How to Get a Mortgage: Step-by-Step Guide for Homebuyers

Buying a home in the Toronto and Durham region can feel overwhelming with all the financial steps that stack up fast. Some buyers are surprised when lenders expect a debt-to-income ratio below 43 percent and a credit score above 680 just to boost approval odds. However, most people do not realize that organizing your documents and understanding the fine details early on can mean the difference between securing your dream house and missing out.

Table of Contents

- Step 1: Assess Your Financial Situation

- Step 2: Research Mortgage Options

- Step 3: Obtain Pre-Approval From Lender

- Step 4: Gather Required Documentation

- Step 5: Submit Your Mortgage Application

- Step 6: Confirm Approval And Finalize Terms

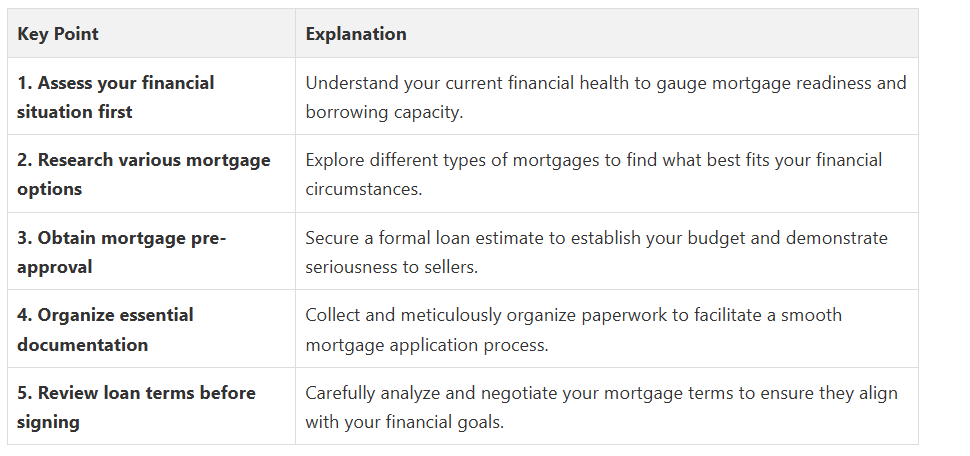

Quick Summary

Step 1: Assess Your Financial Situation

Begin by gathering all relevant financial documents, including recent pay stubs, tax returns from the past two years, bank statements, and records of existing debts. These documents will provide a holistic view of your financial landscape. Pay particular attention to your credit score, as this numerical representation significantly influences your mortgage approval chances and potential interest rates. In the Durham region, including cities like Oshawa, Ajax, Whitby, and Pickering, lenders will scrutinize this metric carefully.

Key Financial Indicators to Evaluate:

- Monthly income from all sources

- Current outstanding debts

- Credit score and credit history

- Existing savings and investment portfolio

- Monthly expenses and potential mortgage payment affordability

Consider consulting with a Real Estate Agent near me in Oshawa, like Fanis Makrigiannis Realty, who can provide personalized guidance through this financial assessment process. Professional insights can help you understand nuanced financial requirements and prepare a robust mortgage application strategy tailored to your specific circumstances in the Toronto and Durham region market.

As you complete this initial assessment, you should have a clear understanding of your financial strengths, potential challenges, and mortgage readiness. This groundwork sets the stage for the subsequent steps in your homebuying journey, ensuring you approach mortgage applications with confidence and preparedness.

Step 2: Research Mortgage Options

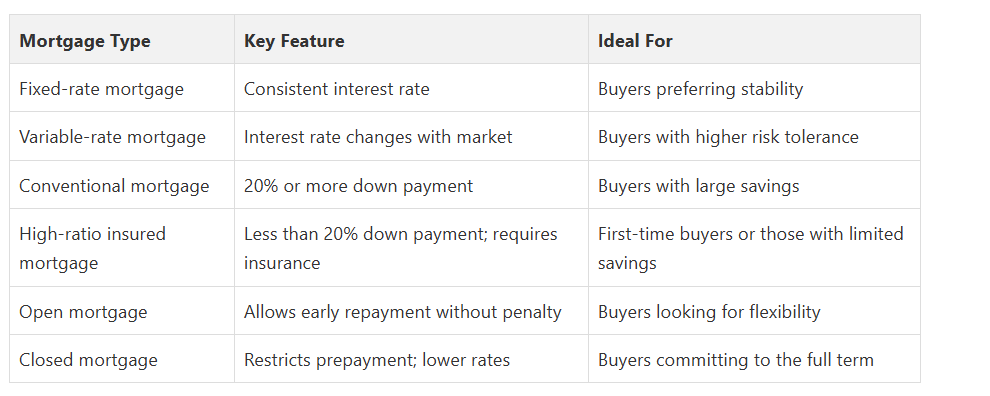

Start by familiarizing yourself with the primary mortgage categories available in Canada. Fixed-rate mortgages offer stability with consistent interest rates throughout the loan term, while variable-rate mortgages fluctuate based on market conditions. Each option carries distinct advantages depending on your financial risk tolerance and long-term housing goals. Learn more about understanding mortgage options for Canadians to make an informed decision.

Mortgage Types to Consider:

- Conventional mortgages

- High-ratio insured mortgages

- Fixed-rate mortgages

- Variable-rate mortgages

- Open and closed mortgages

According to Canada Mortgage and Housing Corporation guidelines, first-time homebuyers should particularly focus on understanding mortgage insurance requirements. Mortgages with less than a 20% down payment require mortgage default insurance, which protects lenders and influences your overall borrowing costs.

As you navigate this research phase, document your findings meticulously. Create a comparison spreadsheet tracking interest rates, term lengths, and lender-specific conditions. This systematic approach will help you make an educated decision tailored to your financial circumstances in the Durham region’s dynamic real estate market.

Below is a comparison table of common mortgage types highlighted in the article to assist you in identifying the best fit for your financial objectives.

Step 3: Obtain Pre-Approval from Lender

What Pre-Approval Means: A mortgage pre-approval is an official document from a lender indicating the maximum loan amount you qualify for based on your financial profile. Explore the detailed guide to mortgage pre-approval in Toronto and Durham to understand the nuances of this process. The pre-approval typically remains valid for 90 to 120 days, offering you a strategic window to explore properties within your confirmed budget.

Documentation Required for Pre-Approval:

- Government-issued photo identification

- Proof of income (recent pay stubs, T4 slips)

- Tax returns from the previous two years

- Bank statements

- Details of existing debts and assets

- Employment verification

Be prepared for a thorough financial examination. Lenders will analyze your employment history, income consistency, and overall financial health.

They may request additional documentation or clarification on specific financial aspects. Transparency is key – provide accurate, complete information to expedite the pre-approval process.

Once pre-approved, you’ll receive a conditional commitment letter specifying your maximum borrowing amount, potential interest rates, and loan terms.

This document becomes a powerful tool in your home search, demonstrating to real estate agents and sellers that you are a credible, serious buyer ready to make a competitive offer in the dynamic Durham region housing market.

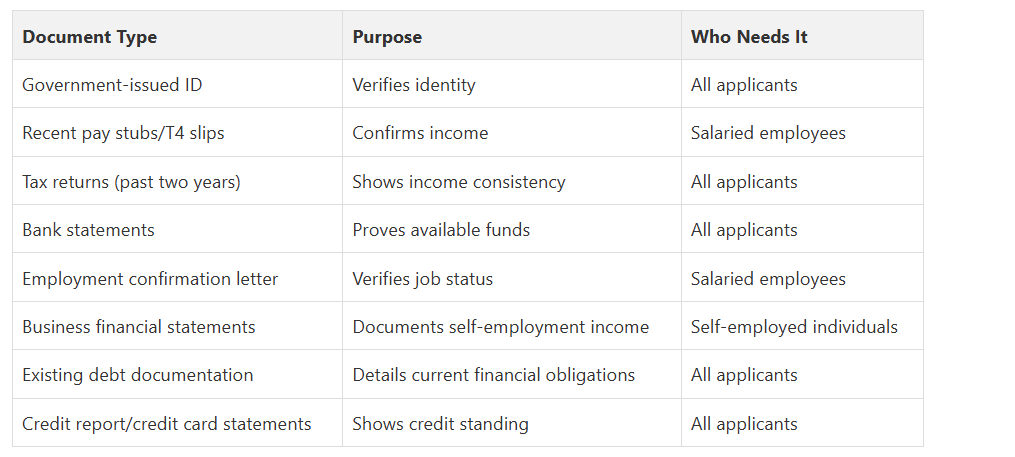

Step 4: Gather Required Documentation

Essential Documentation Checklist:

- Government-issued photo identification

- Comprehensive income verification documents

- Detailed tax returns from the past two years

- Current bank statements

- Employment confirmation letters

- Proof of additional income sources

- Existing debt documentation

For individuals in Oshawa, Ajax, Whitby, and Pickering, specific documentation requirements might vary slightly based on employment status. Self-employed applicants will need additional documentation, including business financial statements, contracts, and potentially two years of professional tax returns. Salaried employees should prepare recent pay stubs, T4 slips, and employment verification letters that confirm job stability and income consistency.

According to Canada Revenue Agency guidelines, maintaining accurate financial records is crucial. Include comprehensive documentation of all income streams, including investment returns, rental income, or supplementary earnings. Lenders will scrutinize these documents to assess your overall financial health and repayment capacity.

Pay special attention to your credit-related documentation. Collect recent credit card statements, loan agreements, and a current credit report. Verify that all information is current, accurate, and reflects your most recent financial status. Any discrepancies or outdated information could potentially delay your mortgage application process in the competitive Durham region housing market.

By methodically gathering and organizing these documents, you demonstrate financial preparedness and professionalism to potential lenders. Your comprehensive documentation package will streamline the mortgage application process, positioning you as a credible and serious homebuyer.

The following table provides a checklist of all the essential documents you should organize to complete your mortgage application efficiently.

Step 5: Submit Your Mortgage Application

Application Submission Essentials:

- Complete all sections of the mortgage application form

- Double-check every detail for accuracy

- Ensure all supporting documentation is attached

- Maintain copies of submitted materials

- Confirm receipt of application with lender

Understand the critical mortgage terms before finalizing your submission. Select your preferred lender carefully, comparing not just interest rates but also their reputation for customer service and processing efficiency. In areas like Oshawa, Ajax, Whitby, and Pickering, local lenders might offer more personalized service and understanding of the regional real estate dynamics.

Prepare for a comprehensive review process. Lenders will conduct a detailed examination of your submitted application, verifying every financial detail. Honesty is paramount – any discrepancies could potentially derail your mortgage approval. Be prepared to provide additional documentation or clarifications promptly if requested.

According to Canada Mortgage and Housing Corporation guidelines, the application review typically takes between 30 to 45 days. During this period, avoid making significant financial changes that could impact your application. This means maintaining your current employment, avoiding large purchases on credit, and keeping your financial situation stable.

After submission, maintain open communication with your lender. Request a timeline for review and follow up regularly to track your application’s progress. Some lenders offer online portals where you can monitor your application status in real-time, providing transparency and peace of mind throughout the process.

Successful application submission represents more than paperwork – it’s a strategic step toward your homeownership goals in the dynamic Durham region real estate market.

By approaching this phase with meticulous preparation and professional diligence, you significantly enhance your chances of mortgage approval.

Step 6: Confirm Approval and Finalize Terms

Key Elements to Review:

- Interest rate structure

- Mortgage term length

- Payment frequency options

- Prepayment privileges

- Potential penalties and fees

- Mortgage insurance requirements

Schedule a comprehensive review meeting with your lender to discuss every aspect of the mortgage offer. Negotiation is key – don’t hesitate to seek clarification or potentially more favourable terms. Some lenders might offer flexibility in areas such as prepayment options or interest rate adjustments, especially for clients with strong financial profiles.

According to Canada Mortgage and Housing Corporation guidelines, understanding the implications of different mortgage structures is crucial. Fixed-rate mortgages provide stability, while variable-rate options might offer initial cost savings. Consider your long-term financial goals and risk tolerance when making this critical decision.

Pay special attention to the mortgage commitment letter, which outlines the formal terms of your loan. This document specifies the approved loan amount, interest rate, term length, and any specific conditions attached to the approval.

Verify that all details align precisely with your expectations and financial planning.

Before final signing, consider consulting with a financial advisor or Real Estate Agent near me in Oshawa, like Fanis Makrigiannis Realty. Professional guidance can help you navigate the complexities of mortgage terms, ensuring you make an informed decision that supports your homeownership objectives in the dynamic Durham region housing market.

Ready to Turn Your Mortgage Knowledge Into Homeownership Success?

Let Fanis Makrigiannis Realty be your dedicated ally in the real estate journey. Get personalized coaching on mortgage readiness, access to exclusive property listings, and professional support for every milestone outlined in the article. Visit https://fanis.ca now and schedule your consultation. Put your new knowledge to use today and move closer to owning the perfect home.

Frequently Asked Questions

What mortgage options should I research?

What do I need for mortgage pre-approval?

How can I organize my mortgage application documentation effectively?

What should I expect during the mortgage application review process?

How can I confirm my mortgage approval and finalize the terms?

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca