Buying a Home in Durham Region: Practical Step-by-Step Guide

Most first-time buyers in Oshawa underestimate the full cost of homeownership, with over 40 percent being surprised by expenses beyond their mortgage payments. Entering the Canadian real estate market without solid financial preparation can lead to unnecessary stress and setbacks. This guide breaks down every critical step for Durham Region homebuyers, showing how to assess readiness, secure mortgage support, and confidently move toward your first property purchase.

Table of Contents

- Step 1: Assess Your Financial Readiness

- Step 2: Secure Mortgage Pre-Approval

- Step 3: Select a Trusted Real Estate Agent in Oshawa

- Step 4: Explore Neighbourhoods and Properties

- Step 5: Submit Offers and Negotiate Terms

- Step 6: Validate Closing Details and Ownership

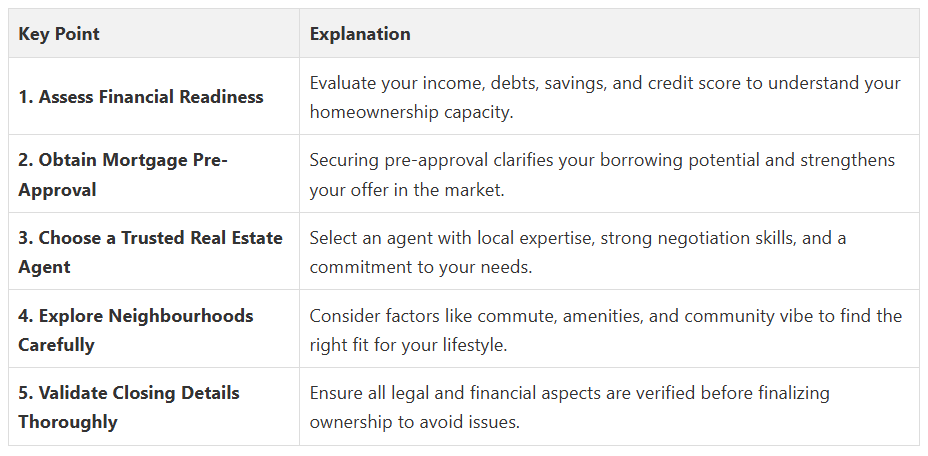

Quick Summary

Step 1: Assess Your Financial Readiness

Starting your home-buying journey means understanding your current financial health. This involves examining your income, existing debts, savings, and credit score to determine if you’re truly ready for homeownership. The Canadian Mortgage and Housing Corporation offers comprehensive guidelines to help potential buyers assess their financial readiness.

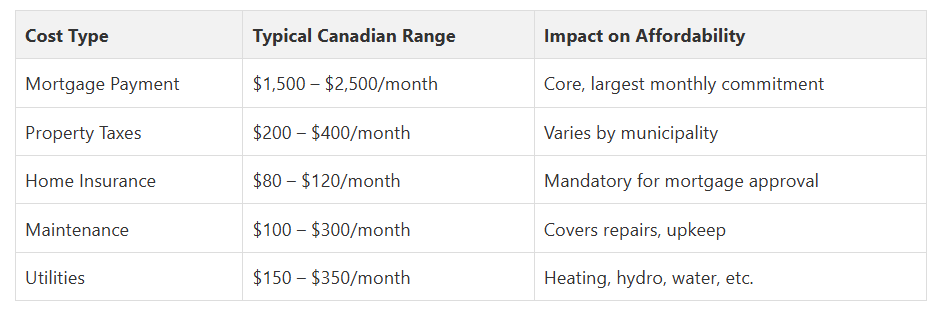

Your first step is calculating how much home you can actually afford. This isn’t just about your monthly mortgage payment but includes property taxes, home insurance, potential maintenance costs, and utility expenses. Most financial experts recommend that your total housing costs should not exceed 30 to 35 percent of your gross monthly income. At Fanis Makrigiannis Realty, we recommend creating a detailed budget that accounts for all these potential expenses, giving you a realistic picture of your true home-buying capacity.

Expert Advice: Create a comprehensive spreadsheet tracking all potential housing expenses before starting your home search to avoid financial surprises.

Expert Advice: Create a comprehensive spreadsheet tracking all potential housing expenses before starting your home search to avoid financial surprises.Here’s a summary of major costs to consider when calculating your realistic home buying budget:

Step 2: Secure Mortgage Pre-Approval

The pre-approval process involves a detailed financial assessment where lenders evaluate your financial readiness to determine mortgage eligibility. You will need to provide comprehensive documentation, including proof of income, employment verification, credit history, existing debts, and assets. This helps lenders calculate how much they are willing to lend you and at what interest rate. At Fanis Makrigiannis Realty, we advise clients that pre-approval typically locks in an interest rate for 60 to 130 days, giving you a solid financial framework for your home search.

Remember that mortgage pre-approval is not a guarantee of final loan approval but a crucial preliminary step that helps you understand your budget and demonstrates to sellers that you are a serious buyer. The Canadian Mortgage and Housing Corporation recommends preparing for the mortgage stress test, which assesses your ability to make payments at a higher interest rate to ensure long-term financial stability.

Expert Advice: Gather all financial documents in advance and check your credit report for any discrepancies before starting the pre-approval process.

Step 3: Select a Trusted Real Estate Agent in Oshawa

When searching for a reputable agent, look for professionals with deep local market knowledge and proven track records. Experts recommend carefully evaluating an agent’s credentials and client reviews to ensure they have the expertise needed to represent your interests effectively. At Fanis Makrigiannis Realty, we understand that the right agent should demonstrate strong negotiation skills, local market insights, and a commitment to personalized client service.

During your initial consultations, ask potential agents specific questions about their experience in the Oshawa market, their recent sales history, and their approach to helping first-time homebuyers. Pay attention to their communication style and how well they listen to your specific needs and preferences. A great agent will not just show you properties but will also provide strategic advice, help you navigate complex paperwork, and support you through every stage of the home-buying process.

Expert Advice: Schedule consultations with at least three local agents to compare their expertise, communication styles, and market understanding before making your final selection.

Step 4: Explore Neighbourhoods and Properties

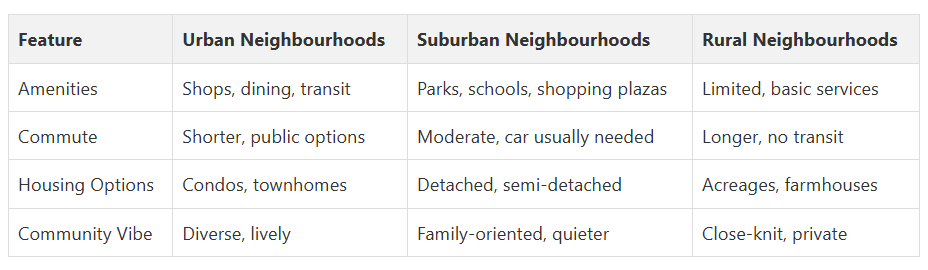

Begin your neighbourhood exploration by considering key factors that matter most to you: proximity to work, school districts, local amenities, transportation options, and future development potential. Understanding the unique characteristics of Durham Region neighbourhoods will help you make an informed decision. At Fanis Makrigiannis Realty, we recommend creating a comprehensive checklist of your must-have community features and prioritizing them during your search.

When viewing properties, look beyond the surface aesthetics. Evaluate the home’s structural integrity, potential renovation needs, and how well the space aligns with your lifestyle. Pay attention to natural lighting, room flow, storage capacity, and the overall condition of critical systems like plumbing, electrical, and heating. Schedule multiple viewings at different times of day to get a comprehensive sense of the property and neighbourhood dynamics.

Expert Advice: Take photographs and notes during property visits to help you objectively compare and remember the unique features of each home you explore.

Compare key features when evaluating potential neighbourhoods in Durham Region:

Step 5: Submit Offers and Negotiate Terms

Crafting a compelling real estate offer involves understanding multiple complex components, including precise legal details, purchase price, deposit amounts, and specific conditions.

At Fanis Makrigiannis Realty, we recommend preparing a comprehensive offer that protects your interests while remaining attractive to the seller.

Your offer should clearly outline key elements such as the purchase price, deposit amount, desired possession date, and critical conditions like home inspection and financing contingencies.

Successful negotiation requires a balanced approach that demonstrates both your serious intent and willingness to find mutually beneficial terms. Be prepared to compromise on some points while standing firm on your most important requirements. Your Real Estate Agent can provide invaluable guidance during this process, helping you understand market conditions, interpret seller responses, and develop counteroffers that move you closer to your home ownership goals.

Expert Advice: Always include a home inspection condition in your offer to protect yourself from unexpected property issues and potential costly repairs.

Step 6: Validate Closing Details and Ownership

The Canadian real estate closing process involves comprehensive legal and financial verification to protect both buyers and sellers. Your legal representative will conduct a thorough title search, confirm property boundaries, verify outstanding liens, and ensure all legal documentation is accurate and complete. At Fanis Makrigiannis Realty, we recommend working closely with a qualified real estate lawyer who can guide you through the intricate details of ownership transfer, review the statement of adjustments, and confirm that all financial transactions align with the agreed purchase terms.

Prepare for closing day by organizing all required documents, confirming your final mortgage details, and understanding the exact funds needed for closing costs. This includes having a certified cheque or bank draft ready for your down payment and closing expenses. Your lawyer will walk you through the final document signing, explain key legal terms, and ensure you fully understand the implications of the property transfer.

Expert Advice: Request a final property walkthrough immediately before closing to confirm the property’s condition matches the agreed-upon state in your purchase agreement.

Take Confident Steps Toward Your Durham Region Homeownership Goals

Take the next step today by exploring trusted property listings and gaining access to valuable neighbourhood insights that simplify your search and sharpen your negotiating position. Connect directly with Fanis Makrigiannis, a dedicated professional ready to provide personalized strategies, detailed market knowledge, and committed support every step of the way. Don’t wait to turn your dream of a Durham home into reality.

Start now by visiting Fanis Makrigiannis Realty and experience how expert assistance transforms your home-buying process.

Frequently Asked Questions

How can I assess my financial readiness to buy a home?

What is the importance of securing mortgage pre-approval?

How should I select a real estate agent in the Durham Region?

What factors should I consider when exploring neighbourhoods?

What steps should I take when submitting an offer on a home?

How do I prepare for the closing process of buying a home?

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Recommended

- Home Buying Process in Toronto & Durham Region for 2025 - Fanis Makrigiannis Realtor®

- Top Common Homebuyer Questions in Toronto & Durham 2025 - Fanis Makrigiannis Realtor®

- First Home Checklist: Toronto and Durham Region 2025 - Fanis Makrigiannis Realtor®

- First-Time Buyer Tips for Toronto & Durham Homes 2025 - Fanis Makrigiannis Realtor®

- Best CRM for Real Estate to Boost Sales | Singleclic