Understanding Real Estate Portfolio Strategies

Building wealth through real estate is about more than just owning a handful of properties. Surprisingly, over 90 percent of the world’s millionaires have made their fortunes through real estate investments. Yet most people still overlook how a smart portfolio strategy can shield them from market swings and drive steady returns. That little-known reality opens the door to investment approaches that can outperform almost any single-property play.

Table of Contents

- What Are Real Estate Portfolio Strategies?

- Core Principles Of Portfolio Construction

- Strategic Investment Approaches

- The Importance Of Diversification In Real Estate

- Understanding Risk Mitigation

- Strategic Property Portfolio Composition

- How Market Trends Affect Your Portfolio Strategy

- Analyzing Economic Indicators

- Adapting Portfolio Strategies

- Key Metrics For Evaluating Real Estate Investments

- Financial Performance Indicators

- Risk Assessment And Performance Analysis

- Real-World Applications Of Portfolio Strategies In Ontario

- Regional Market Dynamics

- Strategic Investment Approaches

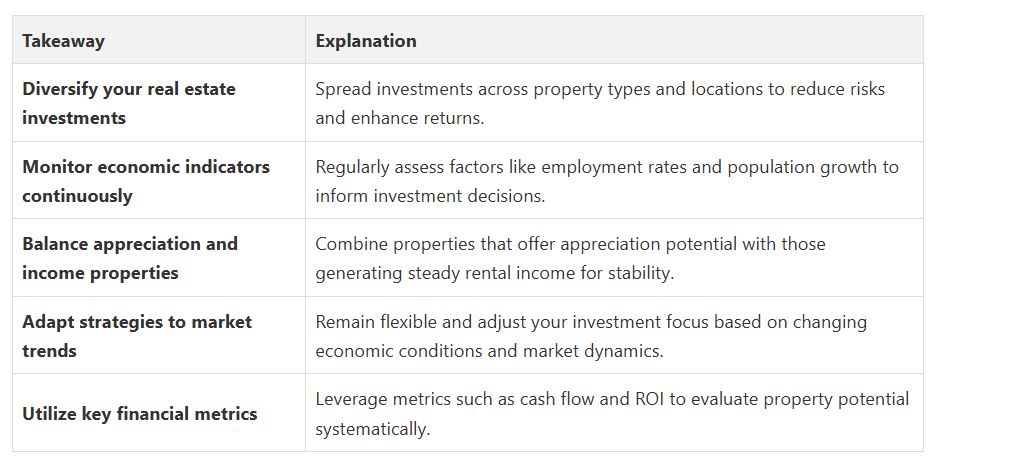

Quick Summary

What Are Real Estate Portfolio Strategies?

Core Principles of Portfolio Construction

Key components of effective real estate portfolio strategies typically include:

- Diversification across different property types (residential, commercial, industrial)

- Geographic spread to minimize regional market risks

- Mix of income-generating and appreciation-focused properties

- Strategic asset allocation based on risk tolerance

Strategic Investment Approaches

The complexity of real estate portfolio strategies means that no single approach is universally effective. Professional investors continuously assess and rebalance their portfolios, adapting to changing market conditions, economic indicators, and personal financial objectives.

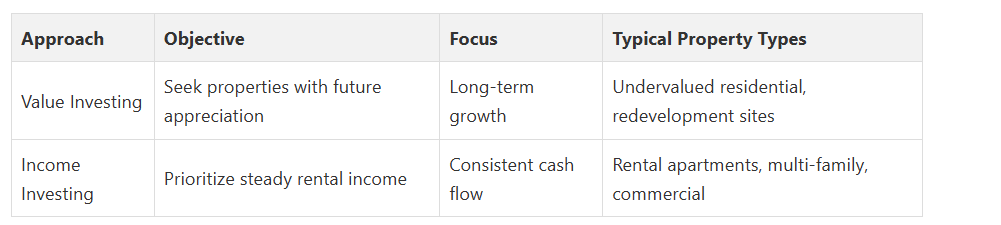

To clarify the different approaches investors use when building a real estate portfolio, the following table compares value investing and income investing as described in the article.

The Importance of Diversification in Real Estate

Understanding Risk Mitigation

Key risk mitigation strategies through diversification include:

Successful diversification requires careful analysis of market trends, economic indicators, and individual investment goals. Learn about building passive income strategies to understand how strategic property selection can enhance overall portfolio performance. Professional investors typically aim to create a portfolio that includes properties with complementary characteristics, ensuring that potential underperformance in one sector can be offset by stronger performance in another.

- Investing across different geographic regions

- Mixing property types (residential, commercial, industrial)

- Balancing properties with different growth and income potential

- Incorporating properties with varying lease lengths and tenant profiles

Strategic Property Portfolio Composition

By spreading investments across different property types, locations, and market segments, investors can create a more stable and potentially more profitable real estate portfolio. This approach allows for greater flexibility and reduces the risk of significant financial loss if one particular market segment experiences a downturn.

How Market Trends Affect Your Portfolio Strategy

Analyzing Economic Indicators

Key economic indicators that impact real estate portfolio strategies include:

- Unemployment rate and job market stability

- Local infrastructure and development projects

- Population migration patterns

- Interest rates and mortgage lending conditions

- Regional economic growth and industry diversification

Adapting Portfolio Strategies

The ability to read and interpret market trends requires continuous learning and a proactive approach. Investors must remain flexible, regularly reassessing their portfolio composition to ensure alignment with current economic realities. This dynamic strategy helps protect investments and capitalize on emerging opportunities in the ever-evolving real estate landscape.

Key Metrics for Evaluating Real Estate Investments

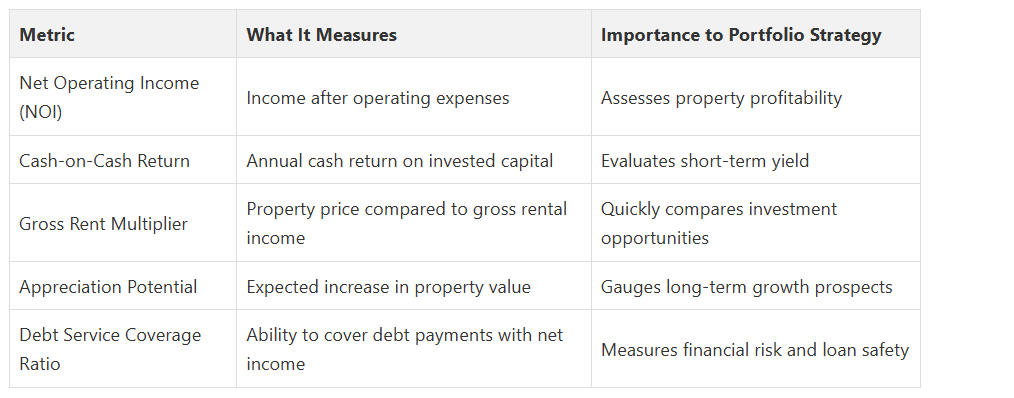

The table below summarizes key financial metrics real estate investors use to evaluate the potential and performance of investment properties, helping to streamline decision-making as described in the article.

Financial Performance Indicators

Critical financial metrics for real estate portfolio evaluation include:

- Net Operating Income (NOI)

- Cash-on-Cash Return

- Gross Rent Multiplier

- Appreciation Potential

- Debt Service Coverage Ratio

Risk Assessment and Performance Analysis

Comprehensive investment evaluation goes beyond simple number crunching. Successful investors combine quantitative analysis with a deep understanding of market dynamics, local economic conditions, and long-term growth potential. By developing a holistic approach to investment assessment, investors can create more robust and resilient real estate portfolios that generate consistent returns over time.

Real-World Applications of Portfolio Strategies in Ontario

Regional Market Dynamics

Explore investment property benefits in Ontario to understand the unique advantages of different regional markets.

Key considerations for Ontario real estate portfolio strategies include:

- Toronto’s competitive downtown condominium market

- Growing suburban markets in the Durham and Peel regions

- Emerging tech corridors in Waterloo and Ottawa

- University town investment opportunities

- Proximity to major transportation infrastructure

Strategic Investment Approaches

By understanding the intricate dynamics of Ontario’s real estate markets, investors can develop targeted portfolio strategies that balance risk, maximize potential returns, and create long-term wealth through strategic property investments.

Take Control of Your Real Estate Portfolio in the GTA

Strengthen your investment strategy with Fanis Makrigiannis at your side. Whether you need tailored advice on diversification, a neighbourhood insight to uncover growth potential, or want to see featured homes that fit your goals, https://fanis.ca connects you directly to actionable resources and listings. Book a personal consultation today and discover how our proven guidance can help you maximize returns and secure your real estate future. Your next smart investment decision starts now—visit https://fanis.ca and explore how expert portfolio strategies can work for you.

Frequently Asked Questions

How do market trends influence real estate portfolio strategies?

What key metrics should I consider when evaluating real estate investments?

How can diversification help mitigate risks in a real estate portfolio?

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended

Building Passive Income with Real Estate - Fanis Makrigiannis Realtor®

Understanding Real Estate Exit Strategies for Success - Fanis Makrigiannis Realtor®

Understanding Real Estate Risks for Toronto Buyers in 2025 - Fanis Makrigiannis Realtor®