Complete Guide to Selling a Home in Durham Region

Did you know that nearly one in five Canadian homeowners underestimate the costs and legal complexities of selling a property? The process of selling a home can impact your finances, stress levels, and plans in ways you might not expect. From taxes to market trends and emotional decisions, every step matters when you want the best result for your biggest investment.

Table of Contents

- What Selling a Home Really Means

- Key Steps in Selling in Toronto and Durham

- Legal Process for Sellers in Ontario

- Pricing Strategies and Market Trends

- Costs and Taxes When Selling Property

- Avoiding Common Home Seller Mistakes

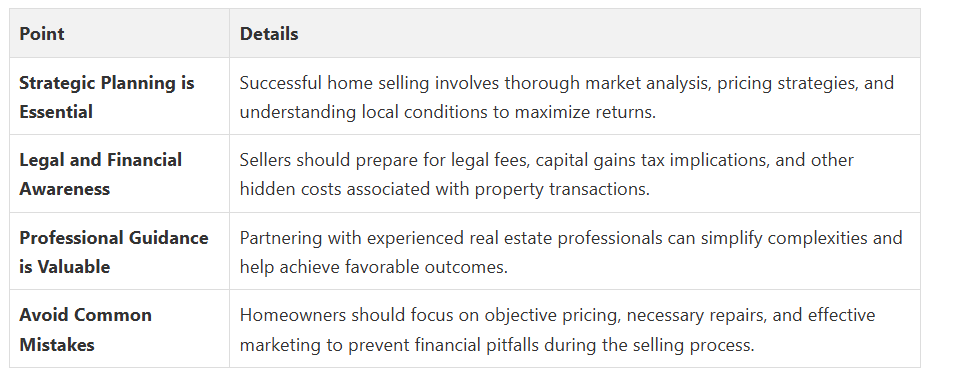

Key Takeaways

What Selling a Home Really Means

At its core, selling a home means preparing to transfer property ownership while maximizing your financial return. This involves several critical components: accurately pricing your home, understanding potential tax implications, and determining the most effective selling strategy. Research from the Financial Consumer Agency of Canada highlights that sellers have multiple options, including working with a professional realtor or managing the sale independently.

Key considerations in home selling include:

- Understanding potential capital gains tax implications

- Preparing your property for market presentation

- Selecting the right selling approach (realtor-assisted or private sale)

- Managing legal and financial documentation

- Negotiating effectively with potential buyers

Key Steps in Selling in Toronto and Durham

The first major step is property valuation.

This involves researching current market trends, comparing similar property listings in neighbourhoods like Ajax, Whitby, Pickering, and Oshawa, and potentially hiring a professional appraiser. Professional realtors can provide invaluable insights into pricing strategies that maximize your property’s market potential.

Key steps in the home-selling process include:

- Conducting a comprehensive home inspection

- Making necessary repairs and improvements

- Staging your home for maximum visual appeal

- Determining an accurate and competitive listing price

- Preparing comprehensive property marketing materials

- Scheduling and managing property showings

- Negotiating offers and terms effectively

Working with experienced professionals like Fanis Makrigiannis Realty can help streamline this complex process, ensuring you achieve the best possible outcome in the competitive Toronto and Durham real estate markets.

Legal Process for Sellers in Ontario

According to the Financial Consumer Agency of Canada, sellers must be prepared for various legal fees associated with property transactions. These typically include legal services for preparing statements of adjustment, mortgage discharge fees, and potential additional costs like realtor commissions and property transfer taxes. The Canada Revenue Agency also highlights critical tax considerations, particularly regarding the principal residence exemption.

Key legal steps in the selling process include:

- Obtaining a clear property title

- Preparing comprehensive property disclosure statements

- Resolving any existing liens or encumbrances

- Drafting a legally binding sale agreement

- Calculating and managing capital gains tax implications

- Transferring property ownership through official channels

- Ensuring all municipal and provincial regulations are met

Pricing Strategies and Market Trends

According to Reuters, recent market data reveals significant fluctuations in the Greater Toronto Area, with home sales dropping 18.7% in December and the average selling price decreasing 0.8% year-over-year to C$1,117,600.

The Financial Consumer Agency of Canada recommends three primary methods for establishing an accurate home valuation: comparing current listings, consulting a professional realtor, or hiring a professional appraiser to determine your property’s precise market value.

Key pricing and market trend considerations include:

- Analyzing recent comparable sales in your specific neighbourhood

- Understanding seasonal market variations

- Evaluating current interest rates and their impact on buyer purchasing power

- Considering local economic factors affecting real estate demand

- Identifying unique property features that might influence pricing

- Monitoring inventory levels in your local market

- Assessing current buyer sentiment and market competition

Costs and Taxes When Selling Property

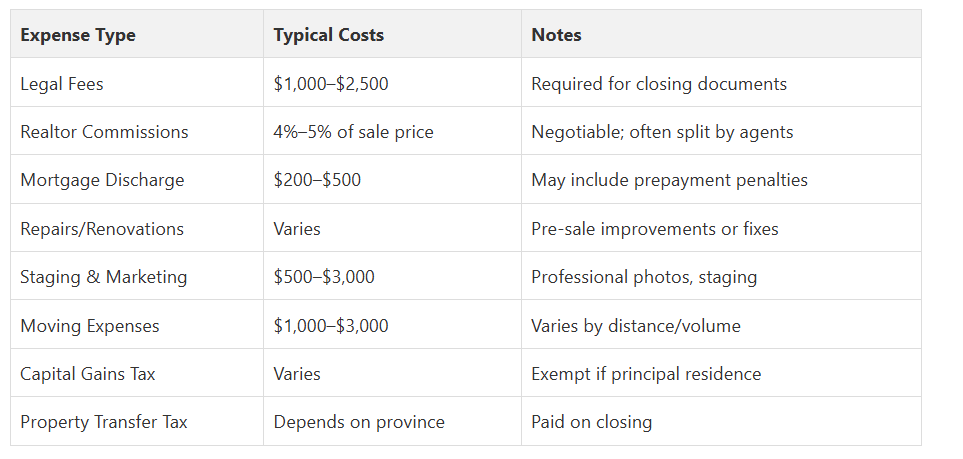

According to the Financial Consumer Agency of Canada, sellers should anticipate multiple standard costs associated with property transactions. These typically include legal fees, mortgage discharge fees, realtor commissions, and potential additional expenses such as repairs, inspections, appraisals, moving costs, staging fees, and cleaning services. The Canada Revenue Agency also emphasizes the importance of understanding capital gains tax implications, particularly regarding the principal residence exemption.

Key financial considerations when selling property include:

- Legal and administrative fees

- Potential mortgage prepayment penalties

- Home repair and renovation expenses

- Professional staging and marketing costs

- Property transfer taxes

- Capital gains tax calculations

- Moving and relocation expenses

- Home inspection and appraisal fees

- Potential real estate agent commissions

Here’s a comparison of common costs and tax considerations when selling a home in Durham Region:

Avoiding Common Home Seller Mistakes

Homeowners often underestimate the emotional and financial complexities of selling a property. Emotional attachment can lead to unrealistic pricing expectations, while inadequate preparation can result in lower sale prices or prolonged market exposure. Strategic sellers recognize the importance of objective assessment, professional guidance, and comprehensive market understanding.

Key mistakes to avoid when selling your home include:

- Overpricing your property based on emotional value

- Neglecting essential repairs and home improvements

- Failing to professionally stage and present your home

- Choosing the wrong selling strategy or realtor

- Overlooking potential tax and legal implications

- Inadequate market research and pricing analysis

- Ignoring potential buyer feedback

- Underestimating the complexity of negotiations

- Rushing the selling process without proper preparation

Navigate Your Home Selling Journey with Confidence

You do not have to face these hurdles alone. With expert guidance from Realtor® Fanis Makrigiannis and the comprehensive resources available at https://fanis.ca, you can simplify this complex process. From personalized home evaluations to tailored marketing strategies and market insights for neighbourhoods like Ajax, Whitby, and Oshawa, every step is designed to maximize your home’s potential and secure the best possible outcome.

Take the first step today and turn your home-selling experience into a success story.

Ready to start? Visit Fanis Makrigiannis Realty now to access detailed guides, property listings, and expert advice that take the guesswork out of selling. Discover how professional support and local expertise can transform your selling journey in Durham Region and beyond.

Frequently Asked Questions

What are the key steps involved in selling a home?

What potential costs should I expect when selling my home?

How can I determine the right price for my home?

What legal obligations do I have when selling a property?

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Recommended

Selling a House Fast in Toronto & Durham Guide in 2025 - Fanis Makrigiannis Realtor®

How to Sell Estate Property in Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

How to Plan a Home Sale in Toronto & Durham for 2025 - Fanis Makrigiannis Realtor®