Buy vs Rent Toronto 2025: Guide for Homebuyers and Sellers

Toronto’s real estate market is buzzing with change, and everyone is searching for the right move in 2025. January brought a 10 percent rise in home sales and a 48.6 percent leap in new listings, opening the door for both buyers and sellers. Most people assume buying is always the smartest way to build wealth in the city. Surprisingly, as it sounds, renters are pocketing about $1,924 more every month than owners right now. This flips the usual story, prompting many people to rethink which option makes the most sense this year

.

The Toronto and Durham Region real estate market in 2025 presents a complex landscape characterized by dynamic shifts in housing demand, pricing strategies, and economic influences. Understanding these regional trends becomes crucial for potential homebuyers and sellers navigating an increasingly nuanced market.

Recent data reveals significant fluctuations in the local real estate ecosystem. According to Toronto Regional Real Estate Board (TRREB) reports, home sales in the Greater Toronto Area experienced a 10% increase in January 2025 compared to the previous month. This surge suggests emerging opportunities for both buyers and sellers, despite ongoing economic uncertainties.

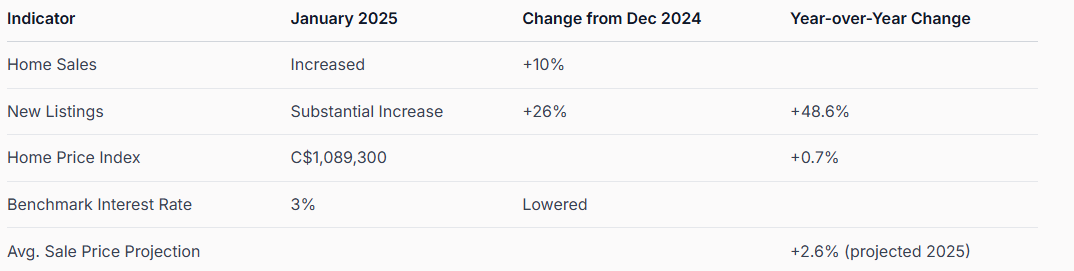

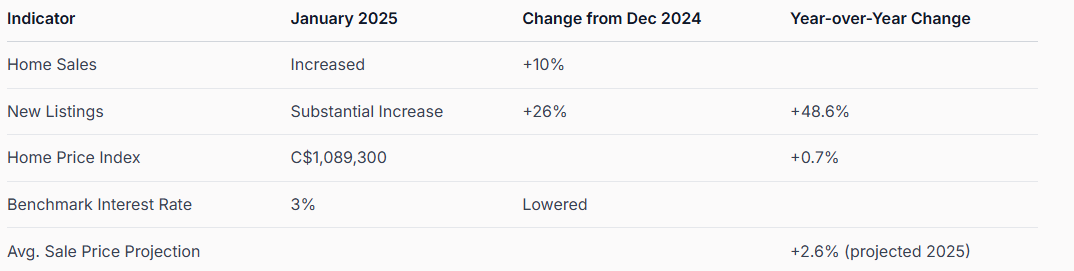

Interestingly, new listings witnessed a substantial rise of 26% from December and an impressive 48.6% year-over-year increase. These numbers indicate growing market activity and potential inventory expansion. The home price index remained relatively stable at C$1,089,300, demonstrating a modest 0.7% increase from January 2024.

Here is a summary table highlighting the key real estate market statistics and changes in early 2025 for Toronto and Durham Region:

Economic conditions play a pivotal role in shaping the regional real estate landscape. Research from Reuters highlights the impact of trade uncertainties on consumer confidence. In February 2025, home sales decreased by 28.5%, reflecting potential economic apprehensions among potential buyers.

The Bank of Canada's strategic interest rate adjustments have been instrumental in market dynamics. By lowering the benchmark rate to 3%, policymakers aim to stimulate economic activity and make homeownership more accessible. This monetary policy could potentially attract more buyers into the market, especially those who were previously deterred by higher borrowing costs.

Projections for the Toronto and Durham Region real estate market in 2025 remain cautiously optimistic. Experts anticipate a 12.4% increase in home sales and a 2.6% rise in average selling prices. These forecasts suggest a gradual recovery and stabilization of the market.

For potential investors and homebuyers, understanding these trends is crucial. The market presents unique opportunities, particularly for those prepared to navigate its complexities. Learn more about strategic real estate investing in our comprehensive guide.

As the market continues to evolve, staying informed about local trends, economic indicators, and regional specifics will be crucial for making sound real estate decisions in the Toronto and Durham Regions.

Navigating the financial landscape of housing in Toronto and Durham Region requires a comprehensive understanding of the intricate costs associated with buying versus renting in 2025. This analysis provides a detailed breakdown of the financial considerations that potential homeowners and renters must evaluate.

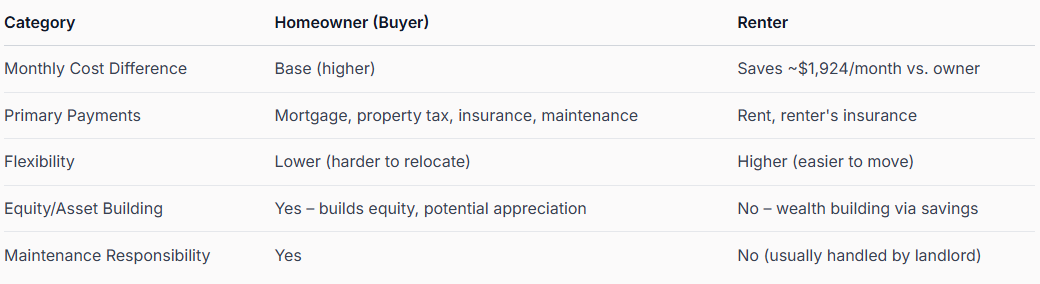

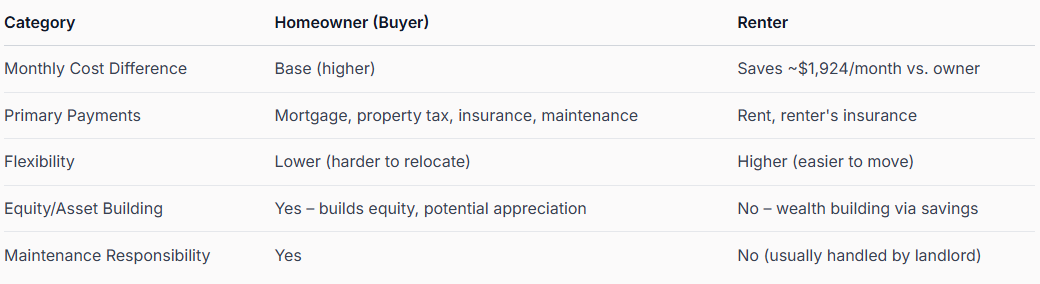

According to research from Zoocasa, the financial dynamics between renting and buying have become increasingly complex. In major Canadian cities like Toronto, renters are currently saving approximately $1,924 monthly compared to homeowners. This significant difference highlights the importance of carefully analyzing individual financial circumstances before making a housing decision.

Toronto and Durham Region Real Estate Trends

The Toronto and Durham Region real estate market in 2025 presents a complex landscape characterized by dynamic shifts in housing demand, pricing strategies, and economic influences. Understanding these regional trends becomes crucial for potential homebuyers and sellers navigating an increasingly nuanced market.

Market Dynamics and Sales Performance

Recent data reveals significant fluctuations in the local real estate ecosystem. According to Toronto Regional Real Estate Board (TRREB) reports, home sales in the Greater Toronto Area experienced a 10% increase in January 2025 compared to the previous month. This surge suggests emerging opportunities for both buyers and sellers, despite ongoing economic uncertainties.

Interestingly, new listings witnessed a substantial rise of 26% from December and an impressive 48.6% year-over-year increase. These numbers indicate growing market activity and potential inventory expansion. The home price index remained relatively stable at C$1,089,300, demonstrating a modest 0.7% increase from January 2024.

Here is a summary table highlighting the key real estate market statistics and changes in early 2025 for Toronto and Durham Region:

Economic Factors Influencing Real Estate

Economic conditions play a pivotal role in shaping the regional real estate landscape. Research from Reuters highlights the impact of trade uncertainties on consumer confidence. In February 2025, home sales decreased by 28.5%, reflecting potential economic apprehensions among potential buyers.

The Bank of Canada's strategic interest rate adjustments have been instrumental in market dynamics. By lowering the benchmark rate to 3%, policymakers aim to stimulate economic activity and make homeownership more accessible. This monetary policy could potentially attract more buyers into the market, especially those who were previously deterred by higher borrowing costs.

Future Projections and Investment Potential

Projections for the Toronto and Durham Region real estate market in 2025 remain cautiously optimistic. Experts anticipate a 12.4% increase in home sales and a 2.6% rise in average selling prices. These forecasts suggest a gradual recovery and stabilization of the market.

For potential investors and homebuyers, understanding these trends is crucial. The market presents unique opportunities, particularly for those prepared to navigate its complexities. Learn more about strategic real estate investing in our comprehensive guide.

As the market continues to evolve, staying informed about local trends, economic indicators, and regional specifics will be crucial for making sound real estate decisions in the Toronto and Durham Regions.

Financial Comparison: Buying vs Renting in 2025

Navigating the financial landscape of housing in Toronto and Durham Region requires a comprehensive understanding of the intricate costs associated with buying versus renting in 2025. This analysis provides a detailed breakdown of the financial considerations that potential homeowners and renters must evaluate.

Cost Analysis and Monthly Expenses

According to research from Zoocasa, the financial dynamics between renting and buying have become increasingly complex. In major Canadian cities like Toronto, renters are currently saving approximately $1,924 monthly compared to homeowners. This significant difference highlights the importance of carefully analyzing individual financial circumstances before making a housing decision.

The monthly expense breakdown reveals multiple layers of financial commitment. Homeowners must account for mortgage payments, property taxes, home insurance, maintenance costs, and potential renovation expenses. In contrast, renters typically have more predictable monthly expenses, limited to rent and renters' insurance. A comprehensive rent vs. buy calculator demonstrates that the break-even point for homeownership varies significantly based on individual financial situations and local market conditions.

The following table compares core ongoing costs and characteristics for buyers versus renters in Toronto and Durham Region in 2025, as discussed in this section:

Beyond immediate monthly expenses, the decision between buying and renting involves considering long-term financial strategies. Research from RE/MAX Canada emphasizes that the financial gap between renting and buying continues to narrow in 2025. Homeownership offers potential equity building and asset appreciation, while renting provides greater financial flexibility and reduced maintenance responsibilities.

Investors and potential homeowners must evaluate several critical factors:

Making an informed housing decision requires a holistic approach. You can explore our detailed guide on strategic property investments to understand the nuanced financial considerations specific to the Toronto and Durham Region markets.

Ultimately, the buy versus rent decision is deeply personal. Factors such as individual financial stability, career trajectory, long-term goals, and personal preferences play crucial roles. Potential buyers and renters should conduct thorough financial assessments, considering current market conditions, personal income, savings, and future financial objectives.

Consulting with financial advisors and real estate professionals can provide tailored insights into the most advantageous housing strategy for your unique circumstances in the Toronto and Durham Region market of 2025.

The Toronto and Durham Region real estate market demands strategic thinking from homebuyers, sellers, and investors in 2025. Understanding the nuanced landscape requires careful evaluation of multiple factors that extend beyond simple financial calculations.

According to Forbes, the decision to enter the real estate market hinges critically on personal financial stability. Prospective homebuyers must conduct a comprehensive self-assessment of their financial health, including credit score, debt-to-income ratio, and long-term income potential.

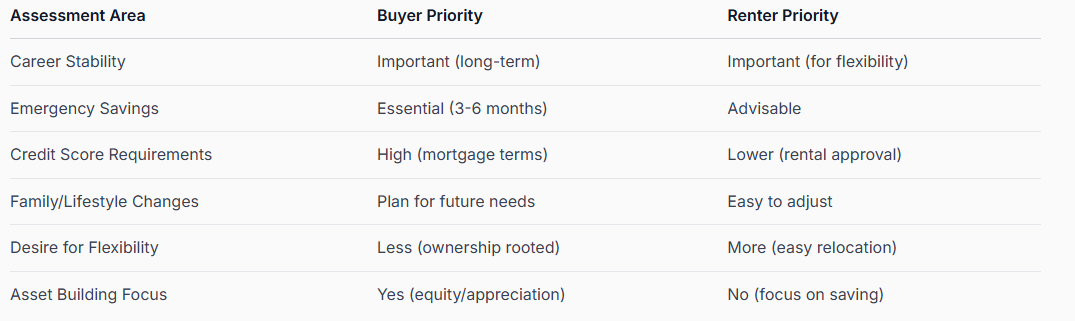

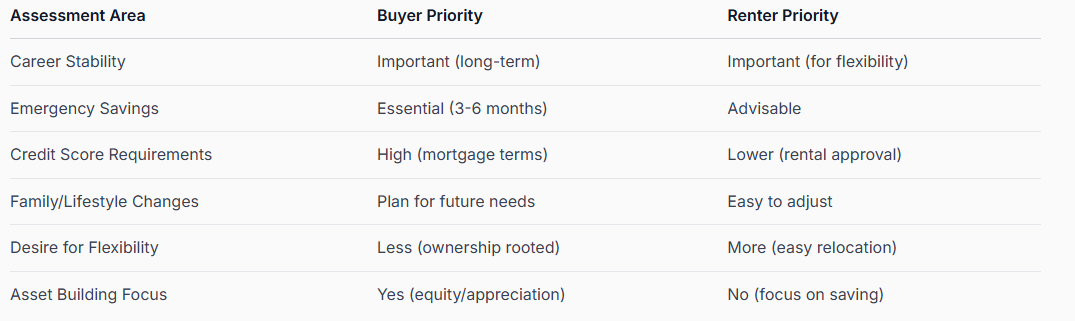

The following table compares core ongoing costs and characteristics for buyers versus renters in Toronto and Durham Region in 2025, as discussed in this section:

Long-Term Financial Implications

Beyond immediate monthly expenses, the decision between buying and renting involves considering long-term financial strategies. Research from RE/MAX Canada emphasizes that the financial gap between renting and buying continues to narrow in 2025. Homeownership offers potential equity building and asset appreciation, while renting provides greater financial flexibility and reduced maintenance responsibilities.

Investors and potential homeowners must evaluate several critical factors:

- Equity Potential: Buying allows for long-term wealth accumulation through property value appreciation

- Flexibility: Renting offers easier relocation and reduced financial commitment

- Market Volatility: Property values can fluctuate, impacting long-term financial planning

Strategic Financial Decision-Making

Making an informed housing decision requires a holistic approach. You can explore our detailed guide on strategic property investments to understand the nuanced financial considerations specific to the Toronto and Durham Region markets.

Ultimately, the buy versus rent decision is deeply personal. Factors such as individual financial stability, career trajectory, long-term goals, and personal preferences play crucial roles. Potential buyers and renters should conduct thorough financial assessments, considering current market conditions, personal income, savings, and future financial objectives.

Consulting with financial advisors and real estate professionals can provide tailored insights into the most advantageous housing strategy for your unique circumstances in the Toronto and Durham Region market of 2025.

Key Considerations for Homebuyers, Sellers, and Investors

The Toronto and Durham Region real estate market demands strategic thinking from homebuyers, sellers, and investors in 2025. Understanding the nuanced landscape requires careful evaluation of multiple factors that extend beyond simple financial calculations.

Personal Financial Readiness

According to Forbes, the decision to enter the real estate market hinges critically on personal financial stability. Prospective homebuyers must conduct a comprehensive self-assessment of their financial health, including credit score, debt-to-income ratio, and long-term income potential.

Interestingly, Bank of America research reveals that 70% of potential homebuyers believe renting could be detrimental to their financial future. This perception underscores the importance of understanding personal financial goals and market dynamics before making a significant housing commitment.

Key financial considerations include:

For investors and homebuyers, the Toronto and Durham regions present unique opportunities that require a strategic approach. Britannica Money highlights that purchasing a home offers long-term investment potential and the ability to personalize living spaces, while renting provides greater short-term flexibility.

Investors should evaluate:

Key financial considerations include:

- Emergency Fund: Maintaining 3-6 months of living expenses

- Income Stability: Consistent employment and predictable income

- Credit Health: Strong credit score for favourable mortgage terms

Market Strategy and Investment Potential

For investors and homebuyers, the Toronto and Durham regions present unique opportunities that require a strategic approach. Britannica Money highlights that purchasing a home offers long-term investment potential and the ability to personalize living spaces, while renting provides greater short-term flexibility.

Investors should evaluate:

- Market Appreciation Potential: Historical and projected property value trends

- Rental Income Opportunities: Potential for generating passive income

- Neighbourhood Development: Infrastructure and community growth prospects

Comprehensive Decision-Making Approach

Successful real estate transactions require a holistic view that extends beyond pure financial metrics. Learn more about confident real estate decision-making to navigate the complex Toronto and Durham Region market effectively.

Potential buyers and sellers must consider lifestyle factors alongside financial considerations. This includes job proximity, family needs, long-term personal goals, and potential market shifts.

Professional guidance from experienced real estate professionals can provide nuanced insights tailored to individual circumstances.

Ultimately, the real estate journey in 2025 requires adaptability, thorough research, and a clear understanding of personal and financial objectives. Whether you are a first-time homebuyer, an experienced investor, or a seller looking to maximize property value, a strategic and informed approach is essential in the dynamic Toronto and Durham Region real estate landscape.

Navigating the complex real estate landscape in Toronto and Durham Region requires strategic insight and carefully considered decision-making. Experts recommend a comprehensive approach that balances personal circumstances, financial goals, and market realities when determining whether to buy or rent in 2025.

According to the Consumer Financial Protection Bureau, evaluating personal and financial goals is crucial in making housing decisions. The process involves a thorough examination of individual lifestyle factors, career trajectory, and long-term objectives that extend beyond immediate financial calculations.

Key personal assessment factors include:

Here’s a table summarizing key personal and financial checklist items to assess before making a buy or rent decision in 2025:

North Dakota State University Extension highlights the critical importance of understanding total housing expenses beyond simple monthly payments. This comprehensive approach includes considering maintenance costs, potential property value appreciation, tax implications, and long-term financial implications.

Financial experts recommend developing a robust financial strategy that includes:

Successful real estate decisions require a holistic approach that balances emotional and financial considerations. Explore our comprehensive guide to making confident real estate choices to gain deeper insights into navigating the Toronto and Durham Region markets.

Professional advisors suggest creating a detailed decision-making matrix that includes:

Consulting with real estate professionals, financial advisors, and conducting thorough personal research will provide the comprehensive perspective needed to make the most advantageous housing decision in 2025.

What are the current trends in the Toronto and Durham Region real estate market for 2025?

Expert Tips for Choosing the Right Path

Navigating the complex real estate landscape in Toronto and Durham Region requires strategic insight and carefully considered decision-making. Experts recommend a comprehensive approach that balances personal circumstances, financial goals, and market realities when determining whether to buy or rent in 2025.

Personal Circumstance Assessment

According to the Consumer Financial Protection Bureau, evaluating personal and financial goals is crucial in making housing decisions. The process involves a thorough examination of individual lifestyle factors, career trajectory, and long-term objectives that extend beyond immediate financial calculations.

Key personal assessment factors include:

- Career Stability: Potential for job relocation or career changes

- Family Dynamics: Current and anticipated family size and needs

- Lifestyle Flexibility: Desire for mobility versus community roots

Here’s a table summarizing key personal and financial checklist items to assess before making a buy or rent decision in 2025:

Financial Strategy and Risk Management

North Dakota State University Extension highlights the critical importance of understanding total housing expenses beyond simple monthly payments. This comprehensive approach includes considering maintenance costs, potential property value appreciation, tax implications, and long-term financial implications.

Financial experts recommend developing a robust financial strategy that includes:

- Emergency Fund: Maintaining sufficient savings to cover unexpected expenses

- Mortgage Pre-qualification: Understanding borrowing capacity and potential loan terms

- Total Cost Analysis: Comparing the comprehensive expenses of renting versus buying

Strategic Decision-Making Framework

Successful real estate decisions require a holistic approach that balances emotional and financial considerations. Explore our comprehensive guide to making confident real estate choices to gain deeper insights into navigating the Toronto and Durham Region markets.

Professional advisors suggest creating a detailed decision-making matrix that includes:

- Projected five-year personal and professional goals

- Potential market changes and economic forecasts

- Individual risk tolerance and financial resilience

Consulting with real estate professionals, financial advisors, and conducting thorough personal research will provide the comprehensive perspective needed to make the most advantageous housing decision in 2025.

Frequently Asked Questions

What are the current trends in the Toronto and Durham Region real estate market for 2025?

The Toronto and Durham Region real estate market is seeing a 10% increase in home sales and a significant rise in new listings, with a 48.6% year-over-year increase. This indicates a dynamic market with growing opportunities for buyers and sellers.

Is it cheaper to rent or buy a home in Toronto in 2025?

Currently, renters in Toronto are saving approximately $1,924 more each month compared to homeowners, making renting a financially attractive option for many individuals.

What economic factors are influencing the Toronto housing market in 2025?

The Bank of Canada has lowered the benchmark interest rate to 3% to stimulate homeownership, but ongoing economic uncertainties are affecting consumer confidence in the market.

What should potential homebuyers consider before deciding to buy or rent?

Homebuyers should assess their financial readiness, long-term goals, lifestyle preferences, and market trends before making a housing decision to ensure it aligns with their needs.

Unlock Your Toronto Advantage: Make Your Buy vs Rent Move with Confidence

Feeling caught between buying or renting in Toronto for 2025? You are not alone. As the article highlights, homebuyers and renters are facing tough questions about rising costs, market shifts, and whether equity or flexibility makes more sense now. Many are struggling to find clarity on what truly benefits their long-term financial goals while staying ahead in a constantly changing market.

Why wait and risk missing out on new opportunities or making the wrong choice for your situation? At https://fanis.ca, you get trusted guidance tailored to today’s housing trends and your unique needs. Let Fanis Makrigiannis help you navigate current listings, lay out both buy and rent options side-by-side, and create a clear plan that matches your financial readiness and dreams. Ready for expert advice and up-to-date property options? Connect now to discover your next best step and put your plan into action before the market changes again.

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca

Recommended Articles:

Buying vs Renting in Toronto & Durham Region 2025 - Fanis Makrigiannis Realtor®

Home Selling Tips for Toronto and Durham 2025 - Fanis Makrigiannis Realtor®

Toronto's Real Estate Market 2025: Trends & Insights - Fanis Makrigiannis Realtor®

Why Buy in Toronto: Real Estate Opportunities in 2025 - Fanis Makrigiannis Realtor®

Equipment Rental vs Purchase: Smart Choices for Projects 2025 - Sterling Access