Tax Benefits Real Estate: Complete Guide for Toronto

More than 60 percent of Toronto households own their homes, and property owners here can access many powerful tax benefits that add real value. Saving on taxes is a top concern for both families and investors who want to grow their wealth. From tax credits like the Home Buyers’ Plan to smart deductions on rental properties, understanding these opportunities can help you keep more of your money and make property ownership even more rewarding.

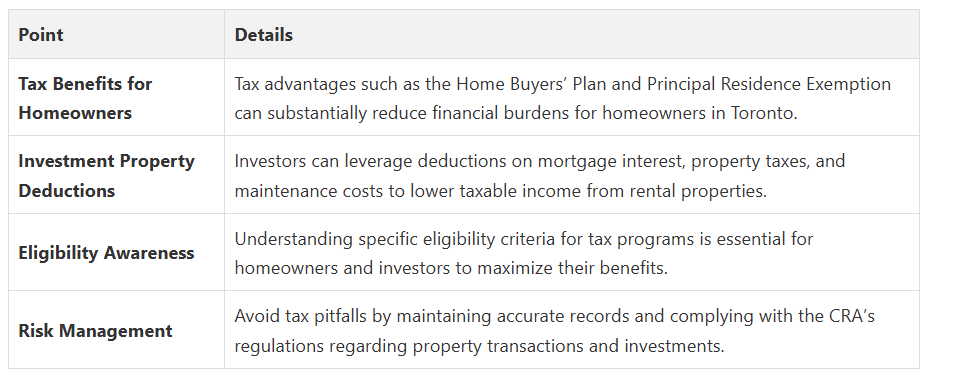

Key Takeaways

Table of Contents

- Tax Benefits Of Real Estate In Toronto

- Main Types Of Real Estate Tax Deductions

- Eligibility Rules For Homeowners And Investors

- Tax Credits And Rebates In Durham Region

- Risks And Common Mistakes To Avoid

Tax Benefits of Real Estate in Toronto

Key tax benefits for Toronto real estate owners include:

- Home Buyers’ Plan (HBP): Allows first-time homebuyers to withdraw up to $35,000 from registered retirement savings plans (RRSPs) tax-free for home purchases

- First Home Savings Account (FHSA): Enables individuals to save up to $8,000 annually, with lifetime contributions capped at $40,000, providing tax-free savings for home acquisitions

- Principal Residence Exemption: Permits homeowners to sell their primary residence without paying capital gains tax, offering substantial tax savings

Investors in Toronto real estate can also leverage additional tax strategies. Investment Property Benefits in Ontario provides deeper insights into maximizing potential tax deductions. Potential tax advantages for investment properties include deducting mortgage interest, property taxes, insurance costs, and maintenance expenses, which can significantly reduce taxable income.

Understanding these tax benefits requires careful planning and professional guidance. Consulting with a tax professional who specializes in real estate can help you navigate complex tax regulations and optimize your financial strategy in the Toronto market.

Main Types of Real Estate Tax Deductions

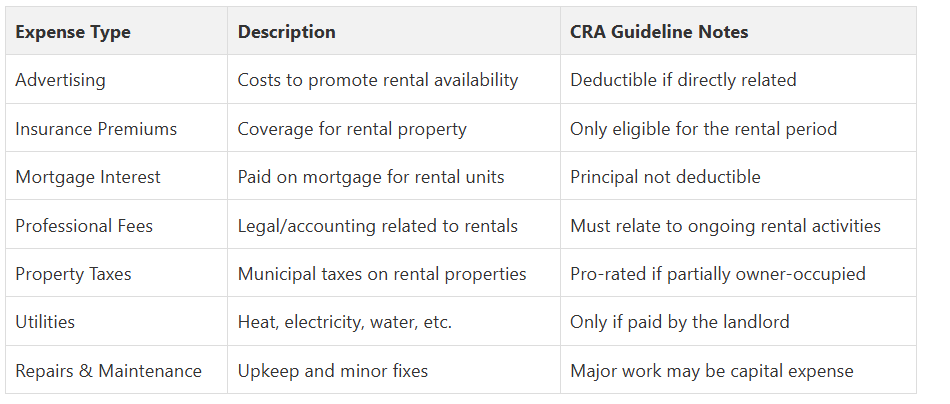

Current Expense Deductions for rental properties include:

Here’s a summary of common eligible rental property deductions:

- Advertising costs for property rentals

- Insurance premiums related to the property

- Mortgage interest expenses

- Professional fees for legal and accounting services

- Property taxes

- Utility expenses

- Repair and maintenance costs

Investors should also understand the distinction between current expenses and capital expenses, which are treated differently for tax purposes.

Capital expenses, such as major renovations or structural improvements, are typically depreciated over time rather than deducted immediately.

It’s crucial to maintain meticulous records and understand the specific CRA guidelines. Professional tax advice can help navigate complex regulations and ensure you’re maximizing available deductions while remaining compliant with Canadian tax laws.

Eligibility Rules for Homeowners and Investors

Key eligibility criteria for major tax programs include:

- Home Buyers’ Plan (HBP): First-time homebuyers can withdraw up to $35,000 from RRSPs, with specific residency and first-time buyer requirements

- First Home Savings Account (FHSA): Open to Canadian residents 18 and older who have never owned a home

- Principal Residence Exemption: Applies to one property per family unit, with strict occupancy and designation requirements

- Home Buyer’s Amount: Available for first-time buyers or individuals with disabilities purchasing qualifying homes

Top Homebuyer Incentives for Toronto and Durham Region 2025 provides additional insights into navigating these complex regulations. Investors should pay special attention to the property flipping rules, which now impose tax consequences for properties held for short periods, and the underused housing tax targeting vacant properties.

Careful documentation and timing are essential. The CRA requires precise reporting of property transactions, occupancy periods, and specific designations on tax returns. Consulting with a tax professional who understands Toronto’s unique real estate landscape can help maximize your eligible tax benefits while ensuring full compliance with current regulations.

Tax Credits and Rebates in Durham Region

Key tax credits and rebates available include:

- Ontario Energy and Property Tax Credit (OEPTC): Provides up to CA$998 for property tax and CA$285 for energy costs for low to moderate-income residents

- Ontario Senior Homeowners’ Property Tax Grant: Offers yearly payments for eligible seniors paying property tax on their principal residence

- Home Accessibility Tax Credit: Supports modifications for seniors and individuals with disabilities

- GST/HST New Housing Rebate: Helps offset sales tax for new home purchases

To maximize these benefits, residents must accurately report their income and property details when filing tax returns. Consulting with a local tax professional who understands Durham Region’s specific regulations can help homeowners identify and claim all available credits, potentially saving hundreds of dollars annually.

Risks and Common Mistakes to Avoid

Common tax-related risks include:

- Property Flipping Trap: Selling residential properties within one year may trigger business income taxation instead of capital gains treatment

- Short-Term Rental Compliance: Operating rental properties without required permits can disqualify expense deductions

- Incorrect Tax Shelter Reporting: Misclassifying real estate investments can lead to lost deductions and potential penalties

- Underused Housing Tax: Failing to report vacant properties can result in significant financial consequences

Top Investment Property Tax Tips for Toronto & Durham 2025 provides additional guidance on avoiding these common pitfalls. The CRA requires precise documentation, including specific forms like T5003, T776, and T5013 for proper investment classification and reporting.

To mitigate these risks, investors should maintain meticulous records, consult with tax professionals who specialize in real estate, and stay current with changing regulations. Understanding the nuanced rules around property investments can save you thousands in potential penalties and ensure you’re maximizing your tax benefits while remaining fully compliant with CRA guidelines.

Unlock Toronto’s Real Estate Tax Advantages With Expert Support

Discover how our personalized support at https://fanis.ca makes all the difference. Whether you’re exploring tax-efficient buying strategies or seeking guidance on investment property benefits in Ontario, our tailored approach connects you with both market opportunities and the latest tax-saving tips. Do not let another year pass without maximizing your financial edge. Reach out now through our contact interface for a confidential consultation and take your next step towards smarter, safer real estate investments in Toronto or the Durham Region.

Frequently Asked Questions

What are the tax benefits available for first-time homebuyers in Toronto?

How can real estate investors reduce their taxable income in Toronto?

What is the Principal Residence Exemption, and how does it work?

What common mistakes should real estate investors avoid to ensure tax compliance?

Recommended

Understanding Property Taxes in Ontario: A Guide for Buyers & Sellers - Fanis Makrigiannis Realtor®

Investment Property Benefits in Ontario - Fanis Makrigiannis Realtor®

Building Passive Income with Real Estate - Fanis Makrigiannis Realtor®

Understanding Taxes on Rental Property: Expert Insights