Understanding Real Estate Investment Risks for Toronto Buyers

Real estate investment looks like a steady path to wealth and security, but hidden risks can shape your financial future overnight. Even though property is often seen as a safe bet, research shows that political uncertainty and regulatory changes can drive up risk premiums for investors. The real difference comes from the investors who spot these risks early and turn them into smart strategies rather than surprises.

Table of Contents

- What Are Real Estate Investment Risks?

- Financial Market Volatility

- Legal and Regulatory Considerations

- Market Unpredictability

- Why Understanding Real Estate Investment Risks Matters

- Financial Protection and Strategic Planning

- Long-Term Investment Sustainability

- Informed Decision Making

- How Market Trends Affect Real Estate Investment Risks

- Economic Indicators and Investment Perception

- Neighbourhood and Location Dynamics

- Technology and Market Transparency

- Key Concepts of Real Estate Investment Risks

- Risk Classification and Assessment

- Financial Vulnerability Analysis

- Strategic Risk Mitigation

- Mitigating Real Estate Investment Risks in the Durham Region

- Local Market Analysis

- Regulatory Compliance Strategies

- Financial Hedging Techniques

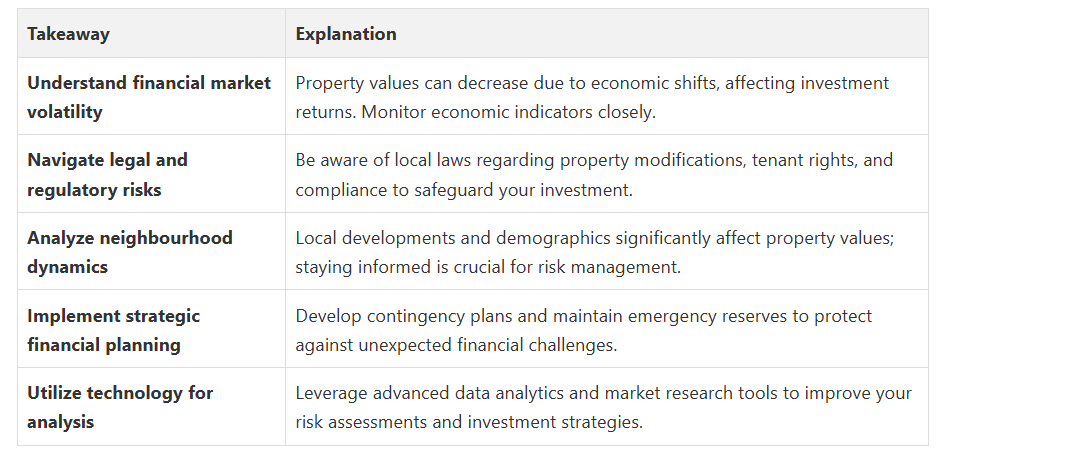

Quick Summary

What Are Real Estate Investment Risks?

Financial Market Volatility

Key financial risks include:

- Potential property value depreciation

- Unexpected maintenance and repair costs

- Fluctuating rental income streams

- Interest rate changes affecting mortgage expenses

Legal and Regulatory Considerations

Investors must be prepared to navigate complex legal landscapes, including potential restrictions on property modifications, rental agreements, and tenant eviction processes. These legal complexities can significantly impact investment profitability and operational flexibility.

Market Unpredictability

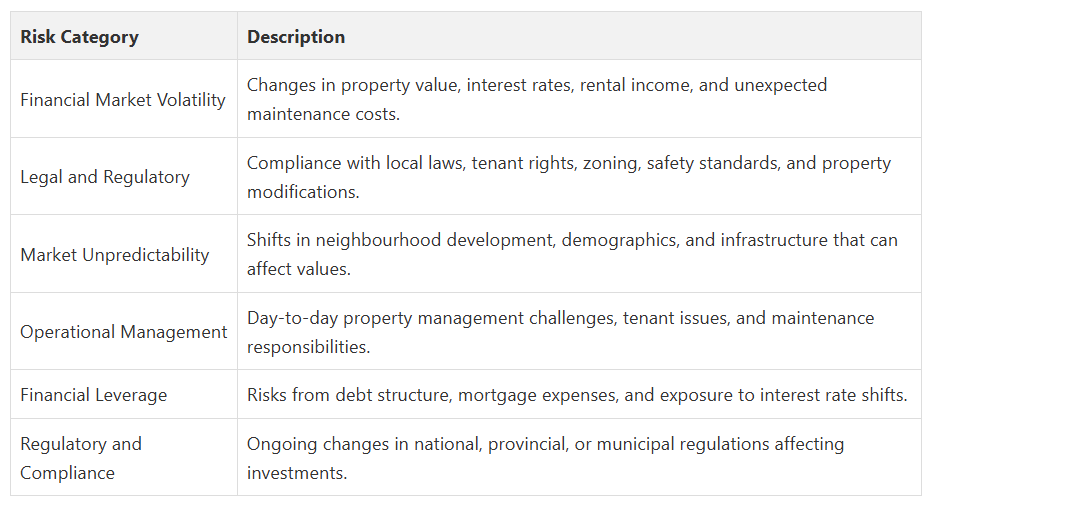

Below is a summary table outlining major categories of real estate investment risks and their key characteristics as discussed in the article.

Learn more about strategic real estate investments to develop a comprehensive approach to managing these multifaceted risks effectively.

Why Understanding Real Estate Investment Risks Matters

Financial Protection and Strategic Planning

Key strategic considerations include:

- Developing robust contingency financial plans

- Creating comprehensive risk assessment frameworks

- Establishing emergency funding reserves

- Implementing diversification strategies

Long-Term Investment Sustainability

Economic uncertainties require investors to remain adaptable and informed about regional market dynamics. By maintaining a nuanced understanding of potential risks, investors position themselves to make sophisticated decisions that protect and potentially enhance their financial investments.

Informed Decision Making

Explore strategic investment insights to develop a comprehensive understanding of navigating complex real estate investment landscapes effectively.

How Market Trends Affect Real Estate Investment Risks

Factors such as employment rates, GDP growth, population migration, and local economic development significantly impact property valuations and investment attractiveness.

According to urban economic research, regional economic health substantially determines real estate market performance and associated investment risks.

Key economic trend considerations include:

- Interest rate fluctuations

- Local employment market stability

- Regional infrastructure development

- Demographic population shifts

Neighbourhood and Location Dynamics

Sophisticated investors recognize that location-specific factors extend beyond traditional metrics, encompassing complex social and economic ecosystem dynamics that shape long-term property performance and risk profiles.

Technology and Market Transparency

Explore emerging market insights for Toronto to develop a nuanced understanding of how technological innovations are transforming real estate investment risk management strategies.

Key Concepts of Real Estate Investment Risks

Risk Classification and Assessment

Key risk categories include:

- Systematic market risks

- Unsystematic property-specific risks

- Financial leverage risks

- Regulatory and compliance risks

- Operational management risks

Financial Vulnerability Analysis

Understanding financial vulnerability requires examining income stability, debt structures, emergency reserves, and potential market sensitivity. Investors must develop robust strategies that create buffers against potential economic uncertainties.

Strategic Risk Mitigation

Discover advanced investment strategies to develop a comprehensive approach to navigating real estate investment risks effectively.

Mitigating Real Estate Investment Risks in the Durham Region

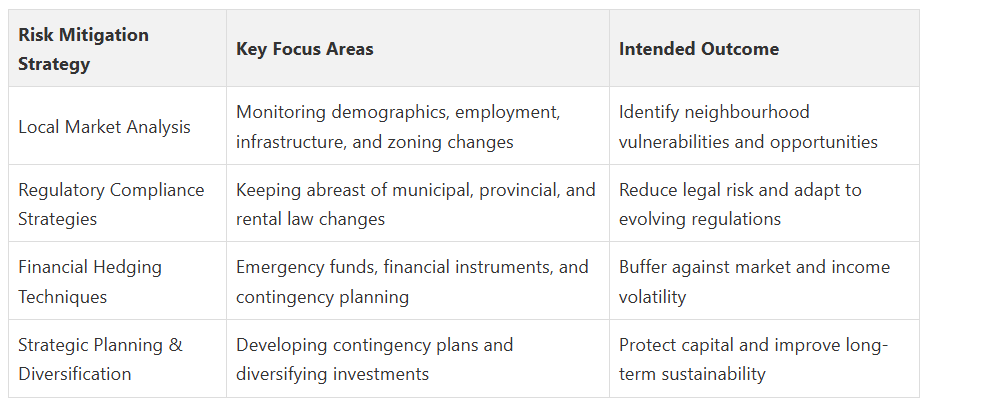

The table below compares some of the main strategies highlighted in the article for mitigating real estate investment risks in Toronto and the Durham Region.

Local Market Analysis

Key local market risk assessment factors include:

- Population growth trends

- Local employment market stability

- Infrastructure development projects

- Municipal zoning regulation changes

- Regional economic diversification

Regulatory Compliance Strategies

Proactive compliance involves continuous monitoring of municipal guidelines, maintaining transparent documentation, and developing flexible investment strategies that can adapt to potential regulatory shifts. This approach transforms potential regulatory challenges into strategic investment opportunities.

Financial Hedging Techniques

Explore regional investment strategies to develop a comprehensive approach to managing real estate investment risks in this dynamic market environment.

Take Control of Your Real Estate Investment Journey in Toronto

Ready to invest in Toronto or the Durham Region with greater confidence? Connect with Fanis Makrigiannis, your neighbourhood expert, to access personalized property searches, tailored investment strategies, and the latest market insights. Take the next step today and see how the right approach can help you navigate and overcome the risks covered in our latest article. For guidance and featured listings, start your journey now at https://fanis.ca.

Frequently Asked Questions

How can I assess the financial risks of real estate investments in Toronto?

What legal considerations should Toronto investors be aware of?

How can I mitigate real estate investment risks in Toronto?

Contact me personally to learn more.

About the author:

Fanis Makrigiannis is a trusted Realtor with RE/MAX Rouge River Realty Ltd., specializing in buying, selling, and leasing homes, condos, and investment properties. Known for his professionalism, market expertise, and personal approach, Fanis is a Real Estate agent in the Durham region, is committed to making every real estate journey seamless and rewarding.

He understands that each transaction represents a significant milestone and works tirelessly to deliver outstanding results.

With strong negotiation skills and a deep understanding of market trends, Fanis fosters lasting client relationships built on trust and satisfaction.

Proudly serving the City of Toronto • Ajax • Brock • Clarington • Oshawa • Pickering • Scugog • Uxbridge • Whitby • Prince Edward County • Hastings County • Northumberland County • Peterborough County • Kawartha Lakes

Fanis Makrigiannis

Real Estate Agent

RE/MAX Rouge River Realty LTD

(c): 905.449.4166

(e): info@fanis.ca