7 Steps for a Smart Real Estate Checklist Oshawa Guide

Over 80 percent of Canadian homebuyers say market trends shape their purchasing decisions. Oshawa stands out in the Durham region with its rapid shifts in pricing, supply, and demand, making searching for a new home or investment both exciting and complicated. Whether you are considering your first home or looking to expand your portfolio, learning how to spot and understand these local patterns gives you a critical edge in making confident real estate choices.

Table of Contents

- Understand Oshawa’s Housing Market Trends

- Prepare Your Budget and Mortgage Pre-Approval

- Find a Trusted Real Estate Agent in Oshawa

- Schedule Home Inspections and Appraisals

- Review Legal Documents with Fanis Makrigiannis Realty

- Negotiate Offers and Closing Details

- Finalize Your Move and Key Handover

Quick Summary

1. Understand Oshawa’s Housing Market Trends

Local Market Dynamics play a significant role in determining property values and investment potential. Oshawa has experienced notable shifts in recent years, influenced by factors such as proximity to Toronto, regional economic developments, and changing demographic patterns. A Real Estate Agent in Oshawa, like Fanis Makrigiannis, can provide critical insights into these evolving trends.

To truly comprehend the market, you’ll want to analyze several key indicators. Home price trends reveal the overall health of the local real estate ecosystem. In Oshawa, this means tracking median home prices, understanding price per square foot, and monitoring how quickly properties are selling. The real estate trends for Oshawa demonstrate the importance of staying current with market movements.

Key Market Trend Indicators to Watch:

- Average days on market for residential properties

- Percentage of list price received by sellers

- Inventory levels in different neighbourhood segments

- New construction rates and development zones

- Demographic shifts affecting housing demand

Working with Fanis Makrigiannis Realty provides an advantage in deciphering these complex market signals. Professional agents have access to granular data and can help you interpret trends that might not be immediately apparent to the average buyer.

Remember that housing markets are living ecosystems. What works today might shift tomorrow. Continuous learning and adaptability are your best strategies for successful real estate transactions in Oshawa.

2. Prepare Your Budget and Mortgage Pre-Approval

Budget Preparation Fundamentals require more than simply checking your bank account. You need a comprehensive view of your financial landscape. Consider your total income, existing debts, monthly expenses, and potential homeownership costs like property taxes, utilities, and maintenance. How to get a mortgage involves understanding these intricate financial dynamics.

Key Budget Calculation Components:

- Monthly net income

- Current debt obligations

- Anticipated housing expenses

- Emergency savings buffer

- Potential future financial changes

Mortgage pre-approval is more than a preliminary step. The mortgage pre-approval process allows lenders to assess your financial health and determine how much they are willing to lend. Canadian financial institutions typically evaluate your borrowing capacity through two critical ratios: Gross Debt Service (GDS) and Total Debt Service (TDS).To improve your mortgage pre-approval chances, focus on:

- Maintaining a strong credit score

- Reducing existing debt

- Demonstrating stable employment

- Saving for a substantial down payment

- Avoiding major financial changes before the application

Working with a Real Estate Agent in Oshawa, like Fanis Makrigiannis, can provide personalized guidance through this complex process. Their expertise can help you understand nuanced financial requirements and position yourself as an attractive borrower.

3. Find a Trusted Real Estate Agent in Oshawa

Professional Credentials Matter. Working with a licensed professional ensures you receive expert guidance and protection.

Real estate agent credentials are crucial because they demonstrate an agent’s commitment to ethical standards and professional development.

The Real Estate Council of Ontario (RECO) provides a public registry where you can verify an agent’s standing and confirm their legitimacy.

What to Look for in a Real Estate Agent:

- Local market knowledge

- Strong communication skills

- Proven track record in Oshawa

- Transparent fee structure

- Client references and testimonials

- Professional certifications

Research becomes your most powerful tool. How to find a Realtor in Oshawa involves more than a simple online search. Interview potential agents, understand their expertise in your specific neighbourhood, and assess their approach to client service.

Personal recommendations and online reviews provide valuable insights. Look for agents who demonstrate a deep understanding of Oshawa’s unique real estate dynamics. An agent like Fanis Makrigiannis, who specializes in Durham region properties, can offer nuanced insights that generic agents might miss.

Remember that the right agent is not just a transaction facilitator but a trusted advisor who understands your specific real estate goals and can strategically guide you through complex market conditions.

4. Schedule Home Inspections and Appraisals

Home Inspection Essentials go far beyond a casual walkthrough. A comprehensive inspection reveals potential structural issues, safety concerns, and maintenance requirements that may not be apparent during initial property viewings. Property inspection techniques help you understand the comprehensive health of your potential home.

Key Inspection Focus Areas:

- Foundation and structural integrity

- Electrical systems

- Plumbing infrastructure

- Roof and exterior conditions

- Insulation and ventilation

- Potential pest or moisture damage

Professional appraisals offer an additional layer of financial protection. Home inspection checklists help ensure you receive an objective assessment of the property’s market value. Certified appraisers from the Appraisal Institute of Canada evaluate multiple factors, including location, property condition, comparable sales, and current market trends.

Working with a Real Estate Agent in Oshawa, like Fanis Makrigiannis, can help you connect with reputable home inspectors and appraisers who understand the unique characteristics of the Durham region market. Their professional network ensures you receive thorough, trustworthy evaluations that support your real estate decision-making.

5. Review Legal Documents with Fanis Makrigiannis Realty

Critical Legal Documents to Review:

- Purchase agreement

- Property title

- Mortgage documents

- Disclosure statements

- Inspection reports

- Transfer documents

Understanding the nuanced legal landscape requires professional guidance. Real estate legal basics provide crucial insights into the intricate documentation process. A skilled Real Estate Agent in Oshawa, like Fanis Makrigiannis, can help interpret these documents and protect your interests.

Professional Document Review Process:

- Verify all legal descriptions

- Check for potential encumbrances

- Confirm property boundaries

- Assess any existing liens

- Understand conditional clauses

- Review financial obligations

Working with Fanis Makrigiannis Realty ensures you have a knowledgeable professional examining every detail. Understanding due diligence becomes your strategic advantage in preventing future legal complications.

Remember that legal document review is not about speed but about thoroughness. Taking time to understand each clause can save you significant stress and potential financial risks in your real estate journey.

6. Negotiate Offers and Closing Details

Negotiation Strategy Fundamentals require more than simply agreeing on a price. Real estate negotiation techniques involve understanding market dynamics, property value, and strategic positioning.

Critical Negotiation Elements:

- Price considerations

- Conditional clauses

- Potential repairs or credits

- Closing date flexibility

- Inclusions and exclusions

- Deposit requirements

Understanding the real estate offer process helps you make informed decisions. The Real Estate Council of Ontario provides clear guidelines on professional negotiation standards, ensuring transparency and fairness.

Key Closing Cost Considerations:

- Land transfer taxes

- Legal fees

- Home inspection costs

- Mortgage registration expenses

- Potential adjustment charges

- Moving and utility setup fees

Working with a Real Estate Agent in Oshawa, like Fanis Makrigiannis, provides strategic advantages. Their expertise helps you understand nuanced negotiation tactics, interpret complex offer details, and protect your financial interests throughout the transaction.

7. Finalize Your Move and Key Handover

Pre-Moving Day Preparation:

- Confirm final property walkthrough

- Arrange utility transfers

- Update address with key services

- Schedule professional movers

- Prepare essential moving documents

- Organize temporary storage if needed

Key Handover Essentials:

- Verify all legal documents are signed

- Confirm mortgage funding is complete

- Conduct final property condition review

- Exchange property keys and access codes

- Review meter readings and utility transfers

- Ensure property is in agreed condition

As a final step, document everything. Take photographs of the property condition, confirm meter readings, and maintain clear communication with the selling party. Working with Fanis Makrigiannis Realty provides professional oversight during this crucial transition, helping you navigate the complexities of property transfer with confidence and peace of mind.

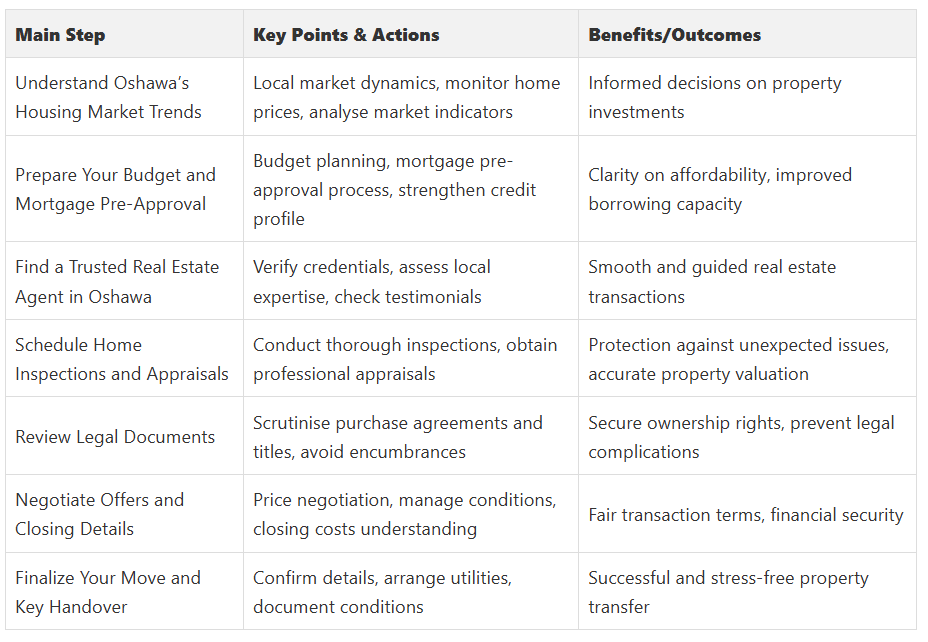

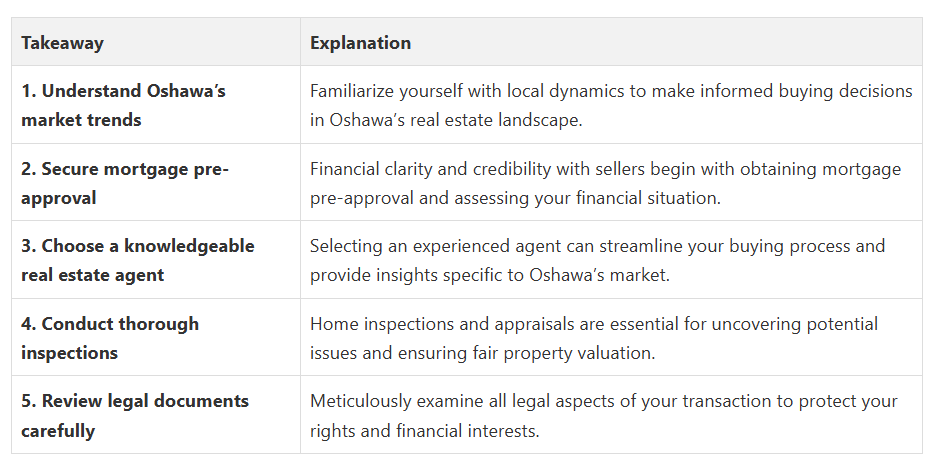

Below is a comprehensive table summarizing the steps and key strategies for navigating Oshawa’s housing market, financial preparation, and property transactions.

Take Control of Your Oshawa Home Buying Journey Today

Start your journey with confidence by partnering with Fanis Makrigiannis, a trusted Real Estate Agent in Oshawa who specializes in guiding buyers through each step with personalized advice. Explore detailed market insights, property listings, and home buying resources at https://fanis.ca. Ready to move forward now? Find out how to get a mortgage or learn more about negotiating offers by visiting pages like How to Get a Mortgage and Real Estate Negotiation Tips.

Take action today and transform the complexity of buying in Oshawa into a clear, manageable process with expert support every step of the way.

Frequently Asked Questions

What are the key steps in a smart real estate checklist for Oshawa?

How can I effectively prepare my budget for buying a home in Oshawa?

What should I look for when hiring a real estate agent in Oshawa?

What is the importance of home inspections when purchasing property?

How do I negotiate offers and manage closing details for a property in Oshawa?

What steps should I take as I approach the final move-in date?

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Recommended

- Complete Guide to the Home Buyer Process in Oshawa - Fanis Makrigiannis Realtor®

- 7 Top Real Estate Marketing Tips in Oshawa - Fanis Makrigiannis Realtor®

- Investment Property Checklist: 10 Essential Tips - Fanis Makrigiannis Realtor®

- 7 Step Home Selling Checklist for Oshawa Home Sellers - Fanis Makrigiannis Realtor®

- How to Qualify for a Mortgage: Step-by-Step Guide for Buyers - Craigburn Capital