How to Get a Mortgage in Oshawa: Secure Home Buying Success

Most Canadian first-time buyers discover that nearly 30 percent of mortgage applications are delayed due to missing financial details. Buying your first home in Oshawa can be a confusing process without clear steps to prepare. Understanding what lenders expect and gathering the right documents can help you move from dreaming about homeownership to actually holding your own keys. This guide will demystify the process, enabling you to approach the Canadian market with confidence.

Table of Contents

- Step 1: Assess Your Financial Readiness

- Step 2: Gather Required Documents And Information

- Step 3: Research And Compare Mortgage Options

- Step 4: Submit Your Mortgage Application

- Step 5: Review And Finalize Your Mortgage Approval

Quick Summary

Step 1: Assess your financial readiness

Start by pulling your complete financial records and performing a thorough review. Check your credit score, gather recent pay stubs, tax returns, and bank statements. Lenders will scrutinize these documents to assess your borrowing potential. Mortgage readiness involves demonstrating stable income, manageable debt levels, and a solid credit history. Aim to understand two key financial ratios that mortgage providers use: your Gross Debt Service (GDS) ratio and Total Debt Service (TDS) ratio. These calculations help determine how much of your income can safely go towards housing expenses and existing debts.

Consider exploring first-time homebuyer programs that can provide additional financial support. The First Time Home Buyer Incentive and Home Buyers’ Plan can offer crucial assistance in managing your initial home purchase. Remember that being financially ready isn’t just about having money right now; it’s about demonstrating long-term financial stability and responsible money management.

Here’s a quick overview of important financial ratios for mortgage qualification

Pro tip: Before applying for a mortgage, get a comprehensive credit report and address any outstanding issues or errors to improve your approval chances.

Step 2: Gather required documents and information

Your document collection should include several key categories. First, gather personal identification documents such as government-issued photo identification and your Social Insurance Number. For income verification, collect recent pay stubs, T1 General tax returns, Notices of Assessment from the Canada Revenue Agency, and an employment letter confirming your current role and salary. Self-employed individuals will need to provide additional business income documentation and financial statements to demonstrate stable earnings.

Financial documentation is equally important. Compile bank statements showing your savings, investment accounts, and assets. Prepare documentation confirming your down payment source, whether it comes from personal savings, a gift from family, or a withdrawal from your Registered Retirement Savings Plan. If you have existing debts like student loans or credit card balances, include statements for these as well. Lenders want a complete picture of your financial landscape to assess your mortgage eligibility.

Pro tip: Create a digital folder with scanned copies of all required documents to streamline the application process and have backups readily available.

Step 3: Research and compare mortgage options

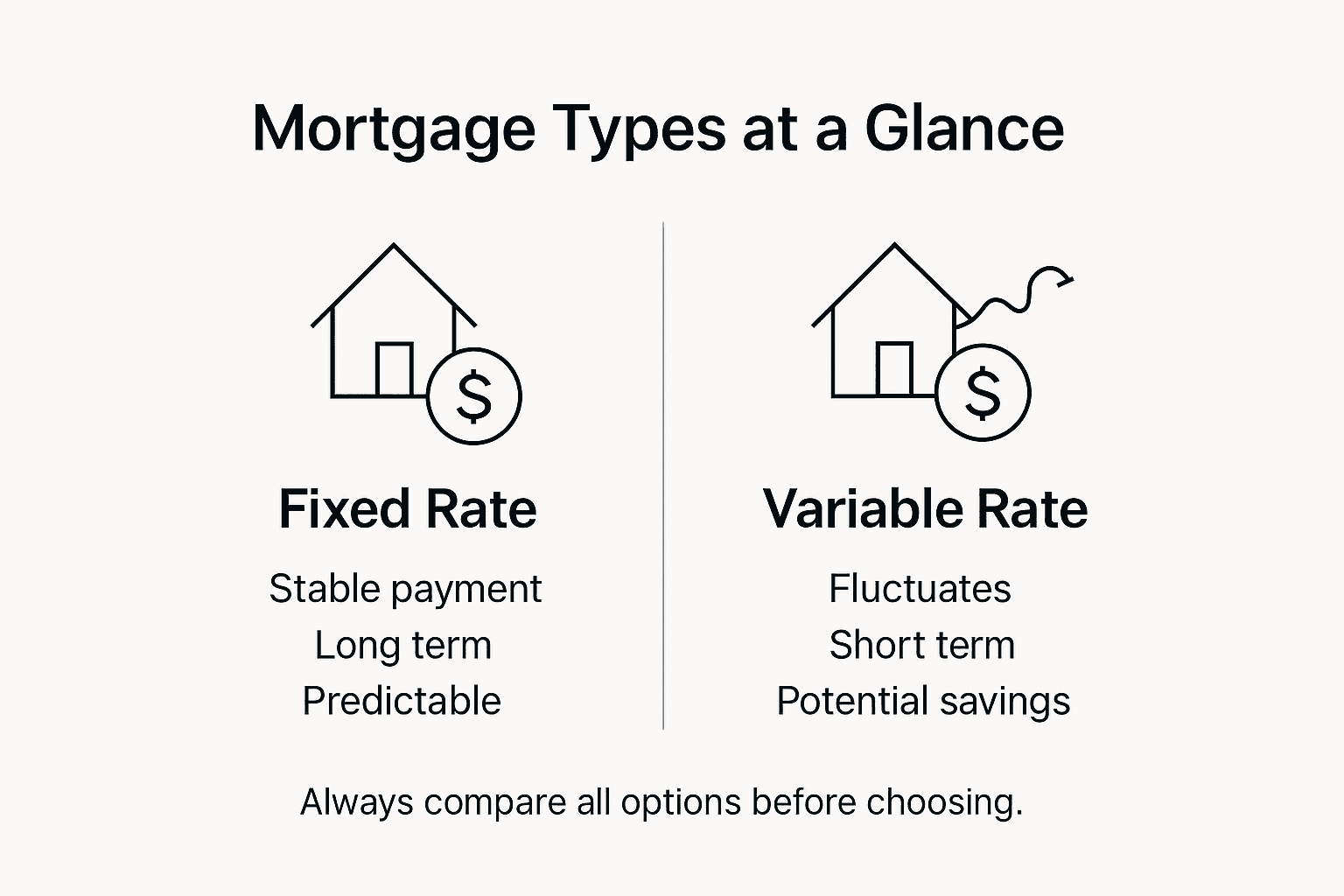

Start by understanding the fundamental differences between mortgage types. Fixed-rate mortgages offer stability with consistent interest rates throughout your term, making budgeting more predictable. Variable-rate mortgages, on the other hand, fluctuate with market conditions and can potentially offer lower initial rates. Current mortgage rates vary based on factors like loan-to-value ratios and whether the mortgage is insured or conventional, so comparing offers from multiple lenders is crucial. Consider your risk tolerance, financial goals, and potential future income changes when selecting a mortgage term.

Don't limit your research to interest rates. Examine the fine print regarding prepayment options, penalties for breaking the mortgage, and portability features. Some mortgages allow you to transfer the loan to a new property or make additional payments without penalties, which can provide valuable flexibility. Consulting with a mortgage professional can help you navigate these nuanced details and find a product perfectly tailored to your specific financial situation.

Here’s a summary of key mortgage types and how they differ:

Pro tip: Request mortgage pre-approval before intensive house hunting to understand your exact borrowing capacity and demonstrate serious intent to sellers.

Step 4: Submit your mortgage application

Your application should present a clear, accurate picture of your financial health. Carefully review every section, ensuring all personal information matches your official documents precisely. The Financial Services Regulatory Authority recommends working with a licensed mortgage professional who can guide you through the submission process and help you access multiple lender options. Be prepared to provide extensive documentation, including proof of income, employment verification, detailed asset and liability statements, and comprehensive information about the property you intend to purchase.

Expect the underwriting process to be thorough and potentially time-consuming. Lenders will scrutinize your application, checking your credit history, income stability, and overall financial capacity. Respond promptly to any requests for additional information to keep your application moving forward. Some lenders may require extra documentation or clarification, so maintain open communication and be patient throughout the review process.

Pro tip: Make digital and physical copies of your entire mortgage application package to ensure you have a complete record of all submitted documents.

Step 5: Review and finalize your mortgage approval

Carefully review the conditional approval letter from your lender, which outlines specific requirements you must satisfy before receiving full mortgage funding.

Pay close attention to conditions such as providing updated income documentation, property appraisal reports, and confirmation of home insurance. Some conditions may require prompt action on your part, so create a checklist and work methodically to address each requirement.

Prepare for the final underwriting review by maintaining financial stability during this period. Avoid making significant financial changes like switching jobs, making large purchases on credit, or opening new credit accounts. These actions could potentially trigger a reassessment of your mortgage application or even jeopardize your approval. Stay in close communication with your mortgage professional, promptly responding to any requests for additional information or clarification.

Pro tip: Schedule a comprehensive review with your mortgage professional to systematically address each approval condition and ensure a smooth final verification process.

Take the Next Step Toward Homeownership in Oshawa with Expert Guidance

Discover tailored solutions at Fanis Makrigiannis’ real estate platform, where you can access expert advice, exclusive property listings in Durham Region, and step-by-step guidance aligned with the mortgage process outlined in this article. Don’t wait until you feel lost in paperwork or mortgage jargon. Visit https://fanis.ca now to start exploring homes and connect directly with a professional who can simplify your home-buying experience. Let Fanis turn your homeownership goals into reality with personalized strategies and insider market insights.

Frequently Asked Questions

What steps should I take to assess my financial readiness for a mortgage in Oshawa?

How do I gather the required documents for my mortgage application in Oshawa?

What types of mortgage options are available for homebuyers in Oshawa?

How can I ensure my mortgage application is submitted correctly?

What should I know during the final stages of mortgage approval in Oshawa?

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region and is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Recommended

- Complete Guide to the Home Buyer Process in Oshawa - Fanis Makrigiannis Realtor®

- How to Get a Mortgage: Step-by-Step Guide for Homebuyers - Fanis Makrigiannis Realtor®

- How to Buy a Home in Ontario - Fanis Makrigiannis Realtor®

- 7 Steps for a Smart Real Estate Checklist Oshawa Guide - Fanis Makrigiannis Realtor®