How to Buy a Home in Oshawa: Simple Step-by-Step Guide

Over 60% of first-time buyers feel unprepared when starting their home search. Buying a house in Oshawa is one of the biggest financial decisions you will ever make, and the process can be confusing without the right guidance. Whether you are looking for key budgeting tips, neighbourhood advice, or negotiation tactics, this guide gives you clear, practical steps to move confidently through every stage of buying your new Oshawa home.

Table of Contents

- Step 1: Assess Your Readiness And Set A Budget

- Step 2: Research Oshawa Neighbourhoods And Listings

- Step 3: Connect With A Real Estate Agent In Oshawa

- Step 4: View Homes And Make Informed Choices

- Step 5: Negotiate And Secure Your Purchase With Fanis Makrigiannis Realty

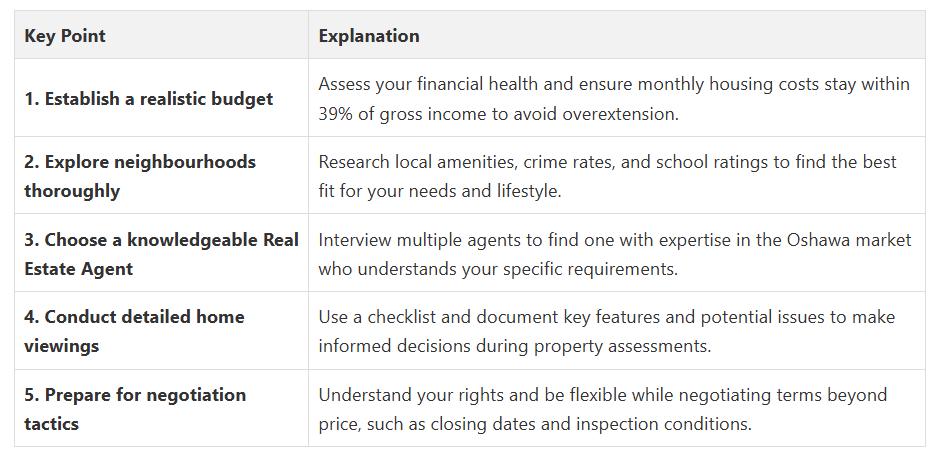

Quick Summary

Step 1: Assess your readiness and set a budget

According to the Financial Consumer Agency of Canada, your monthly housing costs should never exceed 39% of your gross income. This critical guideline helps ensure you do not become financially overextended. When setting your budget, calculate your total monthly income and subtract existing debts, living expenses, and potential mortgage payments. The National Bank of Canada suggests maintaining a budget that allocates at least 6.5% of your property’s value for down payment and initial costs.

Pro tip: Before diving into home hunting, get mortgage pre-approval.

This step gives you a clear picture of your borrowing capacity and demonstrates to sellers that you are a serious buyer. Start by gathering financial documents such as pay stubs, tax returns, and bank statements. Remember that your credit score plays a significant role in determining your mortgage rates and loan eligibility. Work on improving your credit by paying bills on time and reducing outstanding debts.

Your next step will be exploring mortgage options and understanding different lending requirements in the Oshawa real estate market.

Step 2: Research Oshawa neighbourhoods and listings

Start by mapping out Oshawa’s key neighbourhoods and understanding their unique characteristics.

Consider factors like proximity to schools, local amenities, transportation routes, and future development plans. Online real estate platforms, municipal websites, and local community forums can provide valuable insights.

Check crime statistics, school ratings, and walkability scores to get a comprehensive view of each area. Fanis Makrigiannis Realty offers a comprehensive guide to Oshawa real estate that can help you navigate these nuanced considerations.

Pro tip: Do not rely solely on online listings.

Spend time physically exploring neighbourhoods at different times of day. Drive through potential areas during morning and evening rush hours, visit local parks, and get a feel for the community atmosphere. Talk to residents if possible and consider working with a Real Estate Agent in Oshawa who knows the local market intimately. Your next step will involve scheduling property viewings and comparing potential homes against your established budget and lifestyle requirements.

Step 3: Connect with a Real Estate Agent in Oshawa

According to the Real Estate Council of Ontario, verifying an agent’s credentials is your first step. Look for licensed professionals with proven experience in the Oshawa market. The Toronto Regional Real Estate Board offers comprehensive member directories that can help you find qualified agents. When selecting an agent, schedule initial consultations to discuss your goals, ask about their local market knowledge, and evaluate their communication style. Using a Realtor® in Oshawa can provide additional insights into making this critical decision.

Pro tip: Do not just choose the first agent you meet.

Conduct interviews with multiple professionals, ask for references, and request information about their recent sales in Oshawa. Pay attention to their understanding of your specific neighbourhood interests and budget constraints. A great Real Estate Agent in Oshawa will not just show you properties but will be your strategic partner in finding your ideal home. Your next step will involve working closely with your chosen agent to start viewing properties and making informed decisions.

Step 4: View homes and make informed choices

Prepare a comprehensive checklist before each viewing that covers both aesthetic and functional aspects of potential properties. Look beyond surface appearances and evaluate critical elements like structural integrity, potential renovation needs, natural lighting, noise levels, and overall layout. Pay attention to the home’s condition, including plumbing, electrical systems, roof quality, and foundation. House Hunting Tips for Toronto & Durham Region 2025 can provide additional insights into making thorough property assessments.

Pro tip: Always attend home viewings prepared with a measuring tape, camera, and notebook.

Document everything methodically during each visit. Take photos of potential issues, measure room dimensions, and note any questions that arise during the viewing. Remember that a beautiful facade can sometimes mask underlying problems. Trust your instincts and do not hesitate to ask your Real Estate Agent in Oshawa detailed questions about the property. Your next step will involve comparing your top choices and determining which home best aligns with your budget and lifestyle requirements.

Step 5: Negotiate and secure your purchase with Fanis Makrigiannis Realty

According to the Real Estate Council of Ontario, understanding your negotiation rights and processes is fundamental to a successful home purchase. Your agent will help you craft a compelling offer that considers market conditions, property condition, and your specific budget constraints. This involves determining the right initial offer price, identifying potential contingencies, and preparing for potential counteroffers. As your Realtor®: Negotiating for You provides additional insights into effective negotiation strategies that can help you secure your dream home.

Pro tip: Be prepared for potential negotiations beyond price.

Consider factors like closing dates, home inspection conditions, and included appliances or fixtures. Remain flexible but know your absolute maximum budget and walk-away point. Your agent will be your strategic partner, providing professional guidance and ensuring you understand every aspect of the purchase agreement. Your next step will involve completing a home inspection, finalizing financing, and preparing for the exciting moment of closing on your new Oshawa home.

Take Control of Your Oshawa Home Buying Journey Today

Discover tailored neighbourhood insights and exclusive property listings designed to connect you with homes that truly match your goals. Visit Fanis Makrigiannis Realty to start exploring valuable resources and connect with a trusted Real Estate Agent in Oshawa who will champion your interests. Don’t wait until the market changes — take action now and move closer to owning your ideal Oshawa home with professional help. Begin your journey by visiting Fanis Makrigiannis Realty and turn your home-buying dreams into reality.

Frequently Asked Questions

How do I assess my readiness to buy a home in Oshawa?

What should I include in my home-buying budget for Oshawa?

How can I effectively research neighbourhoods in Oshawa?

What should I consider when viewing homes in Oshawa?

How do I negotiate when buying a home in Oshawa?

What is the role of a Real Estate Agent in the home-buying process in Oshawa?

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes