Investment Property Insurance: Complete Guide for Ontario

Nearly one in five Canadian rental properties experience claims related to tenant damage or loss of rental income each year. This risk underscores why ordinary home insurance often falls short for investors in places like Ontario. If you own a rental unit in Toronto, Ajax, Whitby, or Oshawa, specialized investment property insurance can mean the difference between financial security and costly setbacks. Understanding these protections arms landlords with the confidence to safeguard both their assets and income.

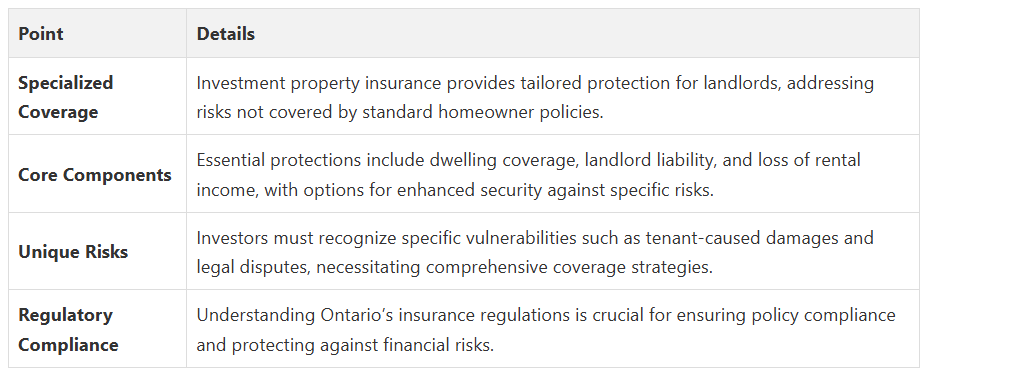

Key Takeaways

Table of Contents

- Defining Investment Property Insurance In Canada

- Types Of Coverage For Investment Properties

- How Investment Property Insurance Works

- Legal Requirements And Ontario Regulations

- Risks, Costs, And Common Mistakes

Defining Investment Property Insurance in Canada

According to SIG Insurance, rental property insurance is engineered to address unique risks faced by landlords, including:

- Tenant-caused property damage

- Comprehensive liability protection

- Loss of rental income coverage

- Legal expense protection for tenant disputes

A strategic investment property guide from Fanis Makrigiannis Realty can help investors understand these nuanced insurance requirements.

Standard rental property insurance typically includes:

Property investors in the Durham Region should recognize that each rental unit presents unique risk profiles. Working with a Real Estate Agent nearby in Oshawa who understands these nuanced insurance requirements can help develop a tailored protection strategy that safeguards your investment while maximizing potential returns.

Investment property insurance operates distinctly from standard homeowner policies, with specialized coverage designed to protect income-generating real estate assets. According to Acera Insurance, property investors must secure a standalone insurance policy that addresses the unique risks associated with rental properties.

The insurance process for investment properties involves comprehensive risk assessment and customized coverage strategies:

Insurance brokers carefully evaluate several crucial factors when structuring investment property coverage:

Learn more about building passive income strategies that complement robust insurance protection. Property investors in Toronto, Ajax, Whitby, Pickering, and Oshawa must understand that a Real Estate Agent near me in Oshawa can be instrumental in navigating these complex insurance landscapes. Each investment property represents a unique financial ecosystem requiring precise, strategic insurance solutions that safeguard your economic interests and potential rental revenue streams.

Navigating the legal landscape of investment property insurance in Ontario requires a deep understanding of provincial regulations that govern insurance and real estate activities.

According to Ontario’s official regulations, two primary legislative instruments shape investment

These regulations create a structured environment that protects both insurers and property investors in the Real Estate Agent near me in Oshawa market. Understanding these legal requirements ensures that investment property insurance policies are compliant, transparent, and designed to mitigate potential financial risks for property owners across Toronto, Ajax, Whitby, Pickering, and Oshawa.

Investment property insurance presents a complex landscape of potential risks and costly pitfalls for real estate investors across Ontario. According to SIG Insurance, one of the most critical errors property owners make is assuming standard homeowners insurance provides adequate protection for rental properties.

Critical risks that investors frequently overlook include:

Without proper insurance, property investors expose themselves to significant financial risks:

Real estate due diligence in Ontario becomes paramount in mitigating these risks. Property investors in Toronto, Ajax, Whitby, Pickering, and Oshawa must recognize that a Real Estate Agent near me in Oshawa can provide critical guidance in navigating these complex insurance requirements. Understanding and addressing these potential vulnerabilities is essential for protecting your investment and maintaining a profitable rental property portfolio.

Worried about protecting your rental property from unexpected risks or costly mistakes? Many Ontario investors face the challenge of finding tailored insurance solutions for their income properties. Standard coverage often leaves you exposed to tenant damage, loss of rental income, and legal complications. As highlighted in our complete guide, a specialized approach is crucial for real estate investors who need more than basic protection.

Investment property insurance is a specialized coverage designed to protect real estate investors from risks associated with rental properties, offering more comprehensive protection than standard homeowner insurance.

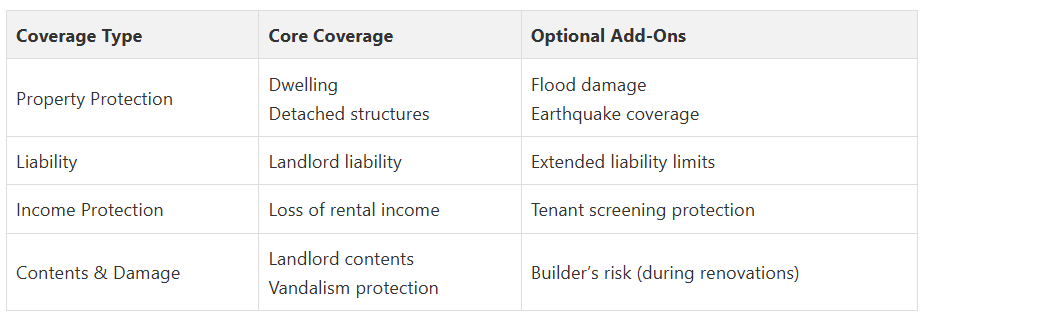

Standard rental property insurance typically includes dwelling coverage, liability insurance, loss of rental income coverage, and protection against tenant-caused damages, as well as optional add-ons such as flood damage and earthquake coverage.

Investment property insurance specifically addresses the unique risks associated with rental properties, whereas standard homeowner insurance focuses on owner-occupied homes and may not provide adequate protection against tenant-related risks.

Common mistakes include relying on standard homeowners insurance for rental properties, failing to secure comprehensive landlord-specific coverage, neglecting optional add-ons, and underestimating potential legal liabilities related to tenants.

Investment Property Benefits in Ontario - Fanis Makrigiannis Realtor®

Rental Property Basics in Ontario - Fanis Makrigiannis Realtor®

Top Investment Property Tax Tips for Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Investment Property Checklist: 10 Essential Tips - Fanis Makrigiannis Realtor®

For property investors in Toronto, Ajax, Whitby, Pickering, and Oshawa, securing the right Real Estate Agent near me in Oshawa who understands these insurance intricacies becomes crucial. Professional guidance ensures you’re not just protecting your physical asset, but also safeguarding your potential rental income stream against unexpected disruptions.

Types of Coverage for Investment Properties

When investing in real estate across Ontario’s dynamic markets like Toronto, Ajax, and Oshawa, understanding investment property insurance coverage becomes critical. According to SIG Insurance, standard rental property insurance encompasses several essential protections designed specifically for landlords.

Core Coverage Components

- Dwelling coverage protecting the primary structure

- Coverage for detached structures like garages or sheds

- Landlord liability insurance for legal protection

- Loss of rental income coverage

- Contents coverage for landlord-owned belongings

- Vandalism and intentional damage protection

Optional Enhanced Protections

For comprehensive risk management, savvy investors exploring real estate portfolio strategies often consider additional coverage options. These optional add-ons can provide extra security against potential financial disruptions:

- Flood damage protection

- Earthquake coverage

- Extended liability limits

- Specialized tenant screening protection

How Investment Property Insurance Works

Key Operational Mechanics

- Standalone policy requirement for revenue-generating properties

- Detailed risk evaluation by insurance brokers

- Tailored coverage reflecting specific property characteristics

- Flexible protection addressing multiple potential scenarios

Critical Coverage Considerations

- Potential vacancy periods during renovations

- Specific renovation-related risks

- Need for builder’s risk insurance during property modifications

- Potential coverage limitations during property transformation stages

Learn more about building passive income strategies that complement robust insurance protection. Property investors in Toronto, Ajax, Whitby, Pickering, and Oshawa must understand that a Real Estate Agent near me in Oshawa can be instrumental in navigating these complex insurance landscapes. Each investment property represents a unique financial ecosystem requiring precise, strategic insurance solutions that safeguard your economic interests and potential rental revenue streams.

Legal Requirements and Ontario Regulations

Current real estate regulations in Toronto and the Durham Region provide critical context for property investors seeking comprehensive protection.

Key Regulatory Frameworks

property insurance and related activities:

Ontario Regulation 122/08 (Property and Casualty Insurers)

- Governs investment and lending activities for property insurers

- Restricts insurers’ real property investments

- Establishes mortgage loan limits (maximum 80% of property value)

- Requires senior executive approval for specific investment activities

Ontario Regulation 121/08 (Life Insurers)

- Details permissible business activities for life insurance providers

- Allows holding and managing real property

- Outlines investment limit conditions

- Caps specialized financing activities

Practical Implications for Investors

Risks, Costs, and Common Mistakes

Common Insurance Mistakes

- Relying on standard homeowner policies for rental properties

- Failing to secure comprehensive landlord-specific coverage

- Neglecting optional but crucial protective add-ons

- Underestimating potential tenant-related legal exposures

Financial Vulnerabilities

- Unprotected property damage

- Potential legal liability for tenant incidents

- Loss of rental income during property repairs

- Expensive out-of-pocket restoration costs

Real estate due diligence in Ontario becomes paramount in mitigating these risks. Property investors in Toronto, Ajax, Whitby, Pickering, and Oshawa must recognize that a Real Estate Agent near me in Oshawa can provide critical guidance in navigating these complex insurance requirements. Understanding and addressing these potential vulnerabilities is essential for protecting your investment and maintaining a profitable rental property portfolio.

Protect Your Investment in Ontario’s Real Estate Market with Proven Expertise

Explore featured homes and market insights for the Toronto and Durham Region and see how expert guidance empowers you to make informed, confident decisions.

Take the next step to secure your financial future. Connect with Fanis Makrigiannis, your dedicated Realtor®, who understands both investment property regulations and practical insurance needs. Schedule a personal consultation today and discover how our platform helps you buy, sell, and invest with confidence—even as markets and regulations evolve.

Frequently Asked Questions

What is investment property insurance?

What types of coverage are included in rental property insurance?

How does investment property insurance differ from standard homeowner insurance?

What are common mistakes investors make regarding investment property insurance?

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty Ltd.

(c): 905.449.4166

(e): info@fanis.ca

Recommended

Rental Property Basics in Ontario - Fanis Makrigiannis Realtor®

Top Investment Property Tax Tips for Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

Investment Property Checklist: 10 Essential Tips - Fanis Makrigiannis Realtor®