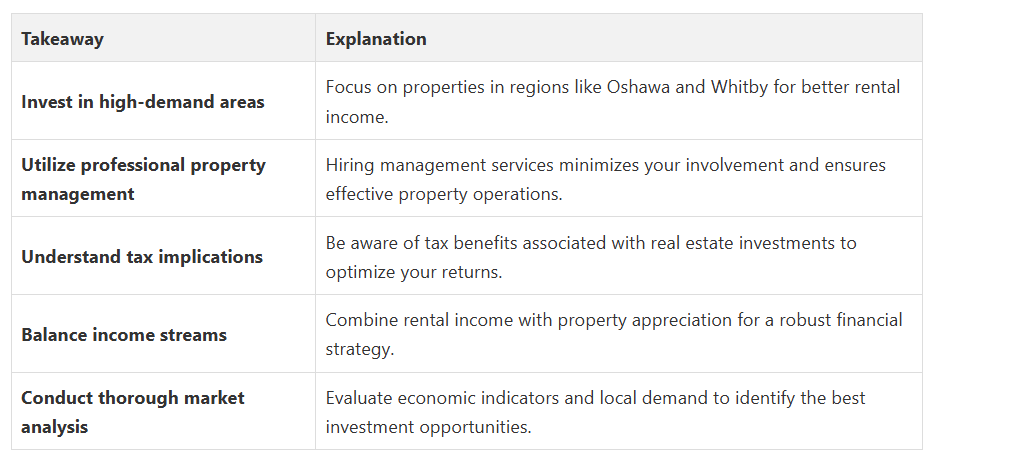

Quick Summary

What is Passive Income in Real Estate?

Understanding the Passive Income Model

According to the Canada Revenue Agency, passive real estate income can be generated through multiple channels:

- Rental properties in Toronto, Oshawa, Whitby, Ajax, Pickering, and surrounding areas

- Real estate investment trusts (REITs)

- Limited partnership investments

- Property appreciation and long-term value growth

Key Characteristics of Passive Real Estate Income

Investment Selection: Choose properties in high-demand areas with strong potential for consistent rental income. In the Durham Region, markets like Oshawa and Whitby offer promising opportunities for investors seeking reliable passive income streams.

Property Management: While passive income minimizes direct involvement, strategic management remains crucial. Consider professional property management services to handle tenant interactions, maintenance, and administrative tasks, ensuring your investment continues generating revenue with minimal personal intervention.

Financial Planning: Develop a comprehensive approach that accounts for potential expenses, market fluctuations, and long-term investment goals. Understanding tax implications and maintaining financial reserves are essential for sustainable passive real estate income.

Why Building Passive Income in Real Estate Matters

Financial Independence and Wealth Accumulation

Key advantages of passive real estate income include:

- Potential for steady monthly cash flow

- Protection against inflation through property appreciation

- Tax advantages specific to real estate investments

- Portfolio diversification beyond traditional stock market investments

Strategic Long-Term Financial Planning

According to recent financial research, real estate passive income offers substantial advantages over other investment vehicles. Investors in Toronto, Oshawa, Whitby, Ajax, Pickering, and surrounding areas can leverage local market dynamics to generate consistent returns.Risk Mitigation: Unlike volatile stock market investments, real estate provides a more stable and predictable income source. Property values in the Durham Region historically demonstrate resilient growth, offering investors a robust hedge against economic fluctuations.

Wealth Compounding: Passive real estate income allows investors to reinvest earnings, creating a compounding effect that accelerates wealth accumulation. By strategically acquiring and managing properties in high-demand markets, investors can build a sustainable financial ecosystem that generates ongoing revenue with progressively reduced personal intervention.

How Passive Income Real Estate Works: Key Concepts

Revenue Generation Mechanisms

Learn more about planning your real estate exit strategies to maximize your investment potential.

Learn more about planning your real estate exit strategies to maximize your investment potential.- Direct rental property ownership

- Real Estate Investment Trusts (REITs)

- Crowdfunding real estate platforms

- Limited partnership investments

- Commercial property leasing

Investment Structure and Risk Management

Income Streams: Passive real estate investments create multiple revenue channels. Rental income provides immediate cash flow, while property appreciation offers long-term wealth accumulation. Smart investors balance these income streams to create a robust financial strategy.

Operational Considerations: Effective passive income real estate requires minimal direct management. Professional property management services can handle tenant screening, maintenance, and administrative tasks, allowing investors to enjoy returns with limited personal involvement.

The key to successful passive real estate income lies in understanding local market dynamics, maintaining strategic property selections, and implementing professional management approaches that optimize investment potential.

Real estate offers diverse investment strategies for generating passive income, each with unique characteristics and potential returns. As a Real Estate Agent in Oshawa, I’ve guided numerous investors through selecting optimal investment approaches tailored to their financial goals and risk tolerance.

Types of Real Estate Investments for Passive Income

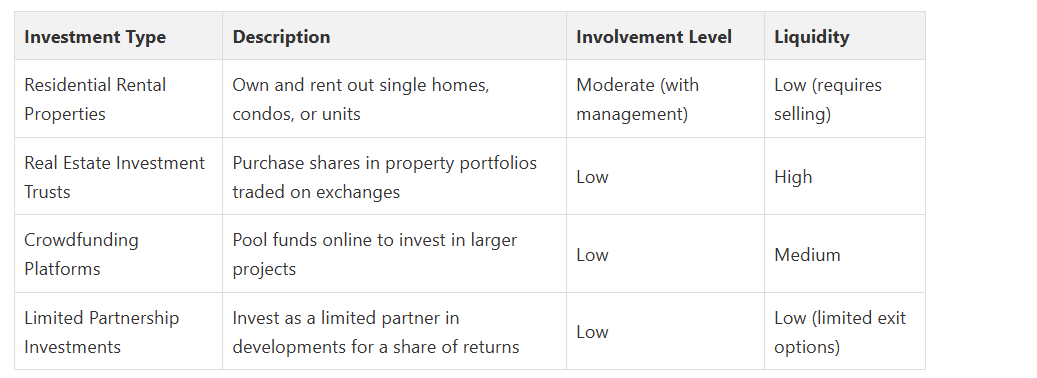

Below is a comparison table to help you understand the main types of passive real estate investments mentioned in the article and their key features.

Residential Rental Property Investments

According to Canadian Real Estate Wealth Magazine, residential passive income investments include:

- Single-family home rentals

- Multi-unit residential properties

- Condominium investments

- Student housing accommodations

- Short-term vacation rental properties

Advanced Passive Real Estate Investment Vehicles

Crowdfunding Platforms: Modern investment technologies enable investors to pool resources and invest in larger commercial or residential projects with lower individual capital requirements.

These platforms democratize real estate investing, offering access to previously unavailable investment opportunities.

Limited Partnership Investments: Sophisticated investors can participate in larger real estate developments by becoming limited partners, receiving proportional returns without day-to-day operational responsibilities. This approach allows for strategic investments in commercial, residential, and mixed-use properties with reduced personal management demands.

Evaluating Market Factors for Real Estate Success

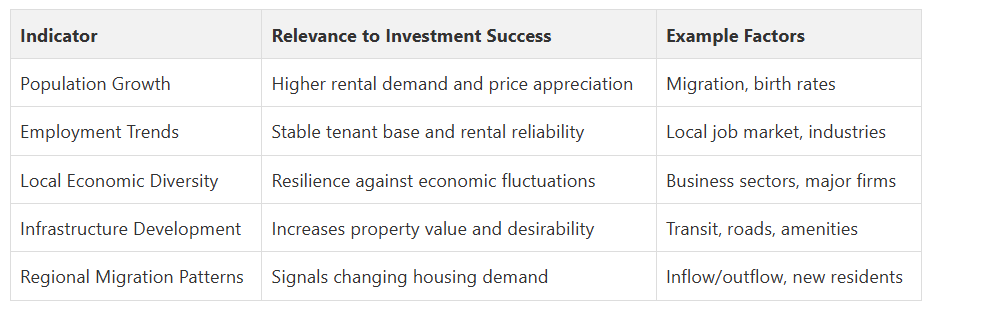

Economic and Demographic Indicators

Explore key economic factors for real estate buyers and sellers to develop a nuanced understanding of market potential.According to Statistics Canada, critical market evaluation factors include:

- Population growth rates

- Employment and income trends

- Local economic diversity

- Infrastructure development

- Regional migration patterns

Localized Market Analysis

Rental Market Dynamics: Assess local rental demand by examining:

- University and college student populations

- Corporate employment centers

- Transportation accessibility

- Local amenity infrastructure

Effective market analysis transforms passive real estate investment from a speculative endeavour to a strategic wealth-building approach, enabling investors to identify opportunities and mitigate potential risks.

This table summarizes the key economic and demographic indicators you should evaluate when considering real estate investment for passive income, as outlined in the article.

Start Earning Passive Income with Local Real Estate Expertise

Take the guesswork out of your next step. Visit Fanis Makrigiannis’ trusted real estate platform to access featured properties, actionable guides and customized strategies tailored to your investment goals. Secure your future by connecting with a local expert who will help you turn potential into profit. Get started at https://fanis.ca for personalized support and the latest local market insights. Now is the perfect moment to move closer to true financial independence with professional guidance you can trust.

Frequently Asked Questions

How can I generate passive income through real estate investments?

What are the key characteristics of successful passive real estate investments?

Why is building passive income in real estate important for wealth accumulation?

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

Investment Property Checklist: 10 Essential Tips - Fanis Makrigiannis Realtor®

Top Investment Property Tax Tips for Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Understanding Real Estate Exit Strategies for Success - Fanis Makrigiannis Realtor®

Understanding Rental Income Security Explained - Rental Income Insurance

Guide til investering i ejendomme til udlejning - Brikk