7 Essential Real Estate Tips for Buyers and Sellers in the GTA

Home sales in Toronto dropped by a striking 18.7% in December 2024, shaking the confidence of many Canadian buyers and sellers. Shifting interest rates and fluctuating prices make real estate decisions feel risky, especially in communities like Oshawa and Durham Region. Whether you are looking to buy your first property, sell a home, or stay informed, understanding these market changes and the latest financing options can create a true advantage in a competitive landscape.

Table of Contents

- 1. Understand Toronto and Durham Region Market Trends

- 2. Calculate Your Home Budget and Financing Options

- 3. Choose the Right Real Estate Agent in Oshawa

- 4. Get a Professional Home Evaluation from Fanis Makrigiannis Realty

- 5. Prepare Your Home for Sale with Smart Upgrades

- 6. Negotiate Offers and Understand Closing Costs

- 7. Plan Your Move and Post-Sale Steps in Toronto

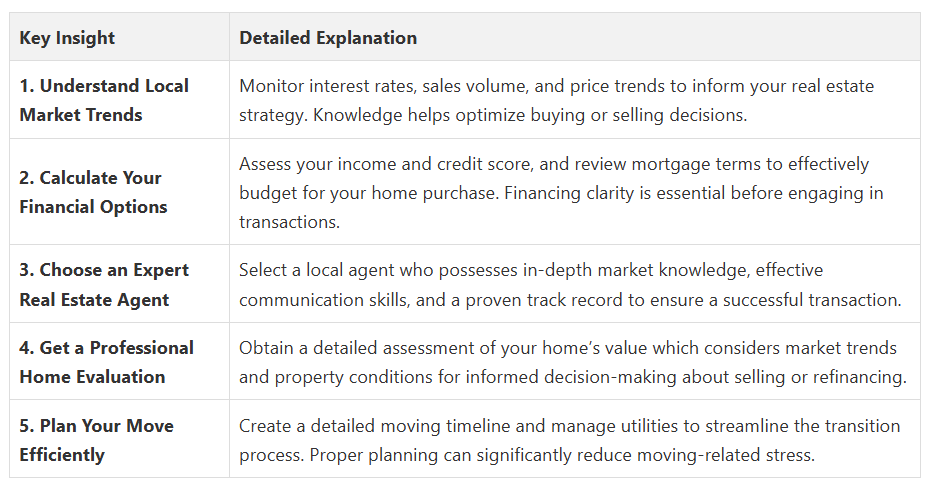

Quick Summary

1. Understand Toronto and Durham Region Market Trends

Recent data from Reuters reveals critical insights about the Greater Toronto Area housing market. In December 2024, home sales declined by 18.7% compared to November, reaching just 5,359 units. This downturn primarily stems from high borrowing costs, even after the Bank of Canada initiated interest rate cuts in June.

For Durham Region specifically, the market shows nuanced changes. RE/MAX Blog reports that between January and July 2025, residential sale prices dropped 3.7% year over year from $934,299 to $900,089. Simultaneously, sales volume decreased by 11.1% while new listings increased by 14.4%, signalling a transition towards a more balanced market.

To navigate these trends effectively:

- Monitor Interest Rates: Track Bank of Canada policy changes that impact mortgage affordability

- Watch Sales Volume: Declining sales can indicate buyer hesitation or potential negotiation opportunities

- Analyze Price Trends: Small fluctuations can reveal broader market sentiment

Working with an experienced local Real Estate Agent in Oshawa who understands these nuanced market shifts can provide you with a strategic advantage in buying or selling property.

2. Calculate Your Home Budget and Financing Options

Recent Canadian policy changes offer promising opportunities for homebuyers. Reuters reports that starting August 1, 2024, first-time home buyers can now extend mortgage amortization periods from 25 to 30 years for newly built homes. This strategic policy aims to make monthly mortgage payments more manageable and stimulate new housing supply.

To effectively calculate your home budget and explore financing options, consider these critical steps:

- Assess Your Income: Calculate your total household income and determine how much you can comfortably allocate to housing expenses

- Check Credit Score: Obtain your credit report and address any issues that might impact mortgage approval

- Understand Mortgage Terms: Review current interest rates and explore different mortgage products

Additionally, Understanding Mortgage Options can provide deeper insights into navigating the complex world of home financing.

The government is also supporting housing affordability. Reuters revealed a C$6 billion Housing Infrastructure Fund launched in April 2024 to accelerate housing construction and support middle-class home ownership.

Consult with a professional Real Estate Agent in Oshawa who can help you align your financial strategy with these evolving market opportunities.

3. Choose the Right Real Estate Agent in Oshawa

When searching for a top Real Estate Agent in Oshawa, like Fanis Makrigiannis Realty, you want someone who understands local market nuances and brings expertise to every interaction. How to Find a Realtor® in Oshawa provides comprehensive insights into making this crucial decision.

Consider these critical factors when choosing your real estate professional:

- Local Market Knowledge: Seek an agent with a deep understanding of Oshawa and Durham Region neighbourhoods

- Track Record: Review recent sales history and client testimonials

- Communication Skills: Choose an agent who responds promptly and explains complex processes clearly

- Professional Credentials: Verify membership in professional real estate associations

A skilled Real Estate Agent in Oshawa will help you understand market trends, negotiate effectively, and guide you through paperwork and legal requirements. They act as your advocate, whether you are buying your first home or selling a property.

Remember that the right agent does more than list properties or show homes. They provide strategic advice tailored to your unique real estate goals and financial situation.

Your chosen professional should feel like a trusted advisor who has your best interests at heart.

4. Get a Professional Home Evaluation from Fanis Makrigiannis Realty

Fanis Makrigiannis Realty provides comprehensive property assessments that go far beyond simple online estimates.

When considering selling or understanding your home’s potential, a professional evaluation offers critical insights into your property’s precise market positioning. Real Estate Agent Tips—What is My Home Worth? provides deeper context about the evaluation process.

A thorough home evaluation considers multiple factors that impact your property’s value:

- Recent Neighbourhood Sales: Analyzing comparable property transactions

- Property Condition: Assessing your home’s current state and potential improvements

- Unique Features: Identifying special characteristics that might increase value

- Market Trends: Understanding current Durham Region real estate dynamics

Professional evaluations from Fanis Makrigiannis Realty provide more than just a number. They offer strategic insights to help you make informed decisions about selling, refinancing, or investing in your property.

By obtaining a Free Home Evaluation directly from a Real Estate Agent in Oshawa, you gain a competitive edge in understanding your property’s true market potential. This personalized assessment can help you strategize your next real estate move with confidence.

5. Prepare Your Home for Sale with Smart Upgrades

Home Upgrades for Maximum Value in 2025 highlights the most effective strategies for enhancing your home’s appeal and marketability. The key is focusing on improvements that potential buyers will immediately recognize and appreciate.

Consider these targeted upgrade strategies:

- Kitchen Modernization: Update countertops, refresh cabinetry, and install modern appliances

- Bathroom Improvements: Replace outdated fixtures and add contemporary lighting

- Curb Appeal: Enhance landscaping and exterior paint to create strong first impressions

- Energy Efficiency: Install smart thermostats and improve insulation

The goal is not to overspend but to make strategic investments that significantly boost your home’s perceived value. A Real Estate Agent in Oshawa can provide personalized guidance on which upgrades will most effectively increase your property’s marketability.

Remember that not all upgrades offer equal returns. Consulting with Fanis Makrigiannis Realty can help you prioritize improvements that will attract buyers and maximize your selling potential.

6. Negotiate Offers and Understand Closing Costs

Understanding the Real Estate Offer Process in Ontario 2025 offers comprehensive insights into navigating complex negotiations. According to RE/MAX Blog, demand for detached housing in the Greater Toronto Area remains strong, with well-priced homes attracting multiple offers.

When negotiating and managing closing costs, consider these key strategies:

- Know Your Market Value: Research comparable property sales in your neighbourhood

- Understand Closing Expenses: Factor in legal fees, land transfer taxes, and home inspection costs

- Prepare Financial Documentation: Have mortgage pre-approval and financial statements ready

- Be Flexible: Consider seller concessions or creative negotiation approaches

A Real Estate Agent in Oshawa from Fanis Makrigiannis Realty can help you navigate complex negotiations and understand potential closing cost implications. Professional representation ensures you make informed decisions and protect your financial interests throughout the transaction.

7. Plan Your Move and Post-Sale Steps

Consider these essential post-sale and moving strategies:

- Create a Comprehensive Timeline: Outline key dates for moving logistics

- Transfer Utilities and Services: Schedule disconnections and reconnections at old and new properties

- Update Legal Documentation: Change address on important government and financial records

- Organize Professional Movers: Research and book reliable moving services early

Working with a Real Estate Agent in Oshawa from Fanis Makrigiannis Realty ensures you have professional support throughout your transition. Our team can help you navigate the intricate details of moving and provide personalized recommendations tailored to your specific needs.

Remember that thorough preparation transforms a potentially chaotic moving experience into a smooth and manageable process.

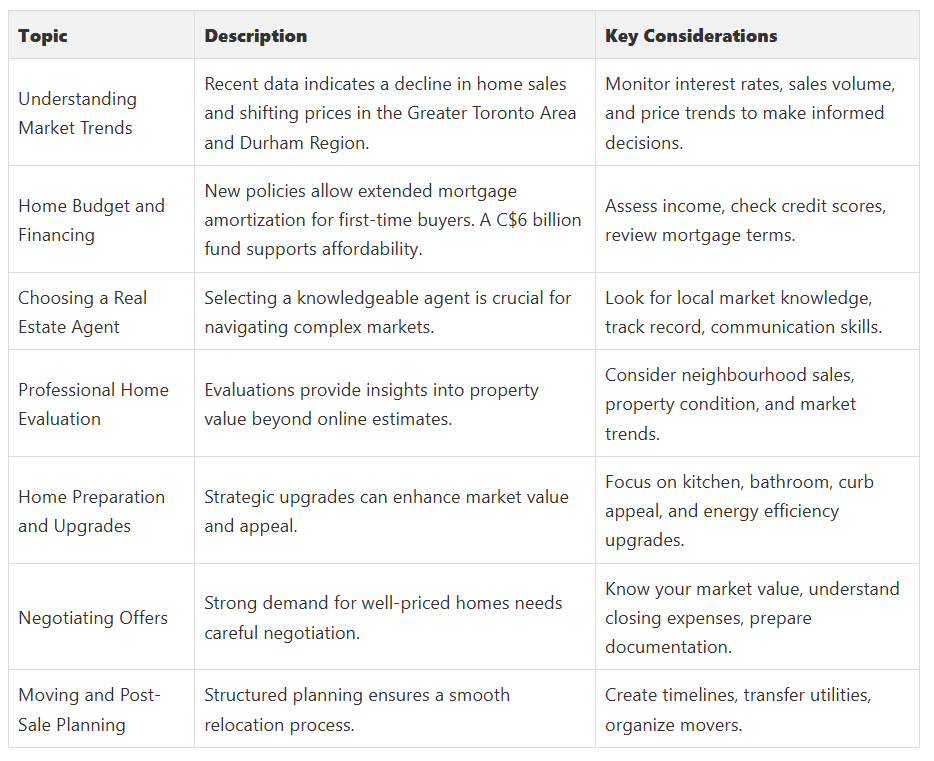

Below is a comprehensive table summarizing the key insights and strategies discussed throughout the article regarding the Toronto and Durham Region real estate market.

Take Control of Your Toronto Real Estate Journey Today

Fanis Makrigiannis Realty offers the expert guidance you need to turn these challenges into opportunities. With deep local market knowledge and personalized strategies, Fanis helps you confidently price, market, and negotiate properties while maximizing your investment potential. Discover how a professional home evaluation or tailored upgrade advice can make your property stand out. Learn more about these services and detailed buying or selling advice on the Fanis Makrigiannis Realty website.

Don’t let uncertainty slow down your real estate goals. Visit https://fanis.ca now to connect with a trusted Real Estate Agent in Oshawa, explore market insights, and start your tailored home search or sale plan. Act today to secure expert support and make confident decisions in the evolving Toronto real estate scene.

Frequently Asked Questions

What are the key market trends I should know when buying or selling real estate in Toronto?

How can I effectively calculate my home budget when preparing to buy?

What should I consider when choosing a real estate agent in Toronto?

How do I prepare my home for sale to maximize its value?

What are the important steps in negotiating offers when selling my home?

How can I ensure a smooth moving process after selling my home?

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Recommended

- Common Home Selling Mistakes in Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

- Real Estate Negotiation for Toronto and Durham Region 2025 - Fanis Makrigiannis Realtor®

- Real Estate Transaction Steps in Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

- Seasonal Home Selling Tips: Toronto and Durham Region 2025 - Fanis Makrigiannis Realtor®