Understanding Real Estate Fees: Key Concepts Explained

Real estate fees can take a big bite out of your budget, whether you are buying or selling in Toronto or the Durham Region. You might expect steep agent commissions to be the main expense, but that’s just one part of the picture. Here is something most people miss: commission rates often range between 4% and 6% (with no standard limit) of the property value. Split between agents and legal or administrative charges, they quickly add up. Understanding exactly how these fees work can completely change how you plan your next move.

Table of Contents

- What Are Real Estate Fees And Charges?

- Understanding Core Real Estate Transaction Costs

- Breakdown Of Commission Structures

- Why Real Estate Fees Matter To Buyers And Sellers

- Financial Impact And Strategic Planning

- Economic Implications Of Real Estate Fees

- How Real Estate Fees Are Structured And Calculated

- Commission Percentage Fundamentals

- Factors Influencing Fee Calculations

- Understanding Common Types Of Real Estate Fees

- Professional Service Fees

- Administrative And Mandatory Fees

- Real-World Examples Of Real Estate Fees In Ontario

- Residential Property Transaction Scenarios

- Regulatory Representation Fee Considerations

Quick Summary

What Are Real Estate fees?

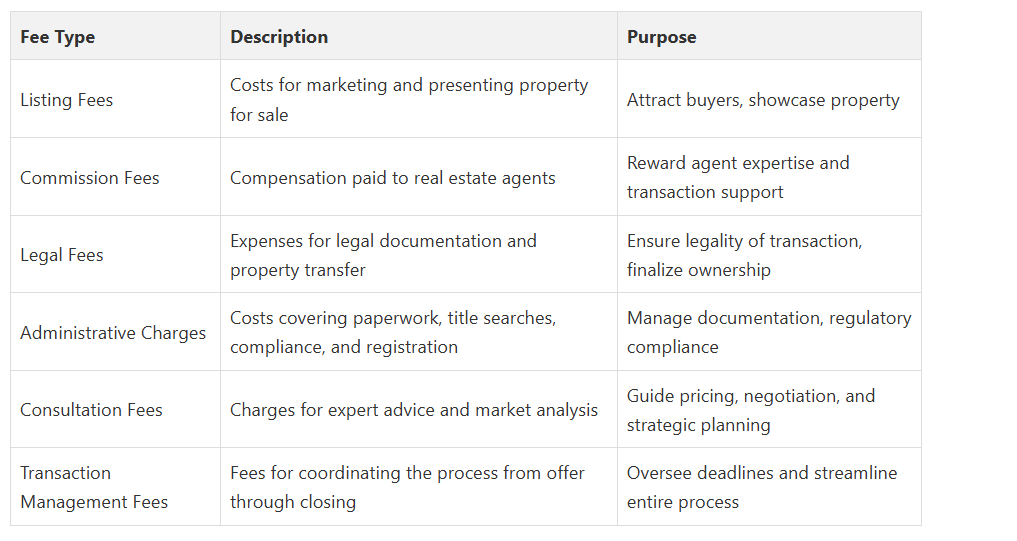

To help clarify the main types of real estate fees and their roles, the table below summarizes each fee category and its core purpose in a typical property transaction in Ontario.

Understanding Core Real Estate Transaction Costs

The primary categories of real estate fees typically include:

- Listing Fees: Costs associated with marketing and presenting a property for sale

- Commission Fees: Compensation paid to real estate agents for their professional services

- Legal Fees: Expenses related to legal documentation and property transfer processes

- Administrative Charges: Miscellaneous costs for processing transaction paperwork

Breakdown of Commission Structures

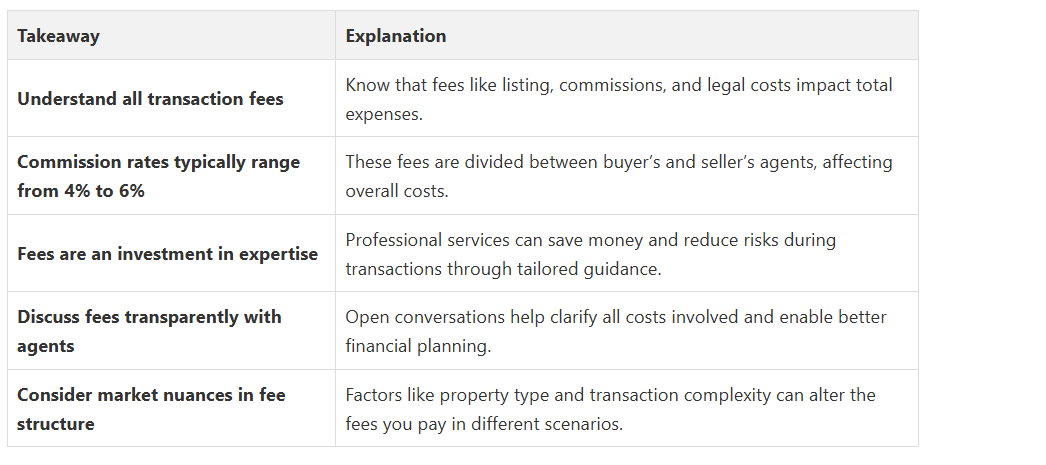

In the Toronto and Durham Region markets, these fees are usually calculated as a percentage of the property’s final sale price. According to the Canadian Real Estate Association, commission rates can vary but generally range between 4% to 6% of the total property value, split between the buyer’s and seller’s agents.

For a Real Estate Agent in Oshawa like Fanis Makrigiannis, these commissions represent compensation for professional services including market analysis, property valuation, negotiation, marketing, and guiding clients through complex transaction processes..

The fee structure ensures that real estate professionals are fairly compensated for their expertise and the significant time investment required to successfully close property transactions.

Homebuyers and sellers in Toronto, Oshawa, Ajax, Whitby, Pickering, and surrounding areas should always discuss fee structures transparently with their chosen real estate professional to understand the complete financial implications of their property transaction.

Why Real Estate Fees Matter to Buyers and Sellers

Financial Impact and Strategic Planning

Key strategic considerations include:

- Cost Transparency: Knowing exact fees helps prevent unexpected financial surprises

- Budget Allocation: Accurate fee understanding allows for precise financial preparation

- Investment Calculation: Fees directly impact potential return on property investments

Economic Implications of Real Estate Fees

Buyers benefit from professional guidance through complex market landscapes, while sellers receive comprehensive marketing strategies and negotiation expertise. The fees essentially fund a professional service that mitigates risks, maximizes property value, and streamlines potentially complicated real estate transactions.

In the competitive markets of Toronto and Durham Region, understanding these fees becomes a critical component of successful real estate strategy. Potential buyers and sellers must view these charges not as expenses, but as investments in professional expertise that can potentially save significant money and reduce transactional risks.

How Real Estate Fees Are Structured and Calculated

Commission Percentage Fundamentals

Key components of commission calculations include:

- Base Percentage: Typically ranges between 4% to 6% of the property sale price

- Split Allocation: Divided between buyers’ and sellers’ representing agents

- Negotiable Rates: Flexible depending on specific property and market conditions

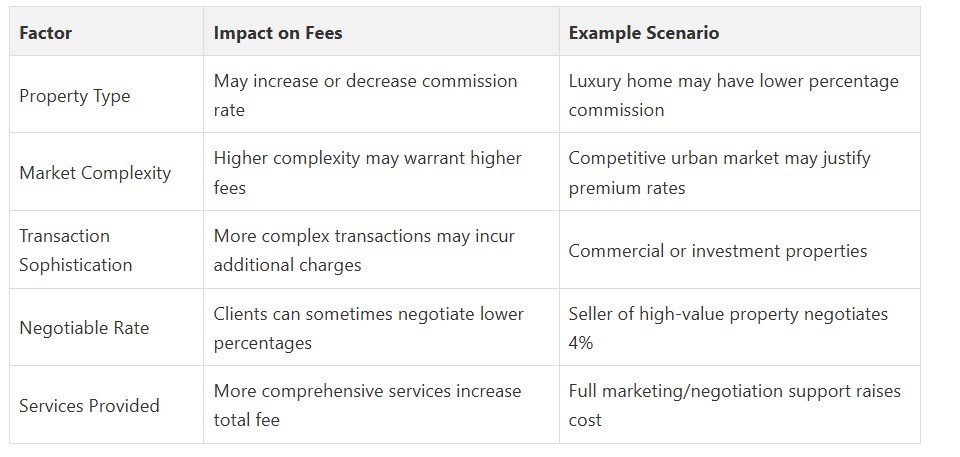

Factors Influencing Fee Calculations

In markets like Oshawa, Ajax, Whitby, Pickering, and broader Toronto areas, agents might adjust their fee structures based on unique property characteristics. Luxury properties, commercial real estate, or challenging market conditions could potentially warrant different commission approaches.

The table below presents a comparison of different fee calculation factors and how they affect the commission structure in real estate transactions across Toronto and the Durham Region.

For clients in the Durham Region, understanding these calculation methods allows for more transparent and strategic property transactions. The fees not only compensate real estate professionals but also cover extensive services, including market analysis, property marketing, negotiation support, and comprehensive transaction management.

Understanding Common Types of Real Estate Fees

Professional Service Fees

Key professional service fees include:

- Listing Fees: Costs for marketing and presenting the property to potential buyers

- Consultation Fees: Charges for professional advice and market analysis

- Transaction Management Fees: Compensation for coordinating complex property transfer processes

Administrative and Mandatory Fees

For Real Estate Agents in Oshawa, like Fanis Makrigiannis, these administrative fees cover critical backend processes that protect both buyers and sellers. The fees support activities such as title searches, document preparation, regulatory compliance checks, and formal property registration.

Clients in Ajax, Whitby, Pickering, and broader Toronto markets should anticipate these administrative expenses as integral components of a transparent and professionally managed real estate transaction.

Understanding these fees helps set realistic expectations and demonstrates the comprehensive nature of professional real estate services.

Real-World Examples of Real Estate Fees in Ontario

These practical examples illustrate how different scenarios impact overall transaction costs for buyers and sellers working with professionals like Fanis Makrigiannis Realty.

Residential Property Transaction Scenarios

Typical fee scenarios might include:

- Modest Home Sale: $400,000 property with standard 5% commission

- Luxury Property Transaction: $1,500,000 home with negotiated commission rates

- Investment Property Transfer: Commercial real estate with specialized fee structures

Regulatory Representation Fee Considerations

For Real Estate Agents in the Durham Region, these regulatory updates mean more detailed disclosure of fee structures and potential conflicts of interest. Clients can now expect more comprehensive explanations of how commissions are calculated and distributed, ensuring a more transparent transaction process.

Understanding these real-world examples helps potential buyers and sellers in Toronto and surrounding areas navigate the complex financial landscape of real estate transactions with greater confidence and clarity.

Navigate Real Estate Fees With Clarity and Confidence

Why settle for guesswork when you can make confident decisions with the help of a proven real estate expert? Take the stress out of your next transaction. Visit Fanis.ca to explore featured properties, get neighbourhood insights, or request a personalized fee breakdown through our Contact page. Your next step could be the difference between a good result and a great one. Reach out now to secure your advantage in Toronto and the Durham Region property market.

Frequently Asked Questions

What are the main types of real estate fees?

How are commission fees calculated in real estate transactions?

Why is understanding real estate fees important for buyers and sellers?

What factors influence the structure of real estate fees?

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty Ltd.

(c): 905.449.4166

(e): info@fanis.ca