How to Buy a Home in Ontario: Step-by-Step for Oshawa Buyers

Nearly half of Canadian first-time homebuyers say the process is far more complicated than expected. Making sense of the Oshawa market, understanding financial benchmarks, and choosing the right Real Estate Agent can feel daunting. Whether you are curious about down payments or worried about credit scores, these steps will break down the entire journey for any Canadian thinking about buying a home in Durham Region, guiding you from initial research right up to securing your keys.

Table of Contents

- Step 1: Assess Financial Readiness For Home Purchase

- Step 2: Research Neighbourhoods And Market Trends In Durham Region

- Step 3: Connect With Fanis Makrigiannis Realty: Real Estate Agent In Oshawa

- Step 4: Browse And Compare Listings For Your Ideal Home

- Step 5: Make An Offer And Navigate The Buying Process

- Step 6: Complete Final Checks And Secure Your New Home

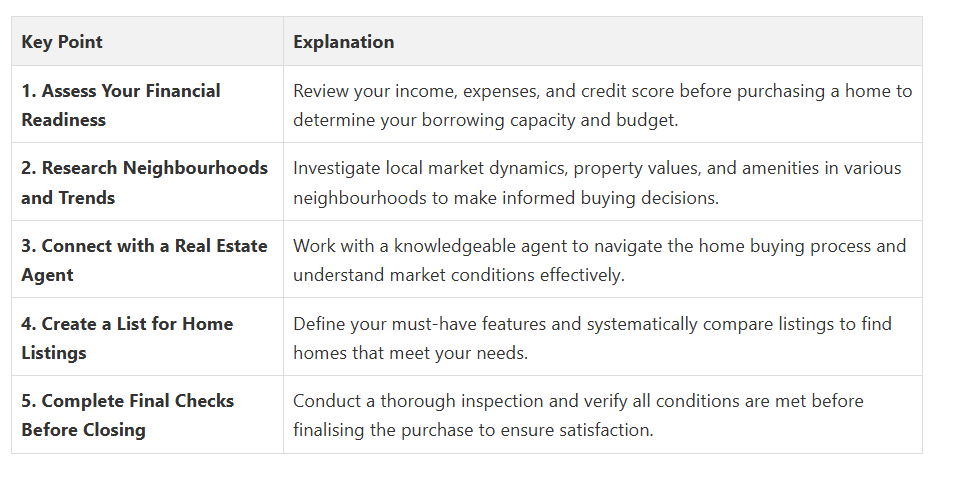

Quick Summary

Step 1: Assess Financial Readiness for Home Purchase

Begin by thoroughly reviewing your current financial situation, including a detailed examination of your income, expenses, savings, and credit profile. Understanding mortgage terms becomes critical at this stage, as lenders will evaluate multiple financial indicators to determine your borrowing capacity. Calculate your total monthly income and subtract all existing financial obligations, including car payments, student loans, credit card debt, and recurring expenses. Financial experts recommend that your housing costs should not exceed 30% of your gross monthly income, a key benchmark for sustainable homeownership in the Durham Region.

A critical component of financial readiness involves checking your credit score. Most lenders in Ontario require a minimum score of 620 for mortgage approval. Obtain a free credit report, address any discrepancies, and work on improving your credit rating if necessary. Save aggressively for your down payment in the Oshawa market, aiming for at least 5% to 20% of the home’s purchase price to secure better mortgage rates and avoid additional mortgage insurance costs. Pro tip: Create a dedicated savings account specifically for your home purchase to track your progress and stay motivated.

Ready for the next step? Your financial preparedness sets the foundation for a successful home-buying journey in Oshawa.

Step 2: Research Neighbourhoods and Market Trends in Durham Region

The market has experienced significant fluctuations, with neighbourhoods across the region showing distinct characteristics that can impact property values and investment potential. Recent reports indicate a surge in homebuyer competition, with some areas experiencing increased overbidding and rapid price movements.

To conduct effective research, start by examining recent sales data, price trends, and neighbourhood amenities. Pay attention to factors like school districts, proximity to public transit, local infrastructure, and future development plans. Look beyond current prices and consider long-term growth potential. Visit neighbourhoods at different times of day, speak with residents, and leverage online resources to gather comprehensive insights. Pro tip: Create a spreadsheet to track neighbourhood features, pricing trends, and your personal preferences to help streamline your decision-making process.

Your thorough neighbourhood research will transform you from a casual buyer to an informed homeowner ready to make a strategic investment in the Durham Region.

Step 3: Connect with Fanis Makrigiannis Realty: Real Estate Agent in Oshawa

The process of finding your ideal real estate professional begins with understanding your specific needs and expectations. Finding a Realtor in Oshawa requires careful consideration of several key factors. Look for a professional with deep local knowledge of the Oshawa and Durham Region housing markets, a proven track record of successful transactions, and a communication style that matches your preferences.

Initiate contact through multiple channels: phone, email, or the agency website contact form. Prepare a list of questions about their experience, specialties, and approach to client representation. During your initial consultation, discuss your budget, preferred neighbourhoods, and specific home requirements. Pro tip: Request references from recent clients and review their professional credentials. Buying and selling homes in Oshawa requires a nuanced understanding of local market dynamics, making the right agent an invaluable partner in your home-buying journey.

Your partnership with Fanis Makrigiannis Realty begins here, a strategic relationship designed to help you navigate the complexities of real estate acquisition in Oshawa.

Step 4: Browse and Compare Listings for Your Ideal Home

Understanding home listings requires a strategic approach. Start by defining your must-have features and deal-breaker criteria. Consider factors like square footage, number of bedrooms and bathrooms, lot size, home age, and specific neighbourhood characteristics. Use online platforms, your realtor’s listings, and multiple real estate websites to cast a wide net. Create a systematic tracking method, such as a spreadsheet or digital folder, to organize and compare potential properties.

Develop a comprehensive evaluation strategy for each listing. Schedule viewings with your Fanis Makrigiannis Realty agent to get an in-depth perspective of potential homes. During visits, take detailed notes, photographs, and ask critical questions about the property’s history, potential repairs, and neighbourhood dynamics. Pro tip: Review the best neighbourhoods to buy in to ensure your chosen home aligns with your long-term lifestyle and investment goals.

Your methodical approach to browsing listings will bring you closer to finding your perfect Oshawa home.

Step 5: Make an Offer and Navigate the Buying Process

Understanding the real estate offer process in Ontario requires strategic preparation and careful negotiation. Your offer should reflect thorough research of comparable property values, current market conditions, and the specific property’s condition. Work closely with your realtor to determine a competitive yet reasonable price point.

Prepare to include conditions such as home inspection, financing approval, and potential sale of your existing property. These conditions protect your interests and provide flexibility during the negotiation.

During the offer presentation, be prepared for potential counteroffers and negotiations. The home buying timeline in Ontario typically involves several critical stages, including offer submission, seller response, home inspection, and final closing. Pro tip: Maintain flexibility and emotional neutrality during negotiations. Your realtor will help you understand each contractual nuance and guide you towards making informed decisions that align with your financial and personal objectives.

Careful navigation of the offer process will bring you one step closer to securing your ideal home in the Oshawa market.

Step 6: Complete Final Checks and Secure Your New Home

Complete home inspection checklists are essential to ensuring your new property meets all expected standards. Schedule a comprehensive final walkthrough to verify that all negotiated repairs have been completed and the home is in the agreed-upon condition. Examine every room meticulously, test all electrical systems, plumbing fixtures, and verify that appliances included in the sale are functioning correctly. Pay special attention to potential issues that might have been discussed during earlier inspections.

Prepare for the transition to homeownership by planning your moving logistics and understanding your financial obligations. Follow a structured moving checklist to ensure a smooth relocation process.

Pro tip: Create a folder with all important documents, including purchase agreements, home inspection reports, insurance policies, and mortgage paperwork.

Budget for closing costs, property taxes, and initial home maintenance expenses.

Coordinate utilities transfers, update your address, and arrange for key services to be connected before moving day.

With these final checks complete, you are moments away from officially becoming a homeowner in the vibrant Oshawa community.

Take Confident Steps Toward Your Oshawa Home Purchase

At Fanis Makrigiannis Realty, we transform these complex processes into clear, manageable actions. Explore expert advice on understanding real estate offers and browse comprehensive property listings carefully selected to fit your needs. Connect with a trusted Real Estate Agent in Oshawa who prioritizes your goals and provides unparalleled local knowledge.

Don’t wait to turn your dream of owning a home in Oshawa into reality. Visit https://fanis.ca to start exploring current listings, gain valuable market insights, and get personalized support every step of the way. Your perfect home and confident buying experience await you today.

Frequently Asked Questions

How do I assess my financial readiness to buy a home in Oshawa?

What should I research before purchasing a home in Oshawa?

How do I choose the right real estate agent in Oshawa?

What features should I consider when browsing home listings in Oshawa?

How do I make a competitive offer on a home in Oshawa?

What final checks should I complete before closing on my new home?

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Recommended

- Complete Guide to the Home Buyer Process in Oshawa

- How to Buy a Home in Oshawa: Simple Step-by-Step Guide

- 7 Steps for a Smart Real Estate Checklist Oshawa Guide

- The Home-Buying Timeline in Ontario

- Étapes Achat Appartement Parisien : Guide Complet - LPI: La parisienne immobilière agence immobilière Paris 19